No Data

WPM241101C67000

- 0.25

- -1.01-80.16%

- 5D

- Daily

News

Wall Street's expectations are consistent: gold is expected to reach $3,000!

Bank of America believes that gold is the best hedging asset. Goldman Sachs pointed out that since the outbreak of the Russia-Ukraine conflict, global central banks' demand for gold has quadrupled. Morgan Stanley believes that the influence of gold ETFs, central banks, and individual investors on gold prices in the futures market continues to grow. Citigroup also pointed out that currently, the overall gold investment demand from both public and private sectors remains at historical highs, putting upward pressure on gold prices.

Wheaton Precious Metals Corp. (WPM) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Gold Bulls Make Handbrake Turn After Reaching Milestone High

"US Treasury bonds fall, gold is full"! What miraculous medicine does the gold, which keeps hitting new highs, have?

①As the spot gold price rose further to the $2790 level on Wednesday, it is now approaching the $2800 integer level; ②According to analyst Lina Thomas from goldman sachs, the inverse correlation between gold and the 10-year real interest rate is already clearly broken.

Gold soared 34% to a new high this year! Experts warn: usa may face a deep pullback after the presidential election.

On the eve of the USA election, the gold price continues to hit a historical high.

Next year, aiming for $3000! Goldman Sachs raises its gold price target, stating that central bank demand expectations have quadrupled.

Goldman Sachs stated that gold is more popular when interest rates are cut; concerns about financial sanctions risks are driving central banks to buy gold, with the focus shifting to the US presidential election, Western investors are returning to the gold market; even by the end of next year, the central bank's gold buying pace will slow to 30 tons per month, only one-third of the monthly average size since 2022, and the gold price will rise by another 9% by the end of the year.

Comments

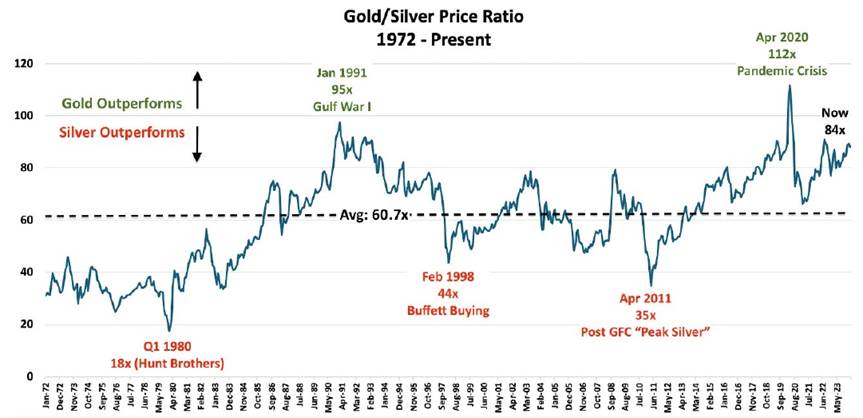

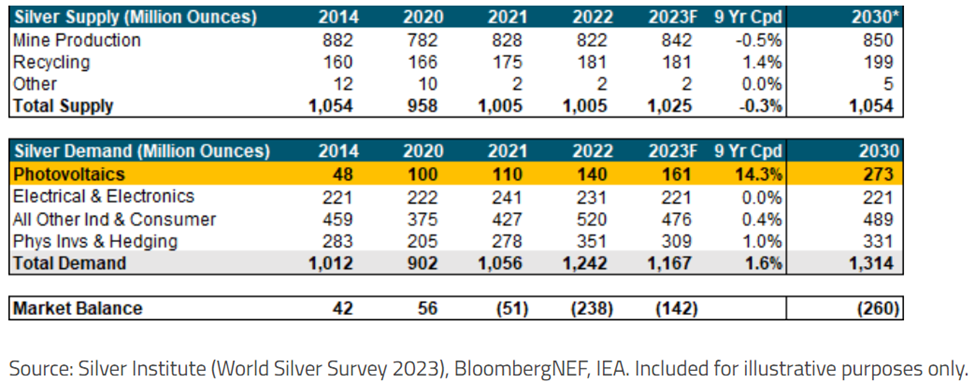

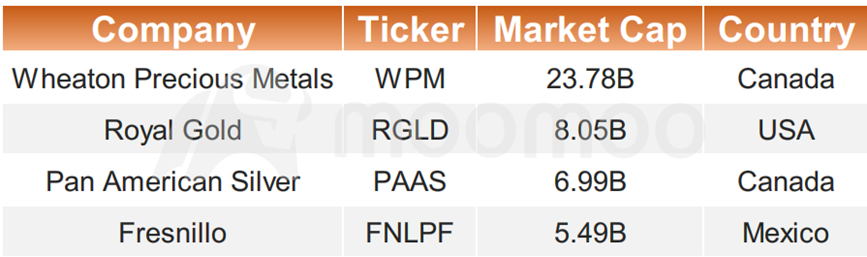

Although gold is considered a better safe-haven asset, silver offers several compelling reasons for consideration. The silver market is smaller and more volatile than gold, which means it has the potential for higher percentage gains.

Moreov...

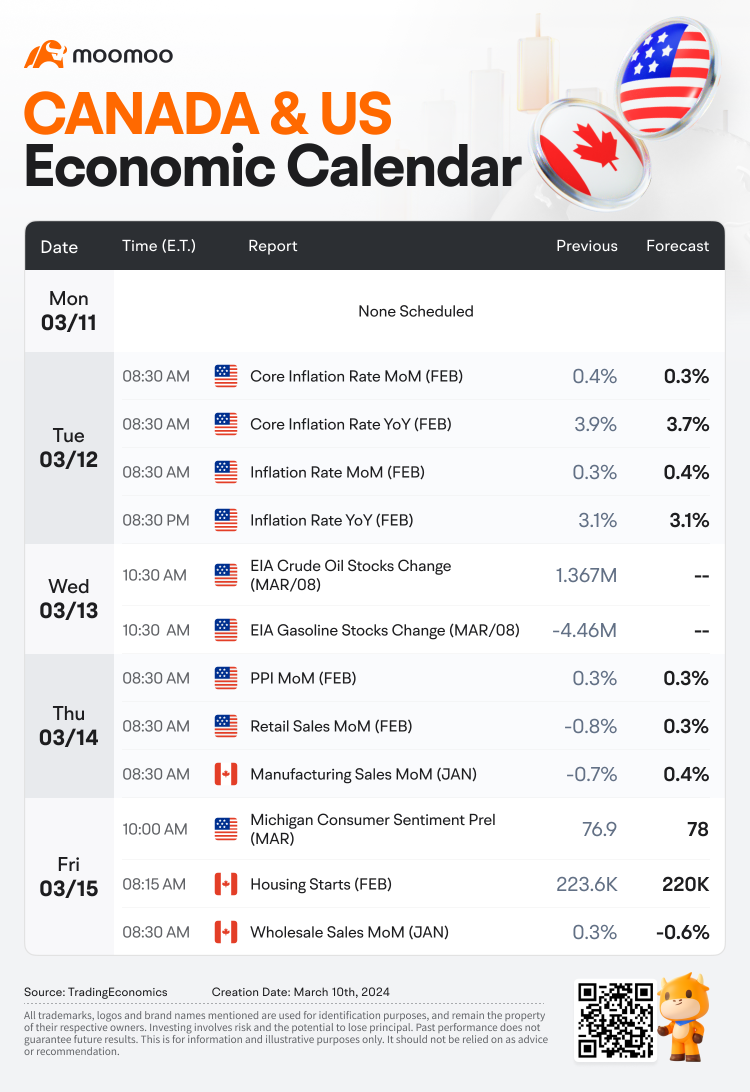

While in Canada, it's a fair...

welcome to the commodity bull market, it will last the decade. load up now!

Any other junior miner bets you all are looking at?