No Data

US OptionsDetailed Quotes

XAU241220P172500

- 0.00

- 0.000.00%

15min DelayClose Dec 20 09:30 ET

0.00High0.00Low

0.00Open0.00Pre Close0 Volume0 Open Interest172.50Strike Price0.00Turnover5880.60%IV-23.90%PremiumDec 20, 2024Expiry Date33.28Intrinsic Value100Multiplier-1DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type-0.9637Delta0.0049Gamma4.16Leverage Ratio-425.4495Theta0.0000Rho-4.00Eff Leverage0.0002Vega

Intraday

- 5D

- Daily

No Data

News

Comments

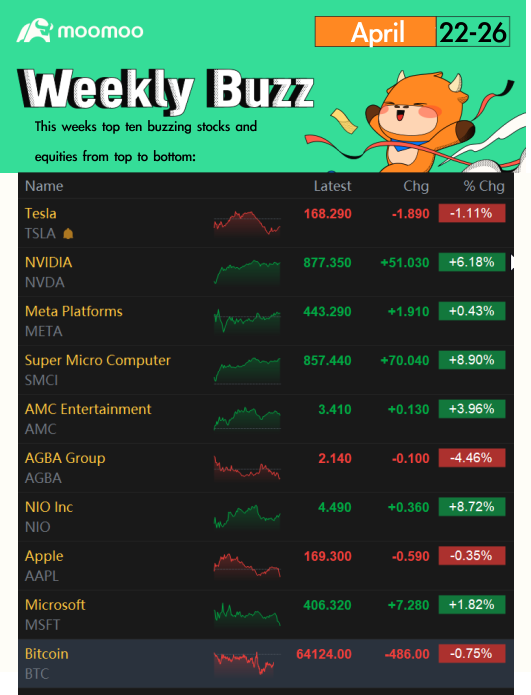

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! Answer the Weekly Topic question for a chance to win an award next week!

Make Your Choice

Weekly Buzz

The market was volatile this week, with all eyes on tech earnings following a dramatic semiconductor sector. Everything had to do with ear...

Make Your Choice

Weekly Buzz

The market was volatile this week, with all eyes on tech earnings following a dramatic semiconductor sector. Everything had to do with ear...

+9

16

9

3

Indexes finished in the green after an AI stock pullback on Friday.

The $S&P 500 Index traded 1.21% higher on preliminary numbers for the day in New York. The $Dow Jones Industrial Average gained 1.02%, and the $Nasdaq Composite Index rose 1.42%.

MACRO

$U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ fell to 4.974 this morning after hitting 5% briefly last week, while $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ slipped to 4.62.

...

The $S&P 500 Index traded 1.21% higher on preliminary numbers for the day in New York. The $Dow Jones Industrial Average gained 1.02%, and the $Nasdaq Composite Index rose 1.42%.

MACRO

$U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ fell to 4.974 this morning after hitting 5% briefly last week, while $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ slipped to 4.62.

...

40

2

5

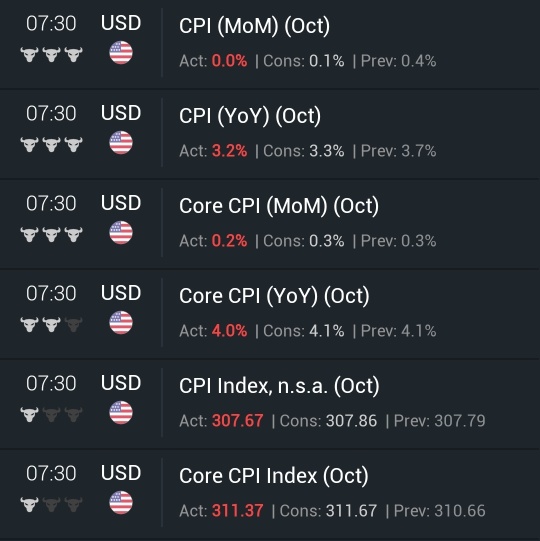

CPI Data Pushes Equity Investors Into a Buying Frenzy

The CPI reading was the final push the market needed to fall back into a bull market. Yields are tanking with the dollar. This is bullish for equities in the "bad news is good news environment," equities are ripping, and gold is tagging along. I think it is safe to say that things are looking very bullish. Short premiums are crushed across the board.

I believe that most of the market was expecting this suppressed...

The CPI reading was the final push the market needed to fall back into a bull market. Yields are tanking with the dollar. This is bullish for equities in the "bad news is good news environment," equities are ripping, and gold is tagging along. I think it is safe to say that things are looking very bullish. Short premiums are crushed across the board.

I believe that most of the market was expecting this suppressed...

+5

17

4

2

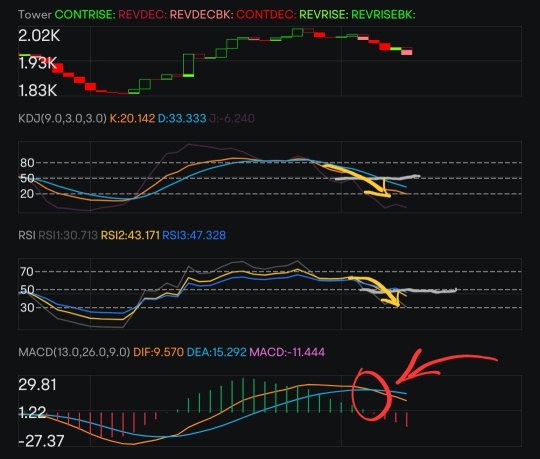

Safe Haven Rally

After the sharp rally in gold futures that followed the onset of the Middle Eastern conflict, gold seems to be losing some of its safe haven appeal.

If the war stays isolated, then we might not see the safe haven investors piling in like we saw at the beginning of October.

In the chart below, you can see the safe haven rally that followed the start of the conflict and the subsequent selling. I highlighted a few local areas o...

After the sharp rally in gold futures that followed the onset of the Middle Eastern conflict, gold seems to be losing some of its safe haven appeal.

If the war stays isolated, then we might not see the safe haven investors piling in like we saw at the beginning of October.

In the chart below, you can see the safe haven rally that followed the start of the conflict and the subsequent selling. I highlighted a few local areas o...

+1

17

5

New capital infusion to boost Republic First Bancorp's stance, inviting further investment. Yet, it's a fraction of the bank's capital deficit, underscoring possible disruptions in unstable smaller banks.

Read more

102362254 : I'll hedge my bets on the remaining Magnificent Seven stocks by utilizing options strategies to safeguard my investments during their earnings reports. Monitoring these stocks closely is imperative for potential surprises. Should they underperform, I’ll adjust my portfolio to minimize risks, ensuring it stays in line with market trends and my financial goals.

mr_cashcow : Yes they are not called the magnificent 7 without any reasons![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

If the remaining Mag Seven stocks do not report good earnings, it could impact the overall market and investor sentiment. If it happens then I will adjust my portfolios by:

1. Rebalancing: Adjusting the allocation of stocks, bonds, and other assets to maintain their target risk profile.

2. Diversification: Spreading investments across different asset classes, sectors, and geographies to minimize exposure to any one stock or sector.

3. Risk reduction: Reducing exposure to stocks and increasing allocation to bonds, cash, or other less volatile assets.

4. Sector rotation: Shifting focus to sectors that are performing well or expected to benefit from changing market conditions.

5. Active management: Actively monitoring and adjusting investments based on changing market conditions and company-specific factors.

Remember to always do your own research before making investment decisions!

Nitrite : Nice summary buzz article to read with a Saturday morning coffee. Keeps me updated and prepared for next week, on the hot stocks of the week. Keep it up.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

HuatLady : I remain calm irregardless of whether the remaining Magnificent 7 companies report strong or weak earnings. As a long-term investor, a negative earnings report is an opportunity for me to purchase more stocks and enhance my portfolio. I approach my investing as a steady journey, not a frantic trade, prioritizing long-term gains over short term ups and downs.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

HuatEver : It’s uncertain whether the remaining Magnificent 7 will report good earnings, but we can prepare to respond appropriately when the time comes. I will think about adjusting my portfolio by re-balancing or spreading out my investments to stay safe.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

If they let me down, I might think about diversifying further or changing how much risk I am taking. My investment decisions are based on a holistic view of the whole market and my individual goals.

View more comments...