AMD Challenges Nvidia With Strategic $665M Purchase Of Finnish AI Lab

AMD Challenges Nvidia With Strategic $665M Purchase Of Finnish AI Lab

Advanced Micro Devices, Inc (NASDAQ:AMD) announced its plan to acquire Finnish AI start-up Silo AI for $665 million, marking one of the largest AI takeovers in Europe.

先进微设备公司(纳斯达克股票代码:AMD)宣布计划以6.65亿美元收购芬兰人工智能初创公司Silo AI,这是欧洲最大的人工智能收购之一。

This acquisition aims to bolster AMD's AI services to compete with market leader Nvidia Corp (NASDAQ:NVDA).

此次收购旨在加强AMD的人工智能服务,以与市场领导者英伟达公司(纳斯达克股票代码:NVDA)竞争。

The acquisition of Silo AI, expected to close in the second half of this year pending regulatory approval, will bring Silo's 300-member team into AMD's fold to build custom large language models (LLMs), the Financial Times reports.

据《金融时报》报道,对Silo AI的收购预计将于今年下半年完成,等待监管部门的批准,这将使Silo的300名成员团队加入AMD的行列,以构建自定义的大型语言模型(LLM)。

Vamsi Boppana, senior vice president of AMD's AI group, emphasized that the deal will accelerate customer engagements and AMD's AI tech stack.

AMD人工智能集团高级副总裁Vamsi Boppana强调说,该交易将加速客户参与和AMD的人工智能技术堆栈。

Silo AI, one of Europe's largest private AI labs, specializes in tailored AI models for enterprise customers. The Finnish company recently launched initiatives to develop LLMs in European languages like Swedish, Icelandic, and Danish, FT writes.

Silo AI是欧洲最大的私人人工智能实验室之一,专门为企业客户量身定制的人工智能模型。英国《金融时报》写道,这家芬兰公司最近启动了用瑞典语、冰岛语和丹麦语等欧洲语言开发法学硕士的计划。

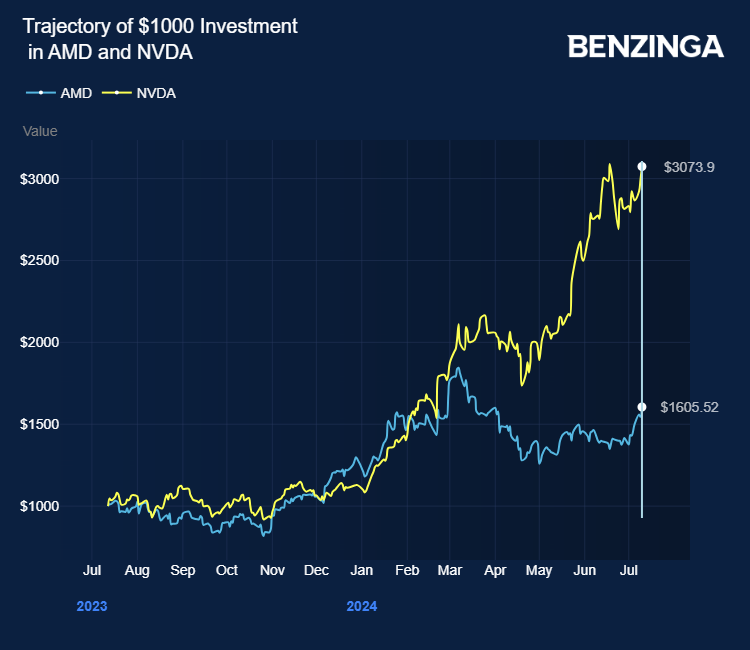

AMD's AI technology competes with Nvidia, whose success has pushed its valuation past $3 trillion this year.

AMD的人工智能技术与Nvidia竞争,Nvidia的成功使其今年的估值突破了3万亿美元。

Nvidia's proprietary software, Cuda, has significantly influenced its AI market leadership, allowing its chips to run a broader range of applications.

Nvidia的专有软件Cuda极大地影响了其人工智能市场的领导地位,使其芯片能够运行更广泛的应用。

In contrast, Silo AI's commitment to open-source models provides a unique offering, distinguishing it from proprietary models by companies like OpenAI and Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) Google.

相比之下,Silo AI对开源模型的承诺提供了独特的产品,使其与OpenAI和Alphabet Inc(纳斯达克股票代码:GOOG)(纳斯达克股票代码:GOOG)(纳斯达克股票代码:GOOG)等公司的专有模型区别开来。

Under CEO Lisa Su, AMD has introduced the MI300 accelerators, promising $4 billion in revenue this year. However, Nvidia will likely generate over $100 billion from its data center chip business alone this year, Bloomberg reports.

在首席执行官丽莎·苏的领导下,AMD推出了 MI300 加速器,承诺今年的收入为40亿美元。但是,彭博社报道,仅今年英伟达的数据中心芯片业务就可能产生超过1000亿美元的收入。

Investors can gain exposure to the semiconductor sector through VanEck Semiconductor ETF (NASDAQ:SMH) and iShares Semiconductor ETF (NASDAQ:SOXX).

投资者可以通过VanEck半导体ETF(纳斯达克股票代码:SMH)和iShares半导体ETF(纳斯达克股票代码:SOXX)获得半导体行业的敞口。

Price Actions: At the last check on Thursday premarket, NVDA shares traded higher by 0.67% at $135.81. AMD is down 0.14% at $183.70.

价格走势:在周四盘前的最后一次检查中,NVDA股价上涨0.67%,至135.81美元。AMD下跌0.14%,至183.70美元。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免责声明:此内容部分是在人工智能工具的帮助下制作的,并由Benzinga的编辑审阅和发布。

Photo via Shutterstock

照片来自 Shutterstock

Vamsi Boppana, senior vice president of AMD's AI group, emphasized that the deal will accelerate customer engagements and AMD's AI tech stack.

Vamsi Boppana, senior vice president of AMD's AI group, emphasized that the deal will accelerate customer engagements and AMD's AI tech stack.