No Data

YUMC Yum China

- 51.250

- -0.560-1.08%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

On March 25, YUM CHINA (09987.HK) spent 4.665 million Hong Kong dollars to buy back 0.0119 million shares.

On March 26, Gelonghui announced that YUM CHINA (09987.HK) spent 4.665 million Hong Kong dollars to repurchase 0.0119 million shares on March 25, 2025, at a repurchase price of 388.2-402 Hong Kong dollars per share.

YUM CHINA (09987) spent HKD 4.6702 million to repurchase 0.0117 million shares on March 24.

YUM CHINA (09987) announced that on March 24, 2025, the company invested HKD 4.6702 million...

Robinhood, Meta, Yum China And A Financial Stock On CNBC's 'Final Trades'

In the past decade, the number of businesses related to Dining has steadily increased year by year, with a year-on-year growth of 6.25% in the registration volume for the first two months.

Jingu Financial News | According to media reports, this year, the Ministry of Commerce and other departments will hold the "Chinese Food Fair" event, launching over 120 special Dining promotion projects aimed at creating new hotspots for Consumer spending. This event integrates elements such as traditional festivals and peak Consumer seasons, innovating consumption models like "Dining + competitions" and "Dining + movies." According to Statistics, in 2024, China's Dining consumption will reach 5.57 trillion yuan, accounting for over 11% of the total retail sales of consumer goods, becoming the largest category by percentage. Data from Qichacha shows that in the past decade, the stock of related enterprises has steadily increased year by year; as of March 24, there are currently 16 Dining-related enterprises in the country.

YUM CHINA (09987.HK) spent 4.6715 million HKD to repurchase 0.0116 million shares on March 21.

Gelonghui, on March 23, announced that YUM CHINA (09987.HK) spent 4.6715 million Hong Kong dollars to repurchase 0.0116 million shares on March 21, 2025, with a repurchase price of 399.8-412.6 Hong Kong dollars per share.

Yum China Holdings Insiders Sell US$2.3m Of Stock, Possibly Signalling Caution

Comments

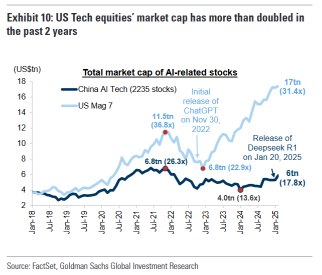

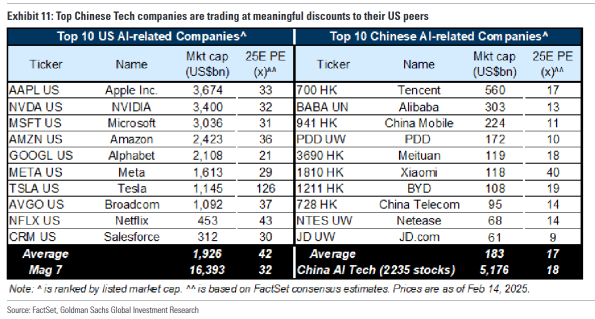

Wall Street banks have issued optimistic reports on Chinese tech stocks, signaling potential revaluation.

Goldman Sachs analyst Kinger Lau published a report titled “AI Changes the Ga...

Yum China Supercharges Shareholder Returns with Massive Dividend Boost, Record Digital Sales Hit $9.6B