US FuturesDetailed Quotes

YMCURRENT E-mini Dow Futures Current Contract

- 42965

- -56-0.13%

10min DelayTrading Jan 6 15:23 ET

43409High42912Low

43024Open43021Pre Close103.39KVolume-528.00OI Change5Multiplier84.24KOI43021Prev Settle--LTD298At Premium--Remaining

E-mini Dow Futures Current Contract Forum

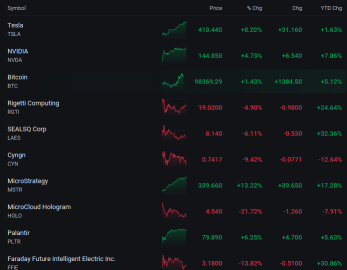

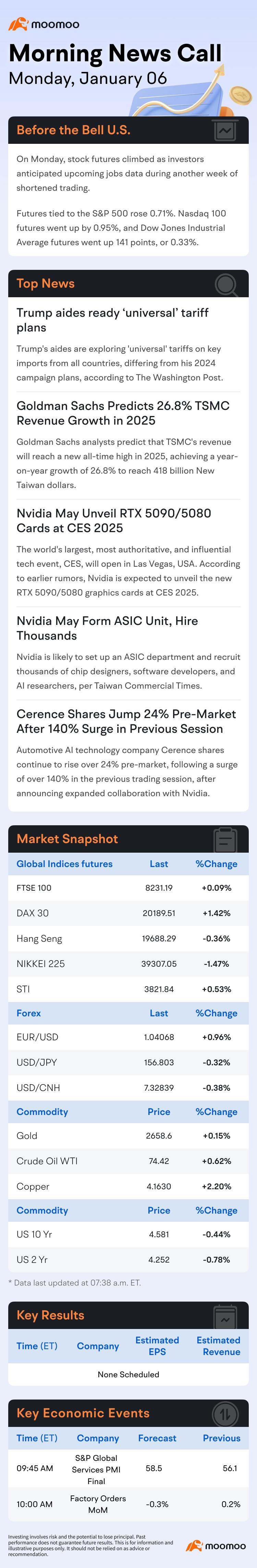

Happy Monday, January 6th, traders. CORRECTION: it is not the first full week, Former President JImmy Carter died and gave us a holiday; markets will close on January 9th in observance. It is snowing across the U.S., with flurries drifting down to hit Wall Street while the market climbed, let's look at stocks live:

$Super Micro Computer (SMCI.US)$ climbed 9%, the highest percentage gainer on the S&P 500 tied with $Micron Technology (MU.US)$....

$Super Micro Computer (SMCI.US)$ climbed 9%, the highest percentage gainer on the S&P 500 tied with $Micron Technology (MU.US)$....

30

11

3

Index Performance

• Nasdaq Composite

The Nasdaq surged 1.77% to close at 19,621.68, marking a robust recovery. However, the 19,800resistance remains a key hurdle. A successful breakout above this level could pave the way for a rally back to the psychological 20,000 mark, reviving bullish sentiment.

• S&P 500

The S&P 500 gained 1.26% to close at 5,942.47, solidly bouncing off the 5,800 support. The upward momentum brings the 6,000 level into ...

• Nasdaq Composite

The Nasdaq surged 1.77% to close at 19,621.68, marking a robust recovery. However, the 19,800resistance remains a key hurdle. A successful breakout above this level could pave the way for a rally back to the psychological 20,000 mark, reviving bullish sentiment.

• S&P 500

The S&P 500 gained 1.26% to close at 5,942.47, solidly bouncing off the 5,800 support. The upward momentum brings the 6,000 level into ...

3

Dow Jones Industrial Average: Testing Resistance at 43,000

The Dow Jones rebounded sharply from its 42,200 support level, aligning with expectations. However, the index remains capped by the resistance at 43,000. This level will be pivotal in determining the next leg of the move. A sustained break above could trigger renewed bullish momentum, while failure to do so may lead to further consolidation.

________________________________________

Nasda...

The Dow Jones rebounded sharply from its 42,200 support level, aligning with expectations. However, the index remains capped by the resistance at 43,000. This level will be pivotal in determining the next leg of the move. A sustained break above could trigger renewed bullish momentum, while failure to do so may lead to further consolidation.

________________________________________

Nasda...

7

Keep the faith and let it rock n' roll!

$E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $NVIDIA (NVDA.US)$ $Apple (AAPL.US)$ $Tesla (TSLA.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $Alphabet-C (GOOG.US)$ $Alphabet-A (GOOGL.US)$ $Taiwan Semiconductor (TSM.US)$ $Microsoft (MSFT.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Brookside Energy Ltd (BRK.AU)$ $Advanced Micro Devices (AMD.US)$ $Coinbase (COIN.US)$ $ASML Holding (ASML.US)$ $MARA Holdings (MARA.US)$ $Invesco QQQ Trust (QQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $ProShares UltraPro QQQ ETF (TQQQ.US)$ $Coca-Cola (KO.US)$ $Costco (COST.US)$

$E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $NVIDIA (NVDA.US)$ $Apple (AAPL.US)$ $Tesla (TSLA.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $Alphabet-C (GOOG.US)$ $Alphabet-A (GOOGL.US)$ $Taiwan Semiconductor (TSM.US)$ $Microsoft (MSFT.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Brookside Energy Ltd (BRK.AU)$ $Advanced Micro Devices (AMD.US)$ $Coinbase (COIN.US)$ $ASML Holding (ASML.US)$ $MARA Holdings (MARA.US)$ $Invesco QQQ Trust (QQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $ProShares UltraPro QQQ ETF (TQQQ.US)$ $Coca-Cola (KO.US)$ $Costco (COST.US)$

5

Happy weekend investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

The market closed higher Friday, but the shortened trading week was negative enough to see a market-wide pullback that barely kept stocks from forming even the slightest Santa Rally. The Rally is really a hi...

Make Your Choice

Weekly Buzz

The market closed higher Friday, but the shortened trading week was negative enough to see a market-wide pullback that barely kept stocks from forming even the slightest Santa Rally. The Rally is really a hi...

+8

75

35

21

So much for the Santa rally. The market closed higher on Friday, but it was not enough to overcome the past five sessions of declines.

Just after 4 pm ET, the $S&P 500 Index (.SPX.US)$ closed very close to the point value it needed to stay positive, but the Grinch came and stole the Christmas rally this year.

The S&P 500 closed up 1.26%. The $Nasdaq Composite Index (.IXIC.US)$ closed up 1.77%, and the $Dow Jones Industrial Average (.DJI.US)$ closed...

Just after 4 pm ET, the $S&P 500 Index (.SPX.US)$ closed very close to the point value it needed to stay positive, but the Grinch came and stole the Christmas rally this year.

The S&P 500 closed up 1.26%. The $Nasdaq Composite Index (.IXIC.US)$ closed up 1.77%, and the $Dow Jones Industrial Average (.DJI.US)$ closed...

64

12

5

Happy Friday, investors! It's January 3rd, a brand new year to invest in! The day started with a climbing market but an overall failure for the hopes of a Santa Claus rally. There is still a possibility of a major turnaround, but there are only a couple more hours of trading to reverse a 1.16% decline in the S&P 500 during a period that normally sees a Santa climb.

$Vistra Energy (VST.US)$ led the S&P 500 in percentage gainers, up 7% after...

$Vistra Energy (VST.US)$ led the S&P 500 in percentage gainers, up 7% after...

55

11

2

Index Performance

• Nasdaq Composite

The Nasdaq fell 0.16%, closing at 19,280.79, after dipping as low as 19,100 during the session. The critical 19,000 support level remains the primary focus for the next session. If this level holds, it could act as a base for a potential rebound; a breakdown, however, may lead to heightened selling pressure.

• S&P 500

The S&P 500 declined 0.22%, ending at 5,868.55. The 5,800 support level is cru...

• Nasdaq Composite

The Nasdaq fell 0.16%, closing at 19,280.79, after dipping as low as 19,100 during the session. The critical 19,000 support level remains the primary focus for the next session. If this level holds, it could act as a base for a potential rebound; a breakdown, however, may lead to heightened selling pressure.

• S&P 500

The S&P 500 declined 0.22%, ending at 5,868.55. The 5,800 support level is cru...

1

No comment yet

Johnsonite : Full week?

Space Dust : food prices are high, when will packaged food stocks turn around?

Stock_Drift Johnsonite : No.

Stock_Drift : $MicroCloud Hologram (HOLO.US)$

Kevin Travers OP Stock_Drift : more quantum!

View more comments...