Financial giants have made a conspicuous bearish move on Lululemon Athletica. Our analysis of options history for Lululemon Athletica (NASDAQ:LULU) revealed 19 unusual trades.

Delving into the details, we found 26% of traders were bullish, while 31% showed bearish tendencies. Out of all the trades we spotted, 14 were puts, with a value of $1,124,282, and 5 were calls, valued at $249,421.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $240.0 to $400.0 for Lululemon Athletica during the past quarter.

Insights into Volume & Open Interest

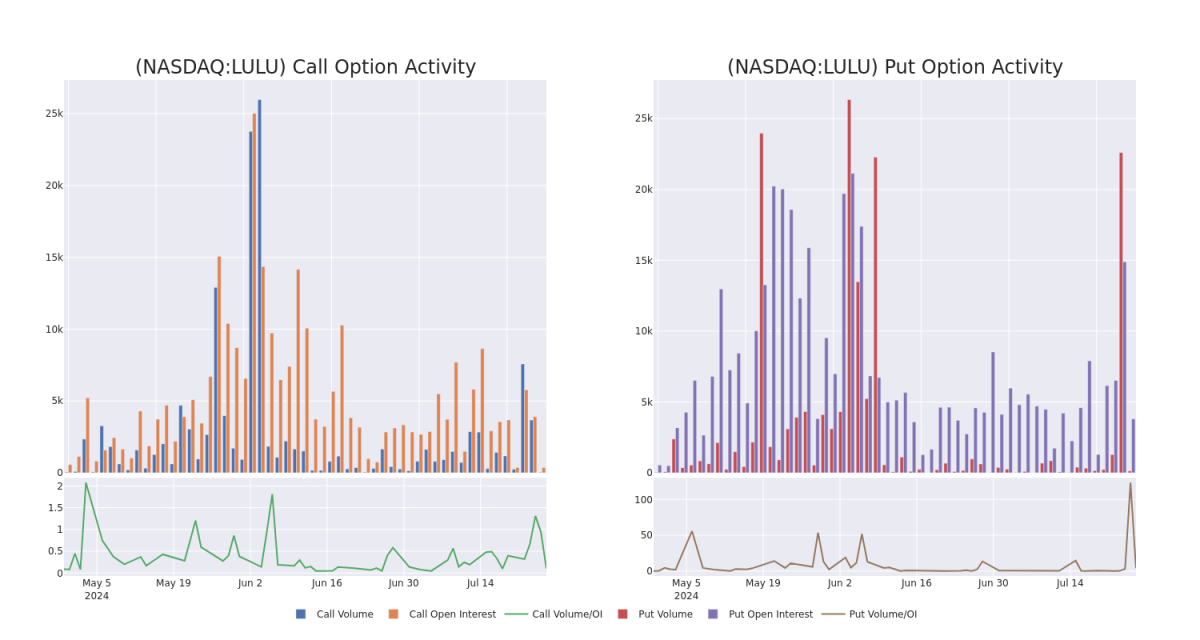

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lululemon Athletica's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lululemon Athletica's substantial trades, within a strike price spectrum from $240.0 to $400.0 over the preceding 30 days.

Lululemon Athletica Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LULU | PUT | SWEEP | NEUTRAL | 01/17/25 | $135.25 | $126.9 | $130.93 | $380.00 | $248.6K | 75 | 0 |

| LULU | PUT | SWEEP | NEUTRAL | 01/17/25 | $133.25 | $125.2 | $129.02 | $380.00 | $232.0K | 75 | 39 |

| LULU | PUT | SWEEP | BEARISH | 01/16/26 | $153.5 | $152.3 | $153.5 | $400.00 | $153.5K | 99 | 10 |

| LULU | PUT | SWEEP | NEUTRAL | 07/18/25 | $68.9 | $64.1 | $66.32 | $300.00 | $99.3K | 101 | 15 |

| LULU | CALL | TRADE | NEUTRAL | 12/18/26 | $72.85 | $67.15 | $70.0 | $250.00 | $70.0K | 47 | 6 |

About Lululemon Athletica

Lululemon Athletica designs, distributes, and markets athletic apparel, footwear, and accessories for women, men, and girls. Lululemon offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. The company also sells fitness accessories, such as bags, yoga mats, and equipment. Lululemon sells its products through more than 700 company-owned stores in about 20 countries, e-commerce, outlets, and wholesale accounts. The company was founded in 1998 and is based in Vancouver, Canada.

After a thorough review of the options trading surrounding Lululemon Athletica, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Lululemon Athletica's Current Market Status

- Currently trading with a volume of 285,017, the LULU's price is up by 0.73%, now at $249.12.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 34 days.

Expert Opinions on Lululemon Athletica

5 market experts have recently issued ratings for this stock, with a consensus target price of $349.6.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Lululemon Athletica with a target price of $338.

- Maintaining their stance, an analyst from TD Cowen continues to hold a Buy rating for Lululemon Athletica, targeting a price of $420.

- Consistent in their evaluation, an analyst from Jefferies keeps a Underperform rating on Lululemon Athletica with a target price of $220.

- An analyst from Baird has decided to maintain their Outperform rating on Lululemon Athletica, which currently sits at a price target of $470.

- An analyst from Citigroup downgraded its action to Neutral with a price target of $300.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lululemon Athletica with Benzinga Pro for real-time alerts.