US Stock MarketDetailed Quotes

XPEV XPeng

- 12.690

- 0.0000.00%

Close Dec 3 16:00 ET

- 12.750

- +0.060+0.47%

Post 20:01 ET

12.05BMarket Cap-14964P/E (TTM)

13.130High12.525Low8.69MVolume12.570Open12.690Pre Close111.60MTurnover1.42%Turnover RatioLossP/E (Static)949.59MShares16.28552wk High2.74P/B7.75BFloat Cap6.55152wk Low--Dividend TTM610.91MShs Float74.490Historical High--Div YieldTTM4.77%Amplitude6.180Historical Low12.843Avg Price1Lot Size

XPeng Stock Forum

$NIO Inc (NIO.US)$ now I know why nio so slow. William Li really needs to hire ppl who have business mindset.. just now got one fixed mindset come lecture me... want to compare xpeng with nio...

for me (and he xpeng), deliveries = sell. We too ahead already... can't compete with a tortoise really... also, I saw nio supporters buying $XPeng (XPEV.US)$ too![]()

![]()

![]()

![]() if nio is saint please stay there. don't come xpeng show off.

if nio is saint please stay there. don't come xpeng show off. ![]()

![]()

for me (and he xpeng), deliveries = sell. We too ahead already... can't compete with a tortoise really... also, I saw nio supporters buying $XPeng (XPEV.US)$ too

5

5

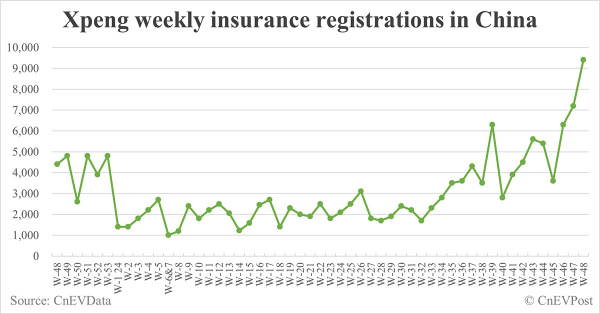

$XPeng (XPEV.US)$ XPeng registered 9400 vehicles in China for last week. New record high, if this trend continues, it will deliver 40K vehicles for December!

China EV insurance registrations for week ending Dec 1: Nio 4,100, Tesla 18,700, Xiaomi 6,300, BYD 97,800

China EV insurance registrations for week ending Dec 1: Nio 4,100, Tesla 18,700, Xiaomi 6,300, BYD 97,800

2

2

$XPeng (XPEV.US)$ $Li Auto (LI.US)$ $NIO Inc (NIO.US)$ In order to reach delivery guidance for Q4,

1. Nio needs to deliver additional 11,425 more vehicles or 55.52%more than November. (55% more, Challenging)

2. XPeng needs to deliver additional 3,105 more vehicles or 10.05% more than November. (10% more, Likely)

3. Li needs to deliver additional 16,260 more vehicles or 33.36% more than November. (33.36% more, Possible)

Out of the three, XPeng is most likely to hit Q4 g...

1. Nio needs to deliver additional 11,425 more vehicles or 55.52%more than November. (55% more, Challenging)

2. XPeng needs to deliver additional 3,105 more vehicles or 10.05% more than November. (10% more, Likely)

3. Li needs to deliver additional 16,260 more vehicles or 33.36% more than November. (33.36% more, Possible)

Out of the three, XPeng is most likely to hit Q4 g...

4

5

$BYD Company ADR (BYDDY.US)$ $XPeng (XPEV.US)$ $NIO Inc (NIO.US)$ $Tesla (TSLA.US)$

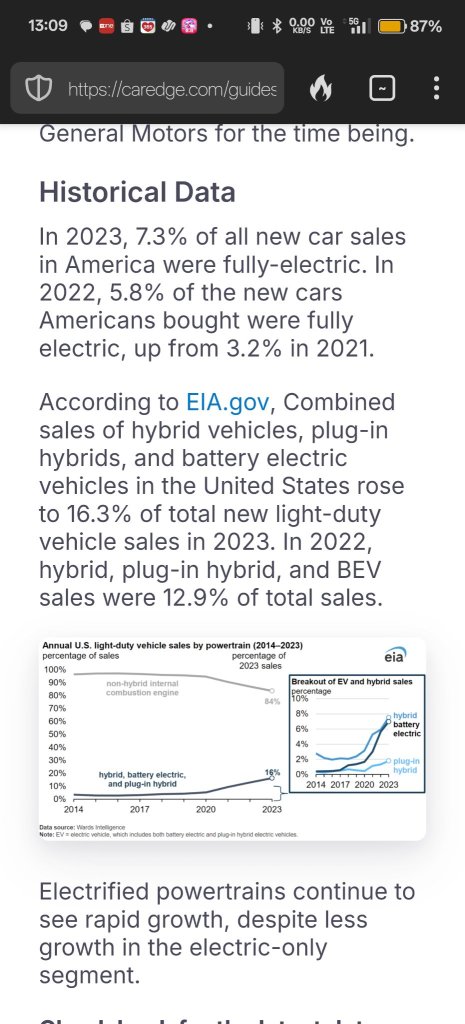

I think ppl don't realise next year's impact on EVs in US market.

no more subsidised credit to buy EVs, oil price cheaper, drop by 25% to 50%, what's the incentive to buy EVs?

I think ppl don't realise next year's impact on EVs in US market.

no more subsidised credit to buy EVs, oil price cheaper, drop by 25% to 50%, what's the incentive to buy EVs?

2

11

$Tesla (TSLA.US)$ $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$ $BYD Company ADR (BYDDY.US)$

Electric Vehicle Sales and Market Share (US - Q3 2024 Updates)

Ultimately Pure Battery EVs will fail.

While the hype and attention's on EVs, especially on Tesla, the fact is, in US market, all types of EVs comprise only up to 16% of new sales (Pure battery EVs 7%, dropping quarter on quarter while Hybrid are rising), ICE vehicles still comprise more than 80% of new vehicles sales.

EVs has not turn...

Electric Vehicle Sales and Market Share (US - Q3 2024 Updates)

Ultimately Pure Battery EVs will fail.

While the hype and attention's on EVs, especially on Tesla, the fact is, in US market, all types of EVs comprise only up to 16% of new sales (Pure battery EVs 7%, dropping quarter on quarter while Hybrid are rising), ICE vehicles still comprise more than 80% of new vehicles sales.

EVs has not turn...

14

$XPeng (XPEV.US)$

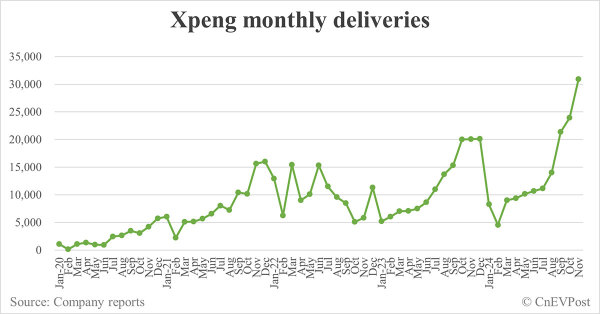

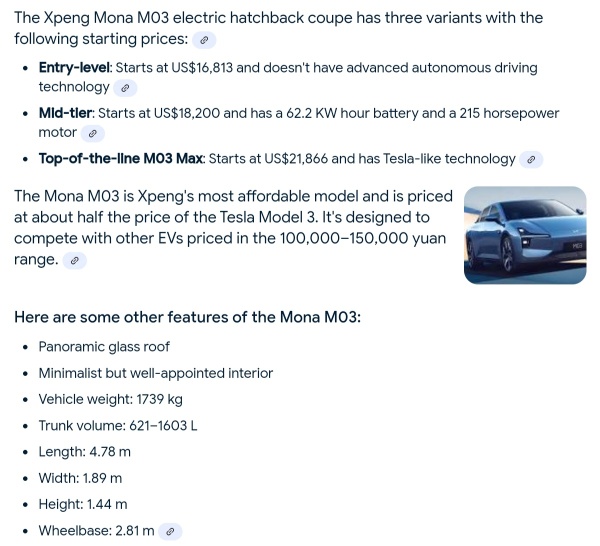

Xpeng saw a new delivery record last month, with hot sales of the new models P7+ and Mona M03.

The company delivered 30,895 vehicles in Nov, the first time it has surpassed the 30,000 mark and the third consecutive month of record highs, according to data it released.

This is up 54.16% from 20,041 in the same period last year and up 29.18% from 23,917 in Oct.

In the Jan-Nov period, Xpeng delivered 153,373 vehicles, u...

Xpeng saw a new delivery record last month, with hot sales of the new models P7+ and Mona M03.

The company delivered 30,895 vehicles in Nov, the first time it has surpassed the 30,000 mark and the third consecutive month of record highs, according to data it released.

This is up 54.16% from 20,041 in the same period last year and up 29.18% from 23,917 in Oct.

In the Jan-Nov period, Xpeng delivered 153,373 vehicles, u...

7

3

Below example...etc...If fireflies are priced the same as the entry level of mona will Nio also hit 30k even without incentive?

7

On Watch

$XPeng (XPEV.US)$

XPENG reported strong delivery results for November 2024, with 30,895 Smart EVs delivered, marking a 54% year-over-year increase and 29% growth from the previous month. The MONA M03 maintained over 10,000 deliveries for the third consecutive month, while the newly launched P7+ achieved 7,000 deliveries in its first 23 days. Year-to-date deliveries reached 153,373 units, up 26% year-over-year. The company's XNGP system achieved 85% monthly active user penetration in urb...

$XPeng (XPEV.US)$

XPENG reported strong delivery results for November 2024, with 30,895 Smart EVs delivered, marking a 54% year-over-year increase and 29% growth from the previous month. The MONA M03 maintained over 10,000 deliveries for the third consecutive month, while the newly launched P7+ achieved 7,000 deliveries in its first 23 days. Year-to-date deliveries reached 153,373 units, up 26% year-over-year. The company's XNGP system achieved 85% monthly active user penetration in urb...

2

$XPeng (XPEV.US)$ X9 “ 8 seater” version launched = X9 launched upgradable massage chair option for front passenger seat for both existing and new X9 owners. Record monthly delivery for XPeng at 30,895 on track to achieve 87K-91K delivery for Q4. He Xiao Peng is truly an Engineering guy, no exaggeration, just work hard to deliver. 👍🏻 XPeng is entering the positive cycle as mentioned by He.

6

1

No comment yet

Trending US Stocks

Fed Rate Cut Beneficiaries Fed Rate Cut Beneficiaries

Stocks that are expected to benefit from a Federal Reserve rate cut. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in Fed Rate Cut Beneficiaries, ranked from highest to lowest based on real-time market data. Stocks that are expected to benefit from a Federal Reserve rate cut. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in Fed Rate Cut Beneficiaries, ranked from highest to lowest based on real-time market data.

bullbearnme : XPEV is way better than NIO in handling the cost. Risk of bancruptcy in NIO is higher than XPEV.

Cui Nyonya Kueh OP bullbearnme : Many people or entrepreneurs have done their best to help William Li. I guess he hired wrong people.

People who have helped him:

1. Lei

2. Li Xiang

3. He Xpeng

bullbearnme : William Li said “ I have no fear of losing”

https://www.forbes.com/profile/william-li/

TWeiT : Can’t agree more, the right people is important. William Li can’t run everything. Last year was the most difficult learning period. G6 had mixed responses on its look but tech wise was very strong, first 800V platform fast charging but Pricing and delivery was poor, can’t deliver fast enough and keep cutting price later when orders ran away to newer cars. Cost and supply chain issues. Then, came Wang Fengyin to restructure the operations and sales channels. She frees He up to focus on technology and innovation. Now they seemed to have found the formula for hit models since MONA, then P7+.

74216494 bullbearnme : Shure. Most of the money, NIO loses, is not his money. Degree in sociology ... No wonder, he has no idea about sales or technology or business management. But he knows already, how to go bankrupt.