An Easy-to-understand Macro Course

Analyzing the manufacturing industry may help you grasp economic trends

Have you heard the phrase "Made in America" a lot lately? It's not just a catchy slogan: it's a real change that's happening in the manufacturing industry. American companies are moving their factories back to the US from Asia, marking a significant shift in global industrialization.

The manufacturing industry is seen by many as a crucial part of industrialization on a global scale. Therefore, this course will dive into how the manufacturing industry can be linked to the economy and investment. Get ready to explore this dynamic field!

Why is the manufacturing industry important and what are some of the indicators?

How can investors interpret indicators to assist in establishing an analysis framework?

What are the potential impacts of manufacturing indicators on the stock market?

Let's put our knowledge into practice!

Summary

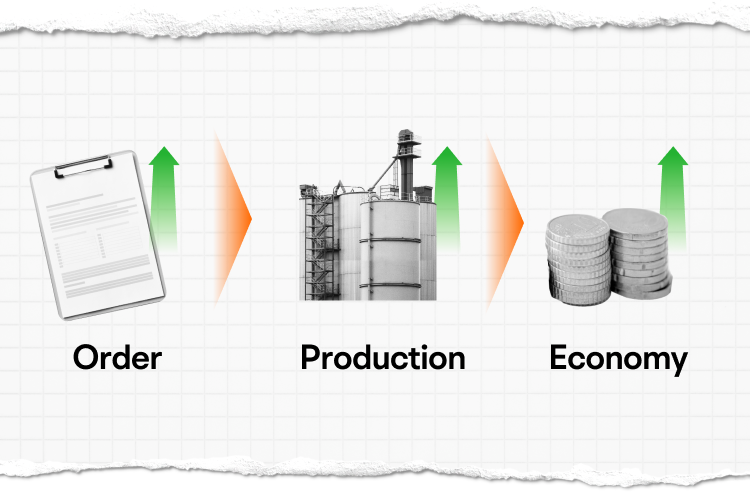

The manufacturing industry is a crucial component of US economic growth. It is a foundation upon which consumption relies - without production, there would be significantly impacted consumption.

As such, upstream production data typically serves as a leading indicator that can help reveal economic trends.

However, policies may also play a significant role in shaping the manufacturing industry.

In recent years, the US has used tax incentives, subsidies, and regulatory measures to attract the return of manufacturing to the country, particularly in semiconductors and electric vehicles. In 2022, the government has earmarked $52.7 billion for companies that build factories in America.

According to Asma Khalid, a White House correspondent for NPR, "President Biden has made support for American manufacturers central to his economic policy. It's expected to be a key part of his economic message when he launches his campaign for a second term".

The market tends to pay most attention to the following indicators:

PMI

New Orders for Durable Goods

Inventory

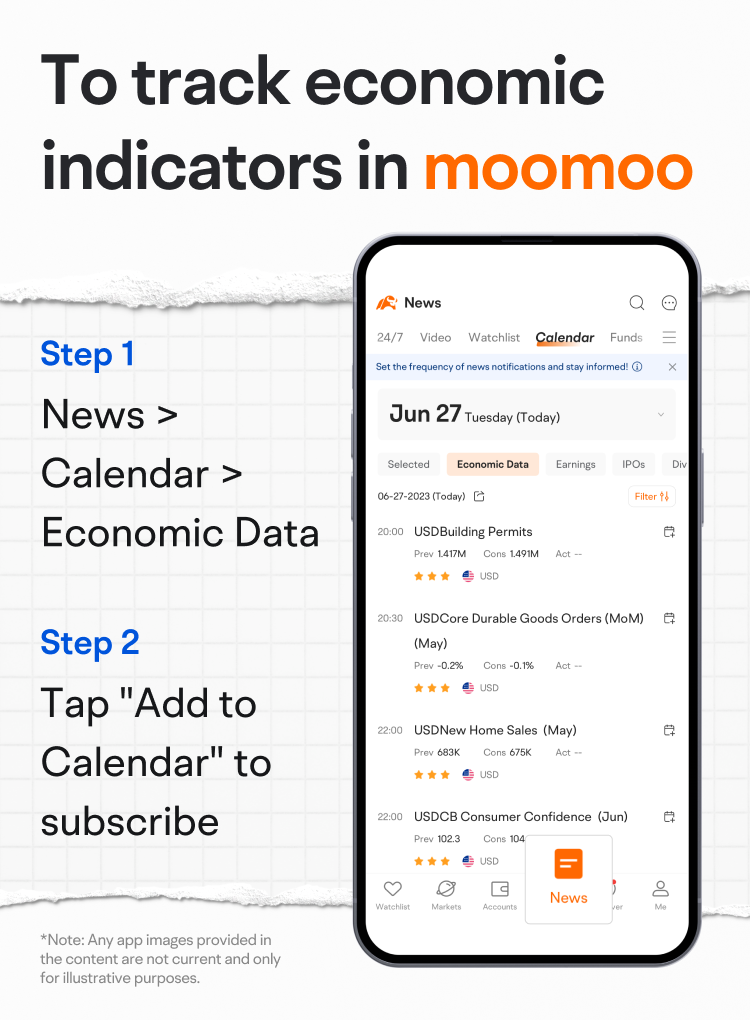

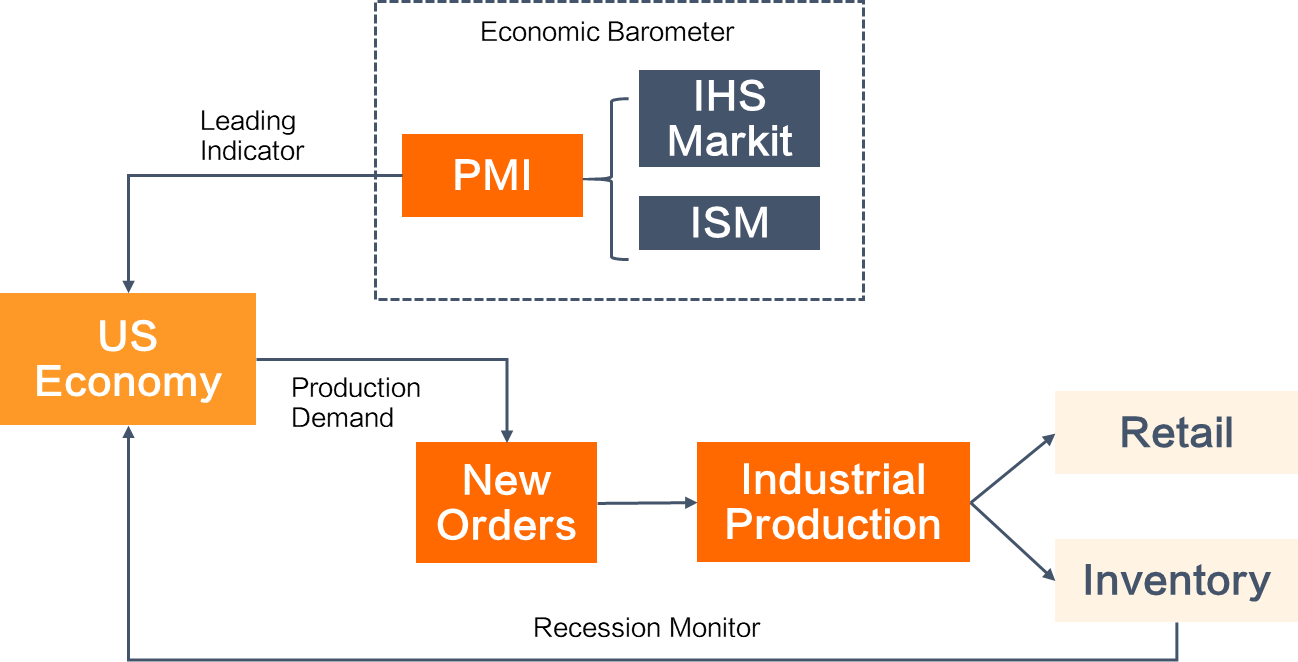

Here's a mind map of some key economic indicators in the US. Let me walk you through one by one.

1. Purchasing Managers' Index (PMI)

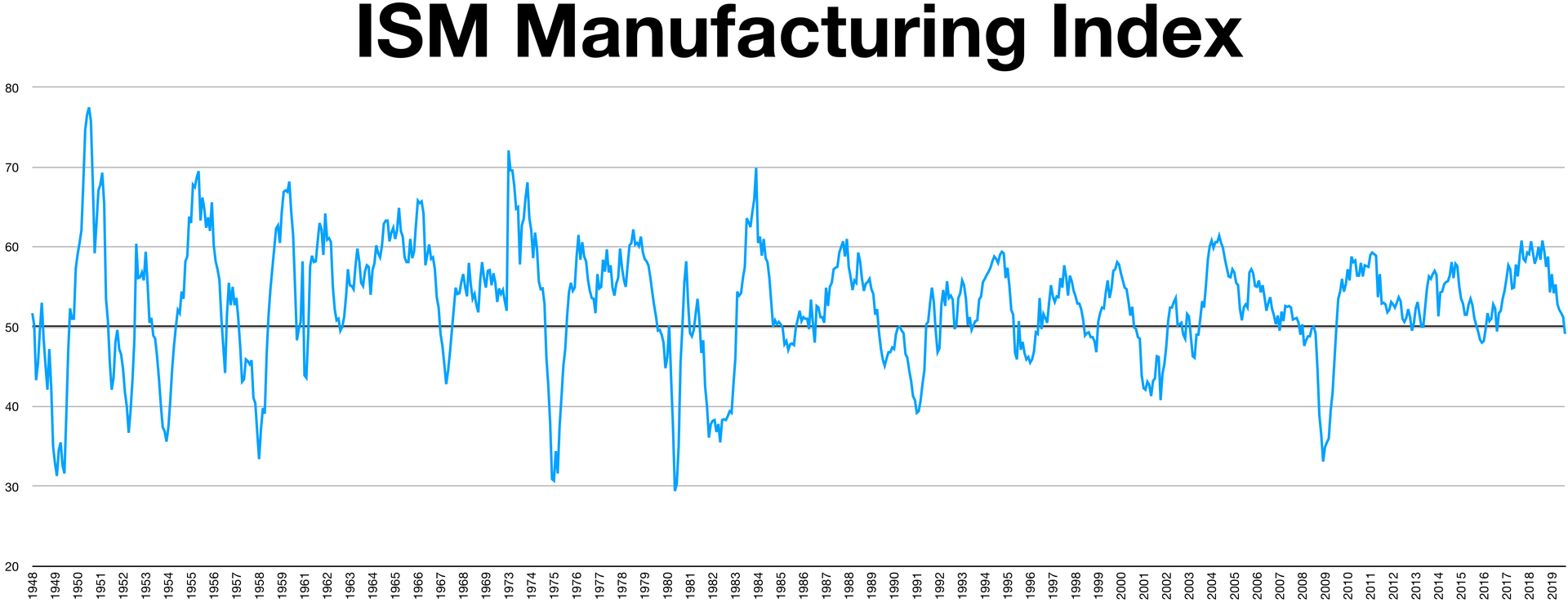

The Purchasing Managers' Index (PMI) is one of the most crucial economic indicators in the US and is often given a five-star rating for its importance.

Three stars are awarded because it is the earliest macroeconomic data released each month, while the remaining two stars are for its ability to monitor the business climate of the manufacturing industry and forecast trends in the US economy. As such, it is often referred to as the "economic barometer."

How is it calculated, you wonder?

The PMI data is compiled from surveys filled out by purchasing managers at manufacturing companies, based on their perceptions of market conditions.

The questionnaire comprises five main categories: new orders, production, employment, suppliers' delivery times, and stocks of purchases.

ISM PMI or Markit PMI?

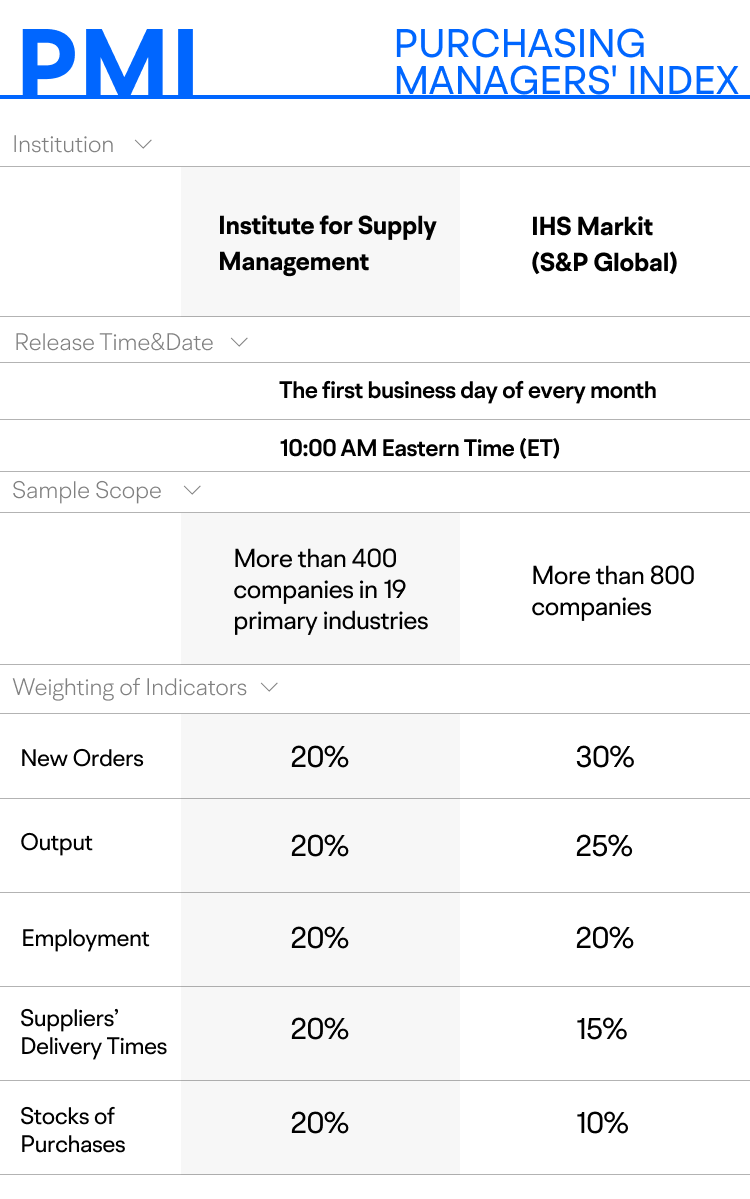

There are two major PMI data releases in the US: ISM and IHS Markit. You can see their similarities and differences listed in the table.

While both ISM and Markit use relatively consistent release times and calculation methods, they differ in their sampling and survey methods as well as the weighting of sub-items.

ISM is generally considered more authoritative, but when there are divergences between the PMI trends of ISM and Markit, some investors believe that Markit provides a more accurate reflection of manufacturing trends.

After learning the basics of the index, how can we analyze the figure?

The analysis method is directly related to the questions in the survey.

Purchasing managers assign weights of 1, 0.5, and 0 to indicate whether they perceive an improvement, no change, or deterioration in the state of the manufacturing industry.

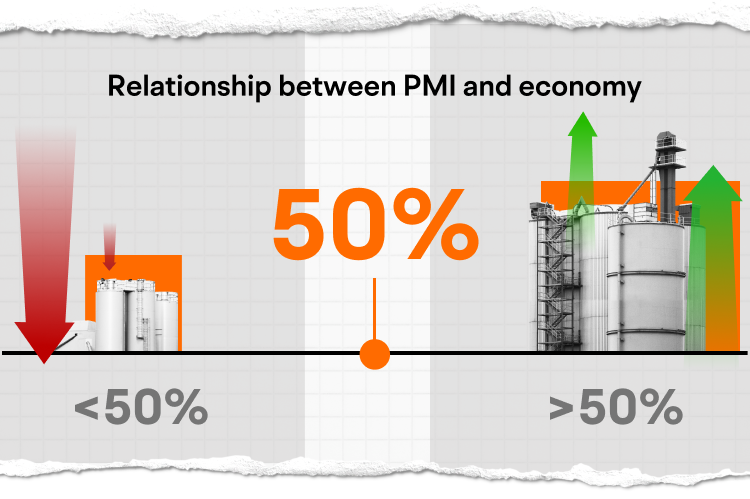

A score of 50% serves as the dividing line between perceived expansion and contraction in the manufacturing industry.

A value above 50% may indicate that the industry is expanding, while a value below 50% might suggest that the industry is contracting.

However, it's important to note that PMI only provides a month-on-month comparison and not year-on-year data. When analyzing PMI, we primarily focus on changes from the previous period, the 50% benchmark, and market expectations.

For example, if the February PMI registers at 49%, an increase of one percentage point from January and better than market expectations. Using the PMI data it can be assumed that the economy is better than last month, even though it's not expanding.

2. New Orders for Durable Goods

Now, let's move on to another leading indicator of the manufacturing industry - new orders for durable goods.

Since producing and delivering goods takes time, an increase in orders will usually lead to an increase in output, while a decrease in orders will generally result in an increase in inventories and ultimately lead to a decrease in production. Many economists use durable goods data to predict fluctuations in the manufacturing industry.

Why "durable" instead of "non-durable"?

Durable goods refer to those that are intended for long-term use, usually three years or longer, such as vehicles and appliances.

In contrast, non-durable goods are typically short-lived, manufactured and delivered more quickly and cheaply goods.

The rationale for using durable goods data over non-durable goods is that families may postpone orders for durable goods if the economy slows down and their income becomes restricted, but they are still likely to purchase non-durable goods.

But how to analyze durable goods new orders?

Let's look at an example. If Mike wants to buy a luxury car for his family, he usually would purchase it in the following two ways:

Purchase Outright - cash or equivalent from savings

Finance - loans

In this case, both options represent discretionary spending and provide an indication of willingness to spend and borrow. Thus, durable goods data can serve as an important indicator of consumer behavior, with high levels of willingness to spend and borrow generally being associated with strong economic conditions.

The new order for durable goods data can fluctuate greatly, making it more difficult to forecast. Here are two primary methods of analyzing this data:

using year-on-year growth rates

excluding defense and transportation orders and analyzing the moving average of three to six months.

If durable goods order data continues to rise continuously, it implies that buyers or investors have a positive outlook on the US economy.

3. Inventory

In addition to leading indicators, lagging indicators such as inventories can also provide valuable insights into the health of the manufacturing industry and the economy.

Why is inventory considered a lagging indicator? That's because matching inventory with future demand tends to be challenging for companies. Usually, companies produce more goods after there is an increase in demand, often resulting in inventory buildup.

Despite its lagging nature, analyzing inventory data can help identify early signs of an economic turning point.

When economic downturns occur, demand tends to decrease, usually leading to a larger backlog of inventory in manufacturing. To address this issue, companies may reduce production to try to reduce their inventory levels, which might exacerbate the economic downturn and create a vicious cycle.

Conversely, during periods of economic recovery, increased demand leads to higher sales and prompts companies to start replenishing their inventory levels through increased orders. These actions may further stimulate demand and drive inflation in the economy.

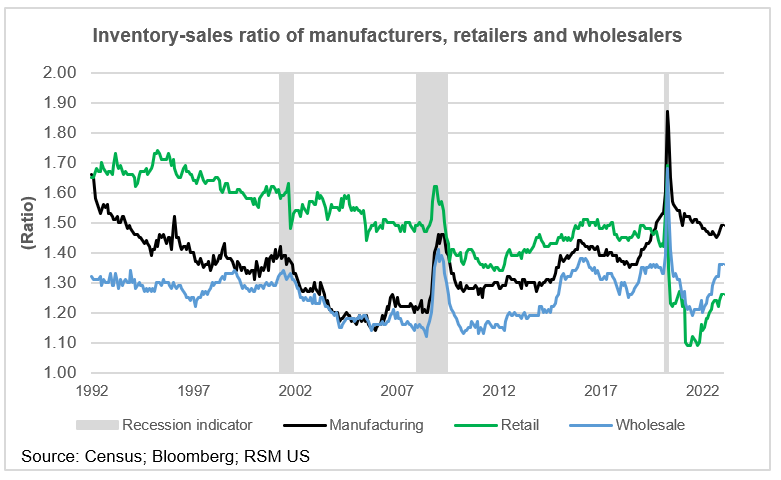

To observe the position of inventory over time, analysts commonly use the "inventory-to-sales ratio."

The chart below shows that during the three most recent recessions in the United States, the inventory-to-sales ratio had significant changes.

What are the potential impacts of manufacturing indicators on the stock market?

Analyzing the manufacturing industry can help investors identify potential investment opportunities because the manufacturing data we discussed above and the corresponding policy support are often reflected in the stock prices of manufacturing companies. The activity level of the industry typically follows a business cycle, meaning that production rates tend to increase during times of economic prosperity and decrease during economic downturns.

Investors can adjust their portfolios based on the current state of the economy, as indicated by the manufacturing data.

For instance, if an investor notices that the manufacturing orders and production volumes in a particular industry are increasing significantly, this may indicate that the company's business is growing, creating a potential investment opportunity.

From an inventory perspective, high inventory levels over a period of time may indicate weak consumer demand. In response to excessive inventory, manufacturers may reduce or stop production, known as "de-stocking" in economics.

However, reducing production can lead to lower profits for manufacturers, which could cause stock prices of manufacturing companies to decline.

Let's put our knowledge into practice!

In May 2023, the ISM PMI registered at 46.9%, down 0.2 percentage points from April's 47.1%. Market expectations were at 47.0%. Here is how we might interpret this data:

Remember that 50% serves as the "Manufacturing Economy Breakeven Line", where a value above 50% indicates optimistic economic prospects, while a value below 50% indicates pessimistic economic prospects.

As the May reading is still below 50%, the overall trend continues to indicate a possible further decline in manufacturing activity. Also, the May reading of 46.9 could suggest an overall economic slowdown.

The lower-than-expected PMI also appears to have contributed to a drop in the stock market.

Here are a few steps that can be used to analyze the manufacturing industry:

Pay attention to news about policies related to the manufacturing industry to identify potential investment opportunities or risks.

Become better informed of the release time and market expectations for critical manufacturing indicators. Conduct risk management before indicators are released to be better prepared.

Keep track of the PMI of the manufacturing industry to get a sense of future economic conditions.

Monitor changes in other key indicators, such as orders and inventory levels, to help determine the current state of the economy.

Consider adjusting investment portfolios accordingly based on the above analysis.

Wanna learn more?

If you now feel more confident in analyzing the manufacturing industry after this lesson, consider checking out our "advanced" section of macro analysis! Keep up with the latest PMI data to assist you in interpreting market trends and staying ahead of the game!