Understanding Bear Put Spread Strategies for Down Markets

In a down market, where prices of assets are falling or expected to fall, some investors may employ options strategies aiming to potentially profit from or hedge against further declines. They have different strategies to choose from and one includes a bear put spread option strategy. This strategy involves buying a put option while simultaneously selling another put option with a lower strike price.

Read on to learn more.

What is a bear put spread options strategy?

A bear put strategy, also known as a bear put spread, is an options trading strategy designed to benefit from a moderate decline in the price of the underlying asset. This strategy involves purchasing put options with a higher strike price while simultaneously selling put options with a lower strike price, on the same underlying stock and with the same expiration date.

The primary goals of the bear put strategy are to limit potential losses and reduce the upfront cost of the position compared to buying a standalone put option. This strategy can be employed when the trader anticipates a bearish market outlook but expects the price decline to be moderate rather than drastic.

How does a bear put spread work?

A bear put spread is a bearish options strategy designed to potentially profit from a decline in the price of the underlying asset. This strategy involves buying and selling put options with different strike prices but the same expiration date.

Here's an example of a bear put spread:

Buy 1 put option with a higher strike price ($100).

Sell 1 put option with a lower strike price ($95).

The net cost of entering the position is the premium paid for the put minus the premium received from the put (less any commissions/fees).

Buy 1 put at $3.20

Sell 1 put at $1.30

Net cost = $1.90

The goal of a bear put spread strategy

The goal of a bear put spread strategy is to potentially profit from a moderate decrease in the price of the underlying asset while limiting both potential profit and potential loss. This strategy is implemented only using put options and it includes two main objectives:

Potentially profit from a decline: By purchasing a put option with a certain strike price and simultaneously selling another put option with a lower strike price, the investor aims to capitalize on a decline in the asset's price between these two strike prices. If the price of the underlying asset falls below the lower strike price by expiration, the spread will potentially be profitable.

Manage risk: Limits both potential profit and potential loss. The theoretical maximum loss is capped at the initial cost of establishing the spread (the difference in premiums between the two put options).

Theoretical maximum profit

The theoretical maximum profit for a bear put spread is the difference between the higher strike price and the lower strike price, minus the net premium paid to establish the position. This potential profit is realized when the underlying asset's price is below the lower strike price at expiration.

For example, if you purchase a put option with a strike price of $50 and sell a put option with a strike price of $45, and the net premium paid is $3, the maximum profit would be $2 per share ($5 difference in strike prices - $3 net premium) less any commissions.

This theoretical maximum profit occurs when the underlying asset's price is at or below $45 (the strike price of the short put) at expiration. But note that below $45, the lower strike (sold) put would be in the money but at that point, the two put options cancel each other out. This caps the potential profit.

Theoretical maximum loss

The theoretical maximum loss for a bear put spread is limited to the net premium paid to establish the position. This loss occurs if the underlying asset's price remains above the higher strike price at expiration. In this scenario, both the bought put and sold put options would expire worthless, resulting in the trader losing the initial net premium paid.

For example, if you purchase a put option with a strike price of $50 and sell a put option with a strike price of $45, and the net premium paid is $3, the maximum loss would be $3 per share.

This defined risk profile may make the bear put spread an attractive strategy for traders looking to benefit from a moderate decline in the underlying asset's price while having a clear understanding of the maximum theoretical loss.

Maximum potential loss and profit for options are calculated based on the single leg or an entire multi-leg trade remaining intact until expiration with no option contracts being exercised or assigned. These figures do not account for a portion of a multi-leg strategy being changed or removed or the trader assuming a short or long position in the underlying stock at or before expiration. Therefore, it is possible to lose more than the theoretical max loss of a strategy.

Breakeven point

The breakeven point for a bear put spread is the price level at which the strategy neither makes a profit nor incurs a loss. It is calculated with the higher strike price minus the net premium paid to establish the position.

For example, if you purchase a put option with a strike price of $50 and sell a put option with a strike price of $45, with the net premium paid at $3, the breakeven point would be $47 ($50 higher strike price - $3 net premium).

At this price, the intrinsic value of the long put will offset the initial cost of the spread, resulting in neither a profit nor a loss. This calculation is essential for traders to understand whether their expectations for the underlying asset’s price movement will lead to a potentially profitable outcome.

How to construct a bear put spread

Constructing a bear put spread involves buying one put option while simultaneously selling another put option with the same expiration date but at a lower strike price.

Here's a step-by-step guide to constructing a bear put spread:

Analyze market conditions: Assess market conditions and identify a bearish outlook for the underlying asset.

Select an underlying asset: Choose the underlying asset (e.g., stock, index) on which you want to trade options if you are considering a multi-leg options trade. Please note that these trades are not suitable for all investors. You need knowledge and experience to trade options because of their level or risk.

Select expiration date: Decide on the expiration date for the options contracts. The expiration date should align with your trading timeframe and market expectations.

Determine option premiums: Evaluate the premiums (prices) of the put options at the chosen strike prices. Consider factors including implied volatility, time to expiration, and the underlying asset's current price.

Execute the trade: Place the trade by entering both the buy and sell orders for the selected put options simultaneously. Ensure that both options have the same expiration date to create a put spread.

Monitor the trade: After completing the opening trade, regularly monitor the performance of the bear put spread.

Manage the position: Consider managing the position based on changes in market conditions. You may choose to close the spread before expiration if it reaches your profit target or if the market conditions change.

How to trade a bear put spread on Moomoo

Moomoo provides a user-friendly options trading platform. Here's a step-by-step guide:

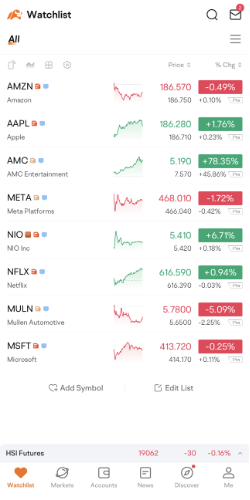

Step 1: Go to your Watchlist, then select a stock's "Detailed Quotes" page.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

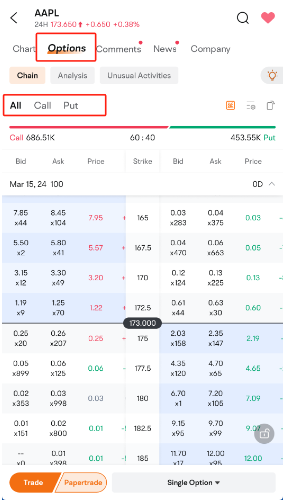

Step 2: Navigate to Options> Chain located at the top of the page.

Step 3: By default, all options with a specific expiration date are shown. For selective viewing of calls or puts, simply tap "Call/Put."

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

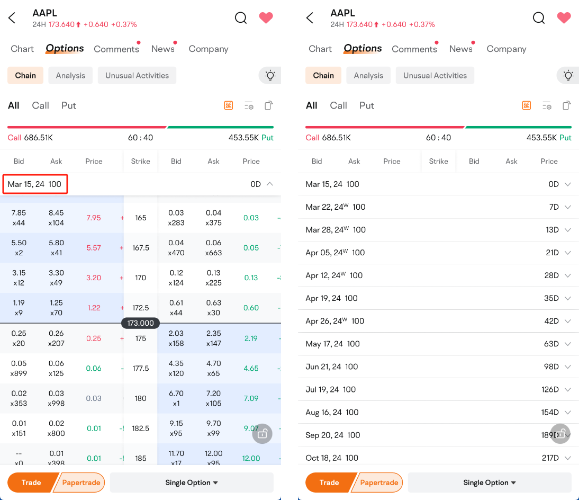

Step 4: Adjust the expiration date by choosing your preferred date from the menu.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

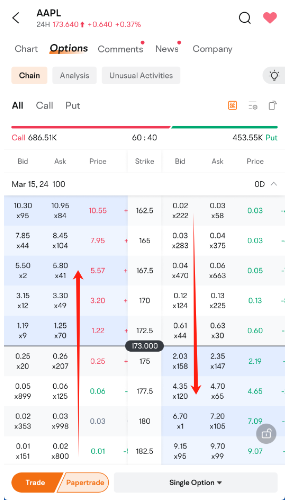

Step 5: Easily distinguish between options: white denotes out-of-the-money, and blue indicates in-the-money. Swipe horizontally to access additional option details.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 6: Explore various trading strategies at the screen's bottom, offering flexibility for your investment approach.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Bear put spread example

To gain a better understanding of how bear put spreads work, here's another example.

An investor bearish on a stock in the near term decides to implement a bear put spread. With a stock currently trading at $50 per share, an investor can open the following trade:

Buy put option: Buy one put option contract with a strike price of $48 with a $3 per share premium. This totals $300 ($3 premium x 100 shares) plus any commission and fees.

Sell put option: Simultaneously, sell one put option contract with a lower strike price of $44 with $1 premium. This totals $100 ($1 premium x 100 shares) less any commission and fees.

The investor will need to pay a total of $2 to set up this strategy ($3 – $1). If the price of the underlying asset closes below $44 upon expiration, the investor will realize a total potential profit of $2 per share. The maximum potential profit is calculated as $4 (difference in strikes prices of $48-$44) x 100 shares/contract - $2 (net price of the two contracts $3-$1) = $200.

If the stock price ends up at or above $48, both options expire worthless and the trader loses the cost of the spread.

Theoretical maximum profit = ($48 - $44) - $2 spread cost = $2

Theoretical maximum loss = $2 spread cost

Breakeven point = $48 strike - $2 spread cost = $46

Factors affecting bear put spreads

There are many factors that can affect the outcome and the potential profitability of a bear put spread strategy. Understanding them can help traders more effectively manage and monitor their bear put spreads, to assist them in achieving their desired outcomes while accounting for various market dynamics.

Here are some factors to consider.

Underlying price change

The most significant factor is the direction and magnitude of the price movement of the underlying asset (e.g., stock or index). The bear put spread potentially profits if the price of the underlying asset decreases, particularly if it falls below the lower strike price of the spread.

Volatility

Changes in implied volatility can impact the value of options, affecting the potential profitability of the bear put spread. Typically, an increase in volatility results in an increase in option premiums generally benefitting this strategy, while a decline can decrease premiums, usually to its detriment.

Time decay

Options lose value as time passes. Since the put spread option involves both buying and selling options, time decay affects each option differently. The long put option's value erodes over time, while the short put option benefits from time decay.

Other factors

Additional factors affecting bear put spreads can include the following:

Assignment risk: As time passes, assignment risk becomes relevant. If the short put option in the spread is assigned early, it can lead to unexpected position changes and additional costs.

Interest rates: Can affect the opportunity cost of carrying positions and may impact options premiums. Higher interest rates generally lead to higher premium prices, affecting the dynamics of the bear put spread.

Market sentiment and events: Can cause rapid shifts in the price of the underlying asset and volatility levels from economic reports, geopolitical events, and company-specific news.

Liquidity: Can affect the execution of the bear put spread as wide bid-ask spreads or low trading volume can result in unfavorable pricing when entering or exiting the position.

Strike price selection: Can significantly impact the risk and potential reward for the put spread. The wider the spread between strike prices, the greater the potential profit, but this also increases the initial cost and risk.

Potential pros and cons of a bear put spread

Here are the potential pros and cons of a bear put spread.

Potential pros

Limited risk: Theoretical maximum loss is restricted to the initial premium paid to establish the position.

Lower cost: Compared to purchasing a single put option, a bear put spread typically involves a lower upfront cost. By simultaneously buying and selling put options with different strike prices, the premium paid for the long put option is partially offset by the premium received from the short put option.

Profit potential in a bearish market: Potentially profits from a decline in the price of the underlying asset. If the price drops below the breakeven point, the spread can generate a potential profit.

Potential cons

Time decay (Theta): Can work against the long bear put spread, particularly if the price of the underlying asset remains stagnant or moves in the opposite direction. As time passes, the value of the options decreases, potentially reducing the spread's profitability.

Limited profit potential: Capped at the difference between the strike prices minus the net premium received. If the underlying asset's price drops significantly beyond the lower strike price, your potential gains are limited.

Bear put spread vs Bear call spread

Both bear put spreads and bear call spreads are options trading strategies used by investors who anticipate a decrease in the price of an underlying asset or a neutral market outlook. However, they involve different combinations of options and have different risk and reward profiles.

Structure

Bear call spread (credit spread): Involves selling a call option at a lower strike price and buying a call option at a higher strike price; both have the same expiration date.

Bear put spread (debit spread): Involves buying a put option at one strike price and selling another put option at a lower strike price, both with the same expiration date.

Net premium

Bear call spread: Results in a net credit because the premium received from selling the lower strike call option is greater than the premium paid for buying the higher strike call option.

Bear put spread: Results in a net debit because the premium paid for buying the higher strike put option is greater than the premium received from selling the lower strike put option.

Theoretical maximum profit

Bear call spread: Limited to the net credit received at the outset. This scenario occurs if the price of the underlying asset is at or below the lower strike price at expiration, causing both call options to expire worthless.

Bear put spread: Maximum profit is the difference between strike prices, minus the net premium paid. This profit is realized if the price of the underlying asset is at or below the lower strike price at expiration.

Theoretical maximum loss

Bear call spread: Maximum loss is limited to the difference between the strike prices, minus the net credit received. If the price of the underlying asset is above the higher strike price at expiration, both call options will be exercised, resulting in the maximum possible loss.

Bear put spread: Maximum loss is limited to the net premium paid to establish the spread. This loss occurs if the price of the underlying asset is at or above the higher strike price at expiration, causing both put options to expire worthless.

FAQs about the bear put spread options strategy

How can you potentially profit from a bear put spread?

Potentially profiting from a bear put spread involves correctly anticipating a moderate decline in the price of the underlying asset and effectively implementing the strategy.

When should you consider a bear put spread?

A bear put spread may be effective when a trader anticipates a moderate decline in the price of an underlying asset over a specific period. Here's a few scenarios.

Mildly bearish outlook: If you're mildly bearish on the asset, believing its price will not dramatically decline, a bear put spread may benefit from the anticipated downtrend while limiting potential losses (assuming the options are not exercised).

Manage risk: If you are seeking to manage risk exposure, a bear put spread offers a predefined potential loss level. The theoretical maxiumum loss is limited to the net premium paid.

Cost sensitivity: If you're seeking a more cost-effective way to potentially profit from a decline in an asset's price, a bear put spread can be more affordable than purchasing a single put option outright. The premium received from selling a lower strike put helps offset the cost of buying a higher strike put.

What is the breakeven point for a bear put spread?

The breakeven point for a bear put spread is the price level at which the strategy neither makes a potential profit nor incurs a loss at expiration. It's the price at which the gains from the bought put option offset the net premium paid or for establishing the spread.

What are the risks of the bear put spread?

While a bear put spread offers several potential advantages, it also comes with risks that investors should consider before implementing the strategy. Here are some risks:

Time decay (Theta): Since a bear put spread involves both buying and selling options, the impact of time decay can affect the potential profitability of the spread. If the price of the underlying asset remains unchanged or moves against the investor's expectations, time decay can erode the value of the spread, leading to losses.

Volatility risk: Changes in implied volatility can impact the value of options and, consequently, the potential profitability of the bear put spread.

Early assignment risk: While less common, there is a risk of early assignment with options, particularly if the short put option (sold put) is ITM near expiration.