How to Use 13F to Find Investment Ideas

02 Identify a fund's investment strategy

In the previous section, we introduced Form 13F.

By reading the 13F filings, retail investors can see top Wall Street institutions' portfolios and changes in their holdings from quarter to quarter to gain investment ideas and learn strategies from leading investors.

However, which 13F should I analyze among the thousands filed every quarter?

To answer this question, we need to know the funds' investment strategies first.

A fund's strategy will affect how its manager trades stocks and build portfolios.

The chart shows the top 20 hedge funds by assets managed in 2021. They are all well-known institutions, such as Bridgewater Associates and Renaissance Technologies LLC.

Can I just buy the same stocks on their 13F filings?

Of course not. Hedge funds can be classified into many types, and their investment strategies differ.

Here are some common hedge fund strategies:

● Long/Short Equity: Take long positions in the winners and short positions in the losers, targeting a net long or short exposure.

● Market Neutral: Long undervalued stocks and short overvalued stocks, targeting zero net-market exposure.

● Event-driven: Profit from a stock's price fluctuations that may occur during or after a corporate event.

● Global Macro: Capture investment opportunities by analyzing how macroeconomics will affect interest rates, currencies, commodities, and stocks worldwide.

● Quantitative: Make investment decisions based on quantitative analysis, which understands price patterns using mathematical and statistical modeling.

The 13F filings are not always helpful since the institutions apply different strategies.

The report has two drawbacks:

1. Missing information: 13F filings only include long positions (equity, call/put options), leaving short positions unidentified. So, it's hard to tell whether its long positions are for hedging or returns.

2. Untimely data: Institutional managers have 45 days to submit their quarterly 13F filings, which means a time lag between the reporting and the filing date.

As a result, some 13Fs may give incomplete and even misleading information.

For instance, Renaissance Technologies Inc., as we mentioned earlier, is famous for quantitative trading, meaning it trades stocks a lot more frequently than funds that focus on equity fundamentals.

In other words, the 13F of quantitative funds may reflect investment decisions made several months earlier.

Are there any tips for picking out valuable 13Fs?

To identify 13F filings that offer valuable information, you may focus on institutions with the following characteristics:

● Long-only funds: Funds that apply a long-only strategy generate returns from their long positions, which may provide more valuable information for stock picking.

● Long-term investment horizons: Funds with this approach usually hold stocks for longer terms. As a result, they have a lower trading frequency, solving the time lag issue of 13F.

● History performance: Focus on funds that have performed well over the years. Strong performance through bull and bear markets may indicate a successful investment strategy worth learning from.

Let's look at some institutions that meet the three characteristics.

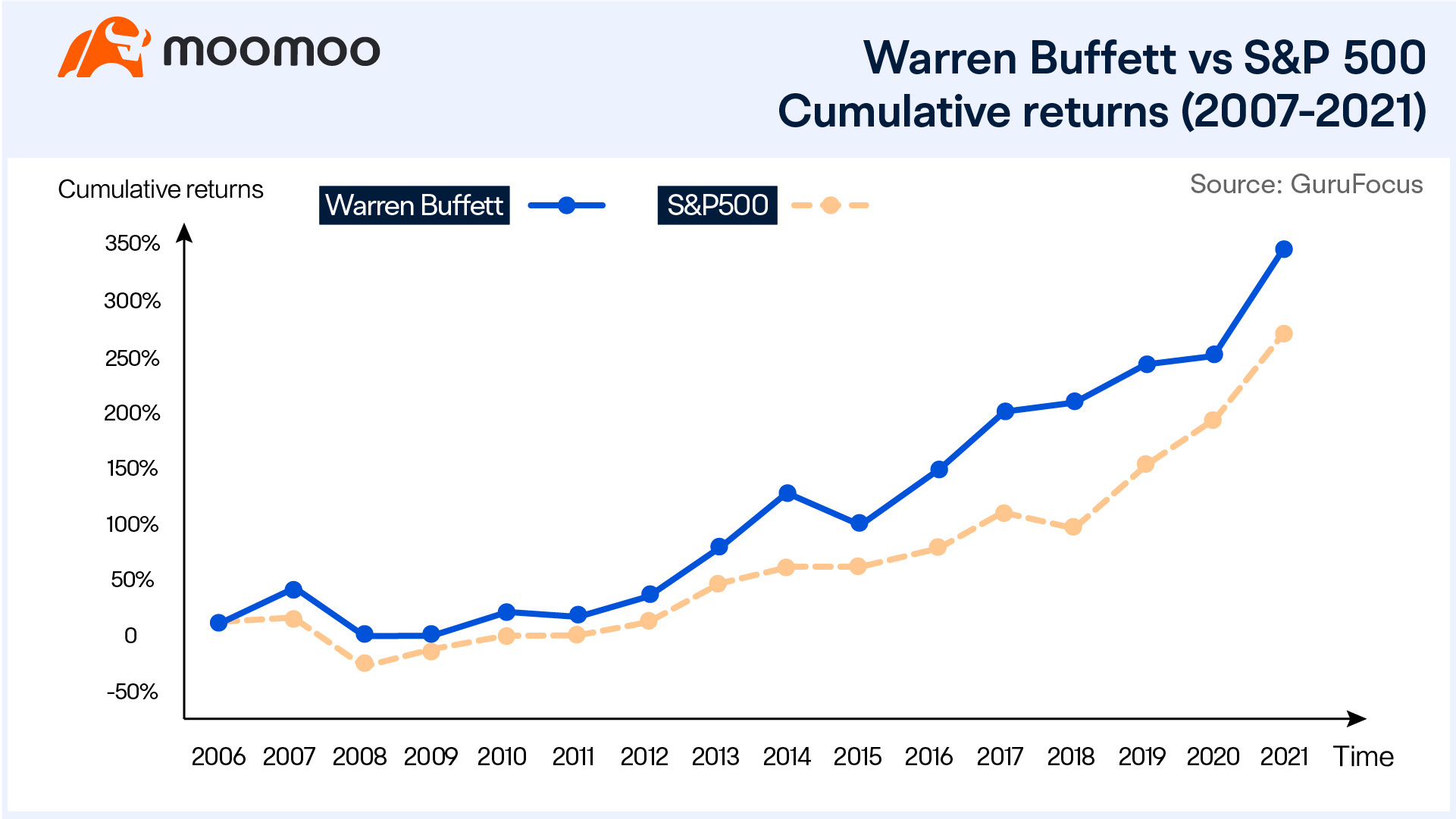

Warren Buffett's Berkshire Hathaway Inc. may be a good example.

Buffett is a well-known value investor. His investment philosophy is to seek undervalued stocks and hold them for a long time. In the past 15 years (2007-2021), Berkshire Hathaway's annualized return has been 9.85%, higher than the S&P 500's 8.41%.

If you are a value investor, you may want to see Buffett's portfolios.

It's important to remember that even the best fund manager will make mistakes. Therefore, don't copy the portfolio directly. Instead, take a closer look at those stocks, examine the fundamentals, and then determine if such companies are worth investing in.

Take a look at a fund investment strategy before reading its 13F filing.

You may focus on funds with the following characteristics: Long-only, Long-term investment horizons, and good performance record.

In this section, we learned how to identify valuable 13Fs. But do you know how to read them?

We will continue in the next section.

Although hedging strategies seek to limit or reduce investment risk, hedging strategies may also limit or reduce the profit potential. There is no assurance that hedging strategies will be successful.

All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.