No Data

6857 Advantest

- 8098.0

- -185.0-2.23%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

As it approaches 38,000 yen, the heaviness of the upper range comes into focus.

The Nikkei average fell slightly, ending trading at 37,677.06 yen, down 74.82 yen (with an estimated Volume of 2.6 billion 60 million shares). In the morning, influenced by the decline of U.S. stocks from the previous day and a pause in the depreciation of the yen, selling started out first. However, after the opening, it was bought back at a low, and by the end of the first half, it was purchased up to 37,968.02 yen. When the good earnings outlook from U.S. semiconductor memory giant Micron Technology Inc was conveyed, some semiconductor-related stocks were bought. Additionally, against the backdrop of expectations for further interest rate hikes by the Bank of Japan, there was anticipation for an improvement in profit margins.

The Nikkei average is up about 120 yen, with positive contributions from SoftBank Group, Tokyo Electron, and Sony Group Corp ranking at the top.

As of 12:46 PM on the 21st, the Nikkei average stock price is around 37,872 yen, up about 120 yen compared to the previous trading day. In the afternoon session, the market appears slightly heavy on the sell side as trading begins. The foreign exchange market continues to fluctuate around 149.20 yen per dollar. The contribution of stocks included in the Nikkei average is positive for SoftBank Group Corp <9984.T>, Tokyo Electron <8035.T>, and Sony Group Corp <6758.T> at the top. On the negative side, Advantest <6857>.

In the afternoon session, there is adjustment of holdings in anticipation of President Ueda's press conference and the outcome of the FOMC.

The Nikkei average fell for the first time in four trading days. It closed at 37,751.88 yen, down 93.54 yen (with an estimated Volume of 1.8 billion 40 million shares). Selling was driven by the weakness in U.S. stocks from the previous day, but buying continued in value stocks such as trading companies due to the influence of famous U.S. investor Warren Buffett, and after the initial selling, there was a quick bounce back. Additionally, when the Bank of Japan's monetary policy meeting decided to maintain the current policy, short-term players also engaged in Futures buying, and just before the morning close, it reached as high as 38,128.58 yen.

Spot information on individual stocks (1)

Advantest <6857.T> fell back. Following the decline of NVIDIA stocks in the U.S., selling pressure spread to related stocks in the Tokyo market. Ohsumi Construction <1814.T> surged, updating its highest price after considering the stock split. A large holding of fundnote was revealed in the 5% rule report filed on March 19, showing a shareholding ratio of 6.21%. Shin Denko <6844.T> plummeted. It announced a downward revision of its performance forecast for the current fiscal year ending in March. Consolidated operating profit was reduced from 2.2 billion yen to 100 million yen (the previous period's actual was 1.278 billion yen). Dividends plan.

The Nikkei average fell by 93 points, marking a retreat after four days, closing at a low due to a cautious mood ahead of the FOMC on the afternoon of the 19th.

On the 19th, the Nikkei average stock price in the afternoon session fell by 93.54 yen from the previous day to 37,751.88 yen, marking a decline for the first time in four days, closing at a low for today's Trade. The TOPIX (Tokyo Stock Price Index) increased by 12.40 points to 2,795.96 points, continuing its rise for six consecutive days. Although selling started in the morning due to falling US stocks, the strong market conditions persisted, leading to a turnaround. Buying to pick up lower prices and purchasing for rights support led to a steady performance. The Bank of Japan held a monetary policy meeting before the end of the morning session.

Earlier session / Active stocks and traded stocks [Active stocks and traded stocks]

*Daisue Construction <1814> 1962 +157 viewed as a Buy due to a significant Shareholding. *Tanseisha <9743> 1116 +66 continues to be positively received for its forecast of double-digit profit growth and planned dividend increase. *Yamashin Filter <6240> 631 +31 also has pointers such as the quarterly report. *Taiyo Yuden <6976> 2673 +131 is particularly lacking in materials, making short covering a dominant trend. *IHI <7013> 11790 +520 expansion in private aviation engine Components.

Comments

American Intl Group Inc (AIG US) $American International Group (AIG.US)$

Daily Chart - [BULLISH ↗ **] AIG US has shaped a bullish breakout of a channel and as long as price holds above 77.85 support, we remain bullish. We expect the price to push towards 87.20 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A daily candlestick closing below support at 7...

Intercontinental Exchange Inc (ICE US) $Intercontinental Exchange (ICE.US)$

Daily Chart - [BULLISH ↗ **] ICE US has shaped a bullish breakout and as long as price is holding above 166.35 support, a bullish push higher towards 183.0 resistance is expected. A daily candlestick close above 183.0 resistance will push price higher to the next resistance at 189.7.

Alternatively: A daily candlestick closing below 166.35 support...

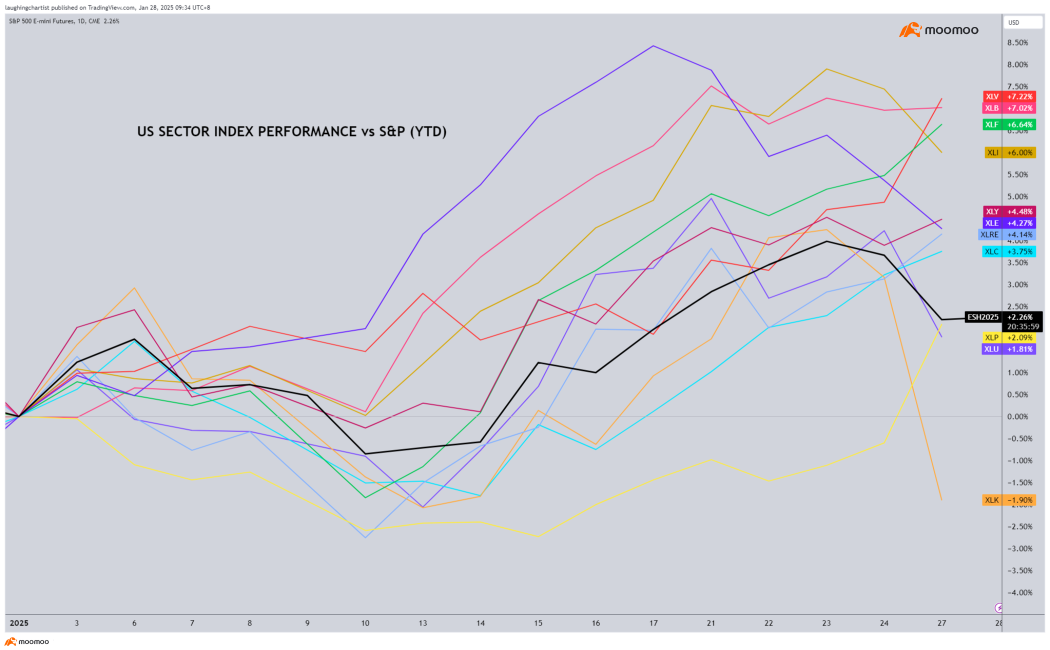

US Market

US markets ended last week on a positive note, with the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ posting their first weekly gains since Donald Trump's inauguration on Monday, rising by 0.81% and 0.93%, respectively. The S&P 500 even closed at a record high after Trump advocated for lower interest rates and reduced oil prices. Howe...

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$(4 Hour Chart) -[BULLISH↗ *]We stay slightly bullish as we expect price to push towards 6000 resistance level. A 4 hour candlestick closing above 6000 resistance level would open a push towards 6035 resistance level. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlesti...

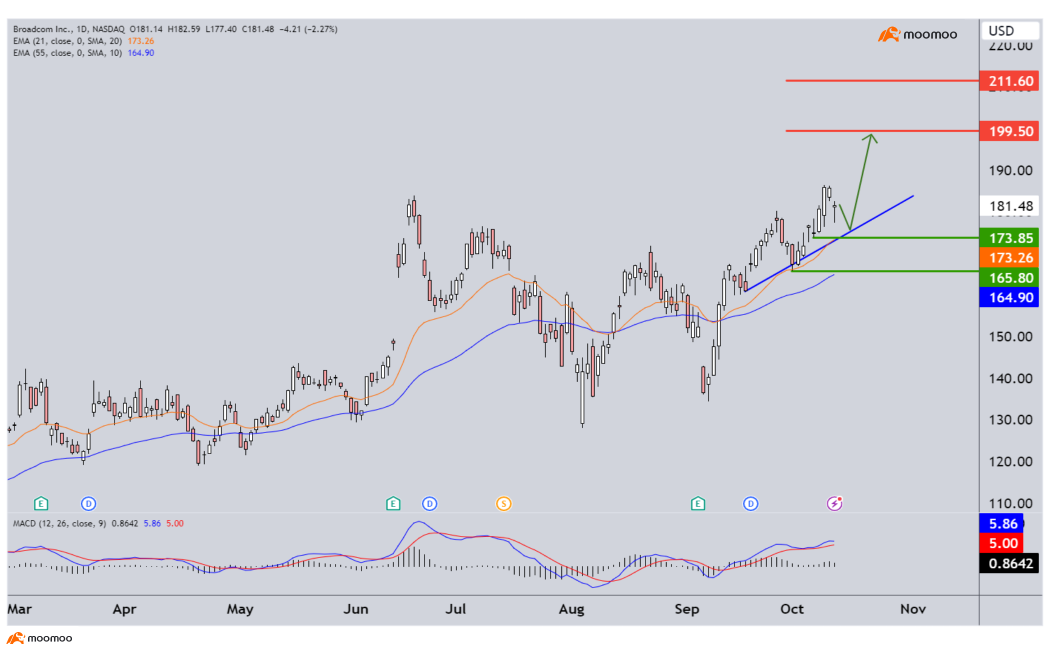

Broadcom Inc (AVGO US) $Broadcom (AVGO.US)$

Daily Chart -[BULLISH ↗ *]AVGO US is holding above its ascending trendline support. As long as price is holding above 173.85 support level, we expect price to drift down towards its ascending trendline support before drifting towards 199.50 resistance level. Technical indicators advocate for a bullish scenario as well.

Alternatively: A daily candlestick closing below 173.85 su...

102640653 : any update on hangseng index,alibaba,Tencent,byd.nio

Trader’s Edge OP 102640653 : Hi, i covered a couple of them during the weekly trader's edge webinar... If you missed the webinar, feel free to watch the replay! Cheers!