'Big Short' Trader Danny Moses Gives Up On Shorting Tesla, Says It Is 'Very Difficult To Short A Name That Is Not Trading On Fundamentals'

'Big Short' Trader Danny Moses Gives Up On Shorting Tesla, Says It Is 'Very Difficult To Short A Name That Is Not Trading On Fundamentals'

Moses Ventures founder and "Big Short" fame trader Danny Moses said on Tuesday that he does not have a short position in Tesla Inc. (NASDAQ:TSLA) anymore.

摩西風險投資創始人兼 「大空頭」 名牌交易員丹尼·摩西周二表示,他在特斯拉公司(納斯達克股票代碼:TSLA)沒有空頭頭寸。

What Happened: Moses has been short on Tesla at various times since Nov. 2016 when Tesla bought SolarCity, which he deemed to be an "awful deal."

發生了什麼:自2016年11月特斯拉收購SolarCity以來,摩西曾多次缺少特斯拉,他認爲這是一筆 「糟糕的交易」。

However, in the first quarter of this year, Tesla started to trade on fundamentals after a long time, Moses said.

但是,摩西說,在今年第一季度,特斯拉在很長一段時間後開始進行基本面交易。

After the quarter's performance dropped, the company made promises of autonomous driving and robotaxis and company CEO Elon Musk started developing a relationship with President-elect Donald Trump, Moses noted in an appearance on CNBC.

摩西在CNBC上露面時指出,在本季度業績下降之後,該公司承諾提供自動駕駛和機器人出租車,公司首席執行官埃隆·馬斯克開始與當選總統唐納德·特朗普建立關係。

"When the story moves from non-fundamentals to technicals... that's when I leave the story," Moses said.

摩西說:「當故事從非基本面轉向技術問題時... 那就是我離開故事的時候。」

"It's very difficult to short a name that is not trading on fundamentals. It's also hard to go long a name when it's all on promises."

「要做空一個不以基本面爲基礎的名字是非常困難的。當這一切都兌現承諾時,也很難長出一個名字。」

Moses added that Musk has "promised things in the past that never came to fruition" and now he's talking about cutting $2 trillion from the federal budget. "You're not gonna be able to do that."

摩西補充說,馬斯克 「過去曾承諾過從未實現過的事情」,現在他正在談論從聯邦預算中削減2萬億美元。「你做不到。」

Why It Matters: Tesla shares closed down 1.6% at $351.42 on Tuesday. The stock is up by nearly 41% year-to-date, particularly after the stock rallied following Trump's victory in the Presidential elections.

爲何重要:特斯拉股價週二收盤下跌1.6%,至351.42美元。該股今年迄今已上漲近41%,尤其是在特朗普在總統大選中獲勝後該股上漲之後。

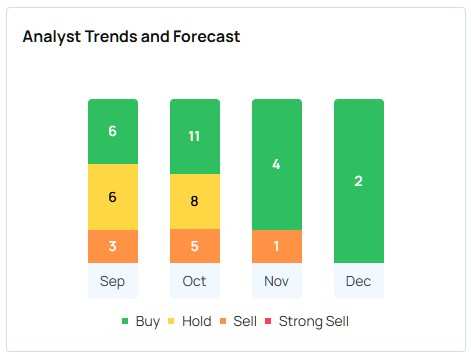

Overall, analysts have a consensus rating of "Buy" on Tesla stock, with the highest price target being $411.

總體而言,分析師對特斯拉股票的共識評級爲 「買入」,最高目標股價爲411美元。

Earlier this week, Roth MKM analyst Craig Irwin raised Tesla's price target by 347% from $85 to $380 and upgraded the rating to a "buy" from "neutral."

本週早些時候,羅斯mKM分析師克雷格·歐文將特斯拉的目標股價從85美元上調了347%,至380美元,並將評級從 「中性」 上調至 「買入」。

A long-time Tesla bear, Irwin turned bullish on Tesla on Monday noting the benefits that Tesla might reap out of its CEO's new association and support for Trump.

作爲特斯拉的長期熊市,歐文週一轉而看好特斯拉,他指出特斯拉可能從其首席執行官的新協會和對特朗普的支持中獲得好處。

Price Action: Tesla stock closed at $351.42 on Tuesday, down 1.6% for the day. Year-to-date, Tesla's shares have risen 41.5%, according to Benzinga Pro data.

價格走勢:特斯拉股價週二收於351.42美元,當天下跌1.6%。根據Benzinga Pro的數據,今年迄今爲止,特斯拉的股價已上漲41.5%。

Overall, analysts have a consensus rating of "Buy" on the Tesla stock, with the highest price target being $411. The most recent analyst ratings by Roth MKM, Stifel, and UBS have an average price target of $339, implying a 3.5% downside.

總體而言,分析師對特斯拉股票的共識評級爲 「買入」,最高目標股價爲411美元。Roth mKM、Stifel和瑞銀的最新分析師評級將平均目標股價定爲339美元,這意味着下跌幅度爲3.5%。

Check out more of Benzinga's Future Of Mobility coverage by following this link.

點擊此鏈接,查看Benzinga對未來交通的更多報道。

- Ford UK Chair Calls For 'Substantial' Incentives To Boost EV Demand: 'We Need And Want To Sell Electric Vehicles'

- 福特英國主席呼籲採取 「大量」 激勵措施以刺激電動汽車需求:「我們需要並且想要出售電動汽車」

Image made via photos on Shutterstock

通過 Shutterstock 上的照片拍攝的圖片

After the quarter's performance dropped, the company made promises of autonomous driving and robotaxis and company CEO

After the quarter's performance dropped, the company made promises of autonomous driving and robotaxis and company CEO