No Data

US Stock MarketDetailed Quotes

XOM Exxon Mobil

- 115.500

- -0.400-0.35%

Close Mar 21 16:00 ET

- 115.500

- 0.0000.00%

Post 20:01 ET

501.17BMarket Cap14.73P/E (TTM)

115.990High114.350Low41.10MVolume115.500Open115.900Pre Close4.74BTurnover0.95%Turnover Ratio14.73P/E (Static)4.34BShares124.19752wk High1.90P/B499.78BFloat Cap103.67052wk Low3.84Dividend TTM4.33BShs Float124.197Historical High3.32%Div YieldTTM1.42%Amplitude10.140Historical Low115.382Avg Price1Lot Size

Full Hours

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Insider Trades: Exxon Mobil, Costco Among Notable Names This Week

RBC Capital Remains a Hold on Exxon Mobil (XOM)

Wells Fargo Maintains Exxon Mobil(XOM.US) With Buy Rating, Cuts Target Price to $130

Exxon Mobil Options Spot-On: On March 21st, 84,257 Contracts Were Traded, With 1.04 Million Open Interest

Is Exxon Mobil Corporation (XOM) The Best Energy Stock to Buy According to Billionaire Ken Fisher?

Activist investor Elliott meets with BP PLC (BP.US) shareholders to discuss potential cost reductions and leadership restructuring.

Informed sources indicate that activist investor Elliott Management has met with several Shareholders of BP PLC, trying to reach a consensus on further changes for the oil giant.

Comments

On Thursday (20 Mar), Gold briefly surged to $3,065 before retreating about $20, this follows the post-Fed decision volatility. While this move might get some bulls back into action, several technical warning signs suggest caution is warranted.

We saw that there is a move to the overbought region with Gold trading above the 12-EMA, but this is what might be seen as a “bull trap”, which is a surge before a potential reversal.

Gold has histo...

We saw that there is a move to the overbought region with Gold trading above the 12-EMA, but this is what might be seen as a “bull trap”, which is a surge before a potential reversal.

Gold has histo...

22

1

1

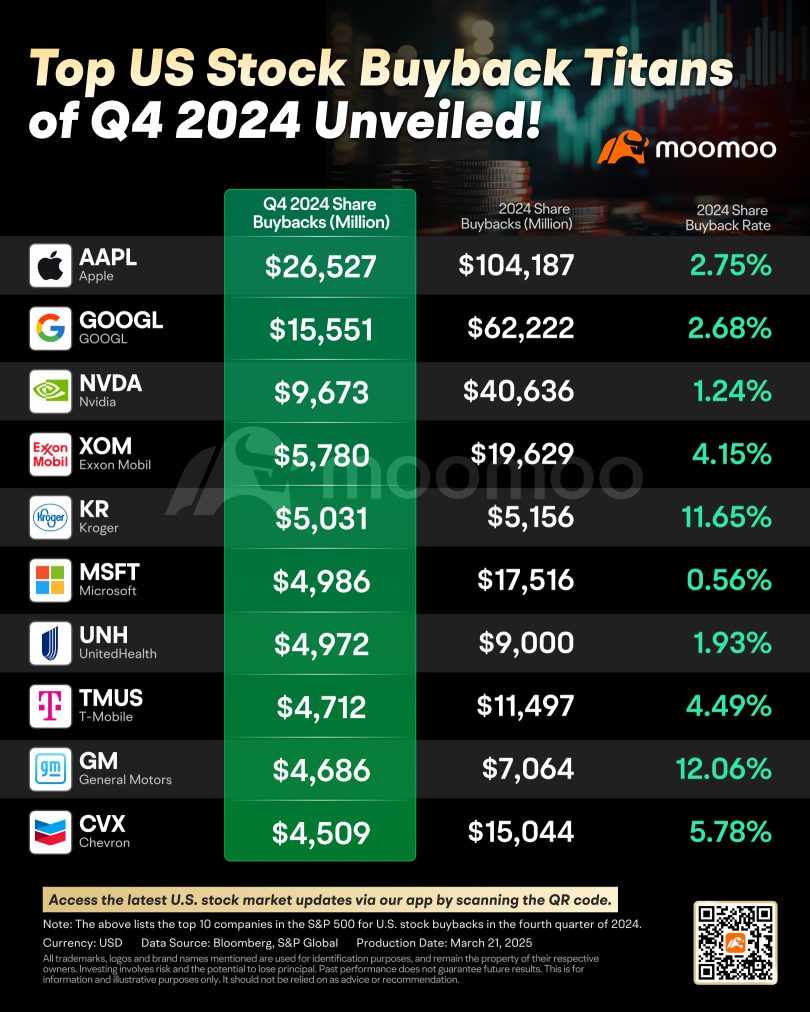

In the fourth quarter of 2024, S&P 500 companies set a new record by repurchasing $243.2 billion of their own stock, a 7.4% jump from the prior quarter and an 11% increase year-over-year. For the full year, buybacks surged to an unprecedented $942.5 billion, up 18.5% from 2023.

Top Buyback Leaders

The top three players in the buyback arena are Apple, Google, and Nvidia.

– $Apple (AAPL.US)$: In Q4 2024, Apple repurchased $26.5 billion...

Top Buyback Leaders

The top three players in the buyback arena are Apple, Google, and Nvidia.

– $Apple (AAPL.US)$: In Q4 2024, Apple repurchased $26.5 billion...

32

2

19

• US markets: Stocks rally. Nasdaq up 3% overnight – Nvidia up 6.4%, Tesla up 7.6% – while the US dollar falls.

• Australian markets: Commodities to be in focus - with oil up 2% overnight. Gold is up 12% this year, silver up 15%

• Stocks to watch: TSLA, NVDA, AMZN. ASX companies to watch: XYZ, WDS. NEM. Also watch CVX, XOM in oil.

US markets see risk-on rally as US inflation falls. Rally could be maintained if tonight's print shines

It ...

• Australian markets: Commodities to be in focus - with oil up 2% overnight. Gold is up 12% this year, silver up 15%

• Stocks to watch: TSLA, NVDA, AMZN. ASX companies to watch: XYZ, WDS. NEM. Also watch CVX, XOM in oil.

US markets see risk-on rally as US inflation falls. Rally could be maintained if tonight's print shines

It ...

From YouTube

12

1

Hey Mooers! 🚀 ![]()

Here is the power of how I leveraged on AI and make it show my direct opinions. Let's have a look at what is happening in the Macro factors. Before I say anything here is a disclaimer.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly, and past performance is not indicative of future results. Always conduct your own research or consult a...

Here is the power of how I leveraged on AI and make it show my direct opinions. Let's have a look at what is happening in the Macro factors. Before I say anything here is a disclaimer.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly, and past performance is not indicative of future results. Always conduct your own research or consult a...

+1

16

15

6

Read more

Market Insights

Fed Rate Cut Beneficiaries Fed Rate Cut Beneficiaries

Stocks that are expected to benefit from a Federal Reserve rate cut. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in Fed Rate Cut Beneficiaries, ranked from highest to lowest based on real-time market data. Stocks that are expected to benefit from a Federal Reserve rate cut. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in Fed Rate Cut Beneficiaries, ranked from highest to lowest based on real-time market data.

booyah

booyah

Jonesey0611 : good recommendations...don't forget other precious metals...I like RIO, BHP, KHC, CVX, ETHA, DVN.......4 of those offer dividend yields near 5 to 6% while also good hedges against Deflation/ and more likely Stagflation cycle