At-the-Money (ATM) Options - A Beginner's Guide

If you're interesting in trading options and have begun educating yourself on how options trading works, chances are you've come across the term 'at-the-money options' or 'ATM options'.

As one of the key concepts in the world of derivatives, ATM options play a significant role in understanding how options contracts work and how investors can use them to hedge risk or speculate on market movements.

Regardless of your level of options trading experience, familiarity with ATM options is essential for anyone navigating the complexities of the stock market.

What does ATM stand for?

ATM stands for 'at-the-money.' It refers to an options trading term describing a situation where the strike price of an option is equal to the current market price of the underlying asset (i.e. the value at which it is currently trading in the market).

Options are classified as 'in-the-money' (ITM) if the strike price is favorable for the holder upon expiration, and 'out-of-the-money' (OTM) if it's not.

Moneyness represents the relationship between the strike price and the current market price of the underlying asset. Understanding moneyness is crucial for options traders to assess risk and potential profitability.

How at-the-money options work

For buyers, ATM options offer the potential for substantial gains if the underlying asset moves favorably, while sellers face the risk of significant losses if the market moves against them. Therefore, ATM options are widely used for hedging and speculative trading strategies due to their sensitivity to market fluctuations, with traders closely monitoring them for potential shifts in market sentiment and volatility.

Options pricing for at-the-money options

Options pricing for at-the-money (ATM) options is influenced by various factors such as the current market price of the underlying asset, time until expiration, volatility, and interest rates.

The intrinsic value of ATM options are typically low because the strike price equals the current market price, making them more sensitive to changes in these factors compared to in-the-money or out-of-the-money options.

Traders utilize sophisticated models to estimate the fair value of ATM options, aiding in informed decisions regarding trading strategies and risk management.

At-the-money call options

At-the-money (ATM) call options have a strike price equal to the current market price of the underlying asset. Buyers of ATM call options anticipate the underlying asset's price to rise, aiming for profits if it surpasses the strike price. Sellers, however, hope for the opposite, hoping that the asset's price won't rise above the strike, thus profiting from the premium.

ATM call options offer a balance between risk and potential reward, being less expensive than in-the-money options but more costly than out-of-the-money ones. Traders assess market conditions, volatility, and time decay when considering ATM call options for their strategies.

At-the-money put options

At-the-money (ATM) put options also have a strike price matching the current market price of the underlying asset. However, buyers of ATM put options speculate on the asset's decline, potentially profiting if it falls below the strike price. Conversely, sellers aim for the opposite scenario, speculating that the asset's price won't drop below the strike, and earning premiums.

ATM put options offer a balanced risk-reward profile, being less costly than in-the-money options but more expensive than out-of-the-money ones. Traders analyze market conditions, volatility, and time decay when considering ATM put options for their trading strategies.

At-the-money (ATM) vs in-the-money (ITM)

At-the-money (ATM) and in-the-money (ITM) options represent different positions concerning the relationship between the option's strike price and the current market price of the underlying asset.

ATM options have a strike price equal to the asset's current market price, making them sensitive to even minor price movements. They offer a balance between risk and potential reward, being less expensive than ITM options but more costly than out-of-the-money ones. Traders often use ATM options for speculative strategies, hedging, or income generation.

On the other hand, ITM options have a strike price favorable to the holder if exercised immediately. They carry intrinsic value, as their strike price is already "in the money". This intrinsic value reflects the profit the option holder would gain if they were to exercise the option at the current market price. ITM options are more expensive than ATM and out-of-the-money options due to their intrinsic value. Traders utilize ITM options for their directional views, leveraging their higher sensitivity to price movements.

Understanding the differences between ATM and ITM options is crucial for traders to devise effective strategies. Each type offers distinct advantages and risks, allowing traders to tailor their approaches based on market conditions, volatility, and their risk tolerance.

How to trade options using Moomoo

After opening, registering, and depositing funds into your Moomoo trading account, you can then apply for options trading privileges. Once you have been approved for trading privileges, you are able to start. For a step-by-step guide to trading option on Moomoo, see here:

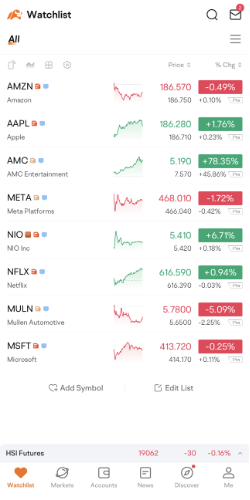

Step 1: Navigate to your Watchlist, then select a stock's "Detailed Quotes" page.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

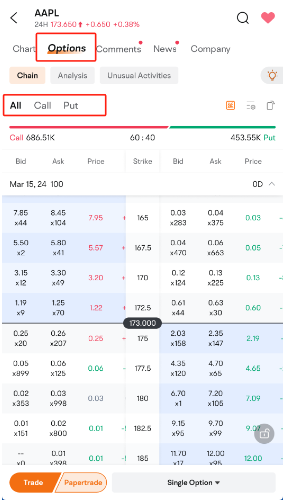

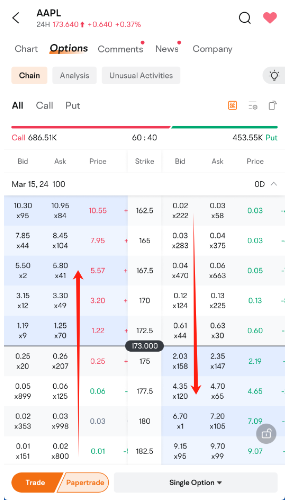

Step 2: Navigate to Options> Chain located at the top of the page.

Step 3: By default, all options with a specific expiration date are shown. For selective viewing of calls or puts, simply tap "Call/Put."

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

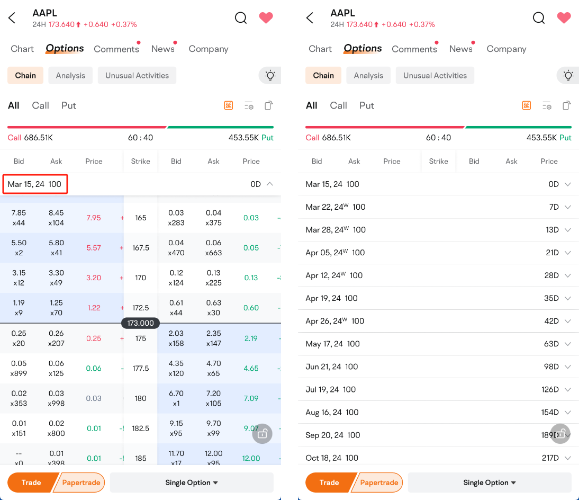

Step 4: Adjust the expiration date by choosing your preferred date from the menu.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 5: Easily distinguish between options: white denotes out-of-the-money, and blue indicates in-the-money. Swipe horizontally to access additional option details.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

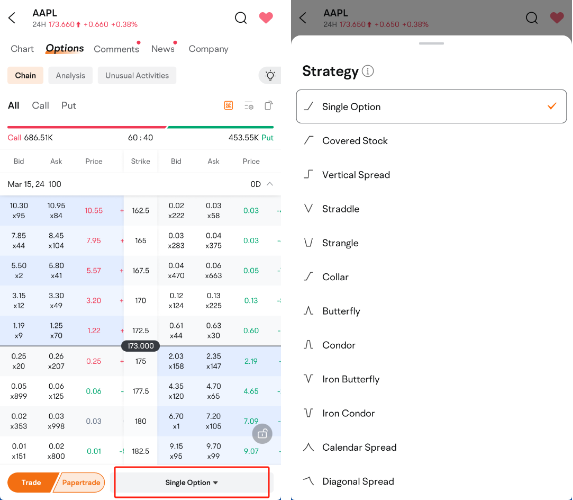

Step 6: Explore various trading strategies at the screen's bottom, offering flexibility for your investment approach.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

FAQ about ATM in options trading

Is it better to buy ATM or OTM?

The choice between buying at-the-money (ATM) or out-of-the-money (OTM) options depends on individual trading strategies and market conditions. ATM options offer a balance between cost and potential profitability, while OTM options are cheaper but require larger price movements to potentially become profitable. Traders seeking options that are more sensitive to price movements of the underlying stock may prefer ATM options, while those seeking higher potential returns may opt for OTM options, understanding the associated risks.

Can I profit from ATM?

Yes, traders can potentially profit from at-the-money (ATM) options through various strategies. ATM options offer a balance between cost and potential profitability. Traders can benefit from price movements in the underlying asset by buying ATM options and hoping to sell them at a higher price. Additionally, they can employ spread strategies like straddles or strangles aiming to capitalize on volatility. However, profitability depends on market conditions, timing, and effective risk management.

It is important to note that ATM long options will still lose money at expiration if the underlying stock price is not past the option's breakeven point, due to the cost of the options (premium). Therefore, traders need to account for this when planning their strategies.

What happens when options expire at-the-money?

When options expire at-the-money (ATM), their holders neither gain nor lose intrinsic value. For call options, if the underlying asset's price remains equal to the strike price, they expire worthless. Similarly, put options expire worthless if the asset's price is identical to the strike. However, option holders may incur losses due to the premium paid. Sellers of these options keep the premiums received if the options expire worthless.

What does near the money mean?

"Near the money" refers to the situation where the market price of the underlying asset is very close to the strike price of an option.

In this scenario, the option is neither "in-the-money" (where the option has intrinsic value) nor "out-of-the-money" (where the option has no intrinsic value). Instead, it's on the threshold of having intrinsic value if the price of the underlying asset moves slightly in a favorable direction.

For example:

If an investor purchases a call option with a strike price of $20, and the underlying stock price is currently trading at $20.50, the call option is said to be near the money.

In the above example, the option would be considered near the money if the underlying stock price was between $19.50 (50 cents less than the $20 strike price) and $20.50 (50 cents more than the $20 strike price).

Traders often closely watch near-the-money options because they can quickly transition into profitable positions if the market price of the underlying asset experiences a modest change. Conversely, near-the-money options can also move to "out-of-the-money" just as quickly if the market price moves unfavorably.