No Data

XSD Spdr Series Trust Spdr S&P Semiconductor Etf

- 260.010

- +7.000+2.77%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Nvidia Adds Hundreds To Its Workforce In China To Build Autonomous Driving Tech Amid Antitrust Investigation: Report

Jim Cramer Bullish On Netflix Nearing $1,000 And AMD's 'Cheap' Valuation Despite Nvidia Dominance

The Nasdaq hits 20,000 points! Besides US bonds, US investors are buying everything.

After the release of USA's November CPI data on Wednesday, investors seem to have finally "confirmed" that the Federal Reserve's interest rate cut next week is a done deal; financial markets across asset classes on Wednesday also appeared quite uplifting; apart from the decline in USA Treasuries, investors are buying everything else - USA stocks are rising, Gold is rising, the dollar is rising, Crude Oil Product is rising, and Cryptos are rising...

The NASDAQ broke through 0.02 million points for the first time, Tesla led a group of tech giants to a new high, and Bitcoin climbed to 0.1 million dollars

The Dow and Apple fell, the Nasdaq rose nearly 2%, Tesla and Google rose nearly 6%, while Meta, Amazon, and Netflix all reached new highs. NVIDIA rose over 3%, Broadcom rose nearly 7%, Super Micro Computer once dropped over 8%, the decline of Chinese concepts narrowed, and Fangdd Network turned to rise over 11%. The U.S. November CPI confirms interest rate cut bets for next week, with a pause on rate cuts expected in January next year. The dollar and U.S. Treasury yields rebounded in a V-shape, while spot Gold reached its highest level in five weeks. The yen plunged below 152, while the offshore yuan once dropped over 300 points, falling below 7.29 yuan. After a significant interest rate cut by the Bank of Canada, the Canadian dollar and Canadian bond yields turned to rise, and oil prices increased by about 2%.

Broadcom's AI Edge: 'Apples-to-Oranges Comparison' Shows ASICs Outgrowing GPUs, Says Analyst

Magnificent Seven Tech Titans Hit $18.2 Trillion Market Cap: Alphabet, Amazon, Apple, Meta, Tesla Jointly Notch All-Time Highs

Comments

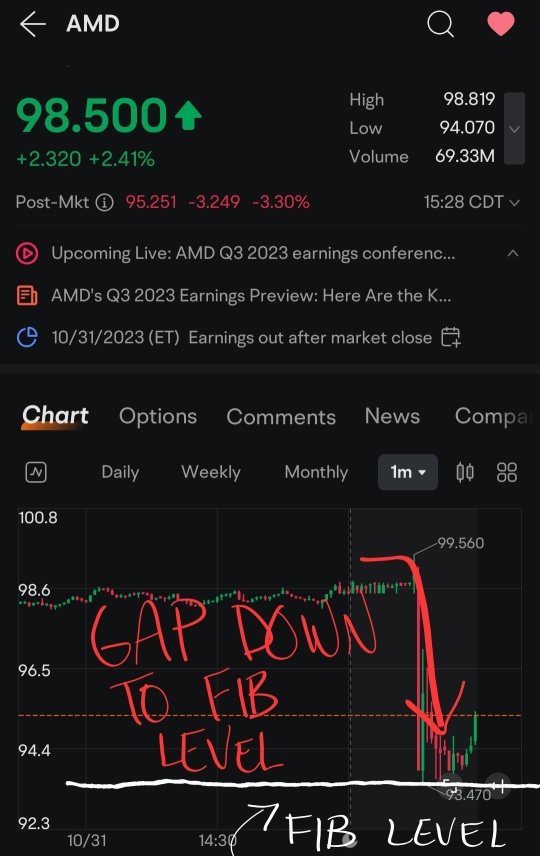

Big gap down to support following AMD's earnings release.

- Apparently, investors didn't like the initial earnings release.

- The gap down abruptly stopped at a major Fibonacci support level.

Bullish investors tend to enter long positions at support.

- You can see a clearer picture of the Fib level below with daily candles.

- This Fib level acted as major support last Thursd...

Apple's pullback may be short-lived amid the China iPhone ban; plujs other implications?

Apple shares are down 9% from their high. They lost 6% of that last week as China wants to expand its ban on iPhones to government-backed agencies and state companies. How could this likely damage Apple, but can Apple offset the revenue loss? W...

2. Nvidia $NVIDIA (NVDA.US)$ just became the first-ever semiconductor company to rack up a $1 trillion market valuation after its shares surged ~229% this year.

3. In Q2 Nvidia's revenue surged 101% YoY to $13.51 b...

_________________________________

W...

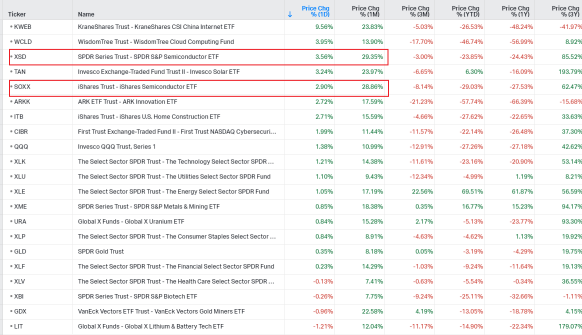

$iShares Semiconductor ETF (SOXX.US)$ gained 2.90% and $Spdr Series Trust Spdr S&P Semiconductor Etf (XSD.US)$ gained 3.56% on Tuesday.

1) Normalized performance in the last month. (20 selected ETFs)

2) Di...

Kube : thanks for the great analysis

Destrier : was it one position that caused the dip?

SpyderCall OP Kube : for sure no prob![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

SpyderCall OP Destrier : I doubt it, but let me check

MonkeyGee : 90% of the stocks looks like amd charts

View more comments...