No Data

ZH241220P2500

- 0.05

- 0.000.00%

- 5D

- Daily

News

Zhihu Price Target Cut to $4.70/Share From $5.40 by Citigroup

Zhihu Analyst Ratings

Citi Maintains Zhihu(ZH.US) With Buy Rating, Cuts Target Price to $4.7

The profit turning point is approaching, AI search is growing rapidly, and it's time to re-examine the opportunities and value of zhihu (ZH.US; 2390.HK).

From the disclosure of the third-quarter report, AI's contribution to the performance of technology giants is becoming increasingly significant, continuously validating an industry trend: AI has entered the second half of application competition, accelerating commercialization. For example, this is directly reflected in the collective unexpected performance growth of overseas AI application companies like Applovin and palantir. In this trend, the capital markets' confidence in AI applications continues to strengthen, viewing them as one of the main lines of technology investment, driving the stock prices of some related domestic and foreign companies to soar. On the other hand, from a broader perspective, the AI applications field contains rich investment opportunities, still holding potential.

Zhihu is seeking the optimal solution between AI and profitability.

Significant reduction in losses.

Zhihu | 6-K: Report of foreign private issuer (related to financial reporting)

Comments

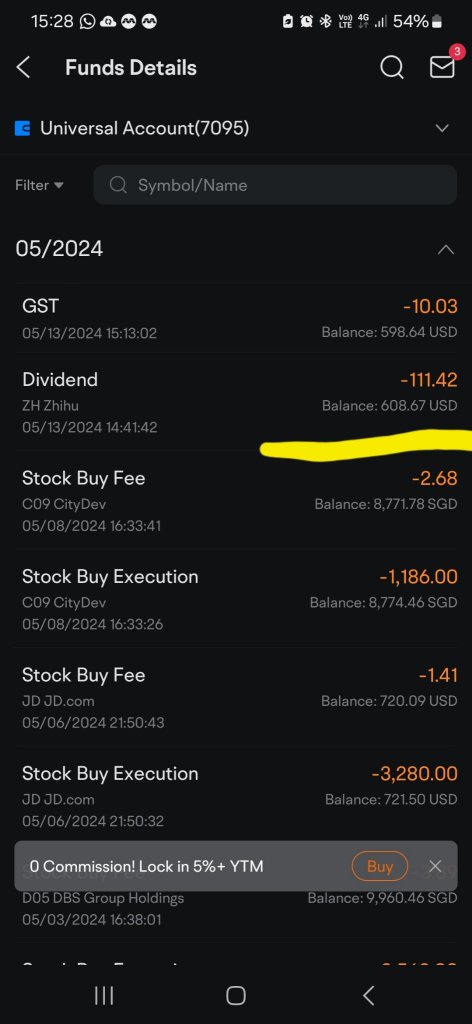

anyone know why the zhihu dividend not give me money, yet deduct from my account, yet I have to pay tax?

Active Heavyweights:

$TENCENT (00700.HK)$ closed at $327, up 3.2%

$MEITUAN-W (03690.HK)$ closed at $90.6, up 0.2%

$BABA-W (09988.HK)$ closed at $72.75, up...

Kevin Matte : $MicroCloud Hologram (HOLO.US)$![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)