No Data

US OptionsDetailed Quotes

XOM250110P111000

- 4.45

- 0.000.00%

15min DelayClose Jan 10 16:00 ET

0.00High0.00Low

0.00Open4.45Pre Close0 Volume0 Open Interest111.00Strike Price0.00Turnover2059.54%IV2.72%PremiumJan 10, 2025Expiry Date1.47Intrinsic Value100Multiplier-12DDays to Expiry2.98Extrinsic Value100Contract SizeAmericanOptions Type-0.8675Delta0.0552Gamma24.61Leverage Ratio-360.4502Theta0.0000Rho-21.35Eff Leverage0.0004Vega

Intraday

- 5D

- Daily

News

US Morning News Call | Trump Scheduled for Virtual Speech at Davos World Economic Forum

Oil Volatile Amid U.S. Policy Uncertainty -- Market Talk

The Zacks Analyst Blog Eli Lilly, Exxon Mobil, Costco and Flanigan's

Oil Prices Dip Amid Tariff Threats And Russian Sanctions

Exxon Mobil (XOM) Stock Sinks As Market Gains: What You Should Know

Exxon Mobil Options Spot-On: On January 22nd, 84,805 Contracts Were Traded, With 835.08K Open Interest

Comments

Once every four years, the US goes through a new presidential term. There has been a theory relating the presidential term to the stock market known as the Presidential Cycle Theory. Along the same vein, at the start of every year, investors look at how the stock market generally performs in January, leading to the theory of "January Effect".

Here, we explore the two seasonal effects and how the US stock market might be impacted in the y...

Here, we explore the two seasonal effects and how the US stock market might be impacted in the y...

44

3

3

Stocks closed solidly higher on Tuesday, one day after President Donald Trump returned to office and issued a barrage of executive orders, including several that will have an impact on businesses and the economy.

The Dow Jones Industrial Average and S&P 500 rose 1.2% and 0.9%, respectively, while the Nasdaq Composite tacked on 0.6%. Stocks added to strong gains posted last week, when the Dow and S&P 500 turned in their...

The Dow Jones Industrial Average and S&P 500 rose 1.2% and 0.9%, respectively, while the Nasdaq Composite tacked on 0.6%. Stocks added to strong gains posted last week, when the Dow and S&P 500 turned in their...

+1

21

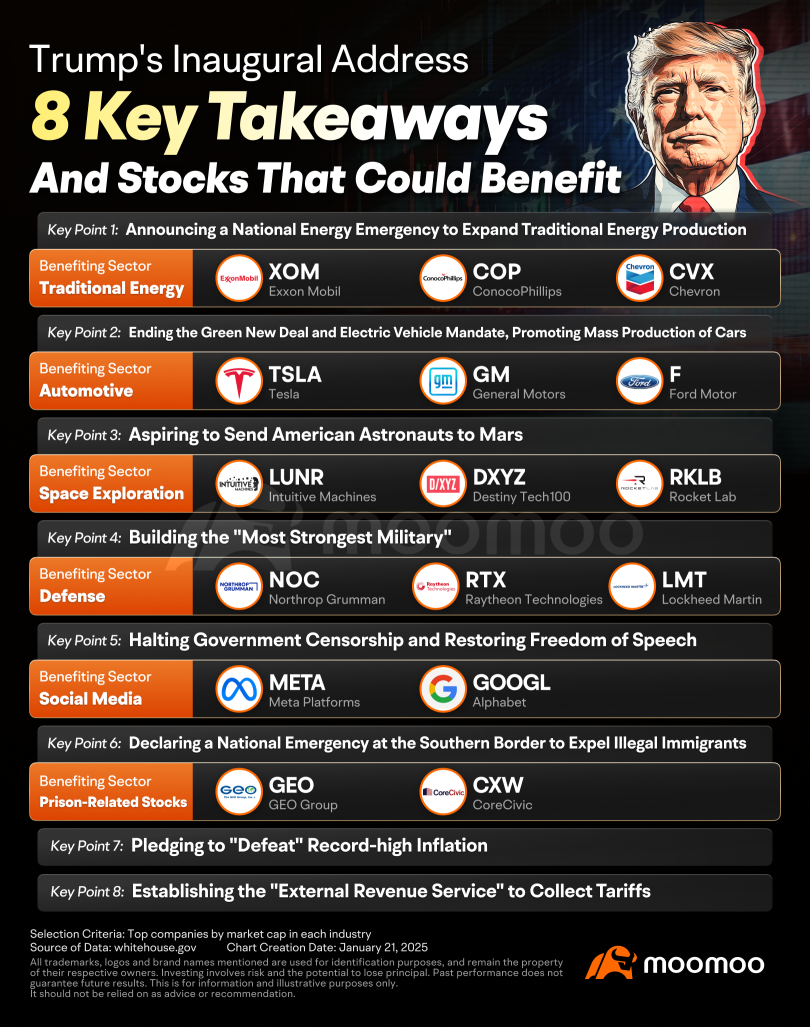

Donald Trump's second term began with bold declarations and swift action. His inaugural address emphasized an "America First" agenda, tackling inflation, energy independence, and border security. On day one, he signed executive orders and outlined policies that set the tone for his presidency. But what does this mean for the markets? Let's break down his priorities and the stocks that ...

95

19

70

Read more

Cui Nyonya Kueh :

Cui Nyonya Kueh : Teacher Lim please write about Chinese too.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Buy n Die Together❤ :