No Data

CA ETFDetailed Quotes

XRE ISHARES S&P/TSX CAPPED REIT IND ETF UNIT

- 15.510

- -0.030-0.19%

15min DelayMarket Closed Dec 12 16:00 ET

15.625High15.490Low

15.625High15.490Low534.46KVolume15.490Open15.540Pre Close8.32MTurnover17.76052wk High0.59%Turnover Ratio90.90MShares13.93552wk Low--EPS TTM1.41BFloat Cap18.729Historical High--P/E (Static)90.90MShs Float2.858Historical Low--EPS LYR0.87%Amplitude0.76Dividend TTM--P/B1Lot Size4.90%Div YieldTTM

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Toronto Stocks Finish Lower; Empire Shares Rise on 2Q Beats, Improving Outlook

Canada's Household-Debt Burden Falls to Post-Pandemic Low

Will Latest Bank of Canada Rate Cut Boost the Housing Market? Analysts Weigh in

Ford threatens to cut off energy supply to U.S. in response to Trump's tariffs

Canada's Provinces Press Trudeau for 'Robust' Retaliation in Event of 25% U.S. Tariff

TSX Closer: The Market Surges as the Bank of Canada Makes Its Jumbo Cut, Further Cuts Predicted

Comments

I think what will happen is RE will see a slight bump only to quickly back down and continue its decline. $VANGUARD FTSE CDN CAPPED REIT INDEX TR UNIT (VRE.CA)$ $ISHARES S&P/TSX CAPPED REIT IND ETF UNIT (XRE.CA)$ $BMO EQUAL WEIGHT REITS INDEX ETF TRUST UNIT (ZRE.CA)$ $CI CDN REIT ETF COMMON UNITS (RIT.CA)$

7

3

Homebuyers are stretched pretty thin trying to make payments on a $1.5 M mortgage, and lowering interest rates by 0.5% will not help lower payments by that much, esp. since many of them locked into fixed rate mortgages.... $ISHARES S&P/TSX CAPPED REIT IND ETF UNIT (XRE.CA)$ $VANGUARD FTSE CDN CAPPED REIT INDEX TR UNIT (VRE.CA)$

2

2

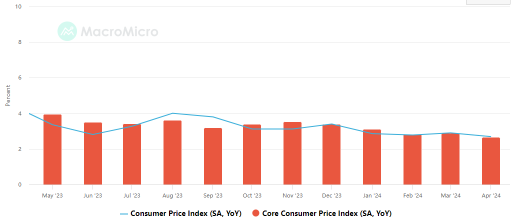

The Bank of Canada has consecutively lowered its interest rate by 25 basis points to 4.25% for the third month in a row, aligning with market expectations. This marks the third rate cut since the initial reduction in June, driven primarily by sluggish economic growth, a high unemployment rate, and easing inflationary pressures.

Inflation levels and employment figures are the key data points closely monitored by the...

Inflation levels and employment figures are the key data points closely monitored by the...

+10

32

2

The Bank of Canada cut interest rates by 25 basis points to 4.5% for the second consecutive month, in line with market expectations, and hinted at further rate cuts in the future. This is the second action since the first rate cut in June, when Canada became the first G7 country to enter an easing cycle. The easing of inflationary pressure is the main reason for the rate cut, with CPI falling from a high in May to 2.7...

+16

17

3

1

During a recent press conference on monetary policy, Tiff Macklem, Governor of the Bank of Canada, hinted that a rate cut could be possible in June if inflation levels continue to decline sustainably. The latest data shows that Canada's annual inflation rate for April was 2.7%, the lowest in nearly three years, and the monthly inflation rate was 0.5%, slightly lower than March's 0.6%, which also met market expe...

+7

9

9

Read more

DanDha : I agree with what you said, but I would like to know why it is like that.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Avaliye OP DanDha : My reasoning here is that, with all the layoffs and the banks tightening their lending, people can no longer afford to hold RE as an investment and they will be looking to dump it fast. They can’t get enough in rent to cover their mortgage and they are likely over leveraged that they risk bankruptcy come renewal while simultaneously they are on the cusp of fear of losing their jobs.

70727465 : More easing measures are expected in Canada, allowing for mortgages of up to 90% loan-to-value without the need for insurance by next year. Additionally, stress tests may be removed, making it easier for buyers to qualify.