Learn Bull Call Spread Options Strategy

If you think a stock's price might increase (but not skyrocket), you may consider a bull call spread. This options strategy can potentially be effective for when you're feeling optimistic but still want to manage your risk exposure.

Here's how it works:

You buy a call option and sell another call option with a higher strike price than that of the call option you bought. Both options share the same underlying asset and expiration date. The crucial aspect is that the call you buy is more expensive than the one you sell, resulting in a net debit to your account. This is why it’s often referred to as a debit call spread.

This strategy leverages options to potentially capitalize on a rising market without needing to invest substantial capital upfront, unlike purchasing the stock directly. Options allow you to control a larger position with a smaller initial outlay, potentially offering more significant gains if the market moves in your favor. However, trading options requires specific qualifications and authorizations. Ensure you have the appropriate level of brokerage approval before you proceed.

Now, let’s delve deeper into how bull call spreads work and explore why some traders often incorporate this strategy into their options trading plans.

What is a bull call spread options strategy?

A bull call spread is an options strategy where an investor buys a call option at a lower strike price and simultaneously sells a call option at a higher strike price, both with the same expiration date and underlying asset.

Why consider this? This strategy can be used when an investor expects the price of the underlying asset to rise moderately. While the investor pays a net debit upfront, the spread rises in value as the underlying asset's price increases.

However, profit potential is capped if the asset's price exceeds the higher strike price of the sold call option. If the underlying asset’s price falls below the strike price of the call option you purchased, your potential loss is capped. The loss is limited to the net cost or difference between what you paid for the bought call and what you received from selling the call.

An example of how a bull call spread works

Imagine you believe a stock's price will rise. A bull call spread is like making two calculated moves: you buy one call option and sell another at a higher strike price. This strategy seeks to profit from the anticipated rise while controlling some of your costs.

First, you buy a call option for the stock at a lower price than you think it'll reach (let's say $50). This is your "long call." Then, to help cover some of the cost of that position, you also sell a call option for the same stock, but at a higher price (maybe $60). This is your "short call."

Both positions have the same expiration date, which is the last day on which the option can be exercised.

The net cost for implementing this strategy and entering this position is the premium paid for the lower strike call minus the premium received from selling the higher strike call.

For example, if you buy a call with a $50 strike price for $5 and sell a call with a $60 strike price for $2, your net premium paid is $3 ($5 - $2). Your theoretical maximum loss is $300 or $3 per share, and your maximum profit is $700 or $7 per share ($10 difference in strike prices - $3 net premium).

Note: The premium cost for each call will depend on several factors, including strike price, time to expiration, volatility, and underlying asset price.

Here's the twist: You pay a bit of money upfront for this strategy. But as long as the stock price goes up, you can potentially make a profit. If the stock goes above $55, your profit is limited. That's because the short call you sold caps your potential earnings.

But there's a downside too. If the stock falls or remains below $50, your theoretical maximum loss is limited to the cost to set up the spread.

So a bull call spread is an option trade that can be employed if there is an expectation of a stock going up, which caps potential gains but defrays some of the initial cost of the trade.

The goal of bull call spread strategy

The goal of a bull call spread strategy is to make money from a moderate rise in the underlying asset's price while aiming to keep potential losses in check. It's all about managing your risk and reward — you reduce the overall cost compared to just buying a call option on its own. You're looking to potentially profit as the asset's price goes up, but within a certain range. It can be a more cost-effective way to try to benefit from the underlying asset's price going up without risking too much.

Maximum profit

The maximum profit is achieved when the underlying asset's price rises above the higher strike price at expiration. At this point, both options are in the money, and the profit is the difference between the two strike prices, minus the initial cost of setting up the spread. The profit potential is capped at this difference, offering a defined risk-reward profile that may be appropriate for bullish market expectations.

Using the above example:

The call option you bought ($50 strike) will be worth the difference between the stock price and $50 at expiration.

If the underlying stock price is above $60 at expiration, the call option you sold ($60 strike) will be worth the difference between the stock price and $60, which at this point offsets the gain from the bought call.

Your potential profit is capped at the difference between the strike prices ($60 - $50) minus the net premium paid.

If the stock price is $65 at expiration, the $50 call is worth $15, and the $60 call is worth $5. Your net profit is ($15 - $5) - $3 = $7.

Maximum loss

The theoretical maximum loss in a bull call spread strategy is limited to the initial cost of setting up the spread. This occurs if the price of the underlying asset at expiration is below the lower strike price of the purchased call option.

In this scenario, both options expire worthless, resulting in a loss equal to the initial net premium paid for the spread. The risk is defined and known upfront, making the strategy more appropriate for moderately bullish market scenarios.

Using the above example:

Both call options expire worthless because the stock price is below the strike price of both options.

You lose the net premium paid for the spread.

Example: If the stock price is $45 at expiration, both calls expire worthless, and your net loss is $3 (the net premium paid).

Breakeven stock price

When we speak about a breakeven stock price in a bull call spread strategy, we are looking at the stock price where you don't make or lose any money on the trade.

The breakeven stock price in a bull call spread strategy is the sum of the lower strike price of the purchased call option and the initial premium paid for the spread.

Using our example:

You buy a call option with a $50 strike price for $5.

You sell a call option with a $60 strike price for $2.

Your net cost is $5 (paid) - $2 (received) = $3.

Breakeven point:

$50 (lower strike price) + $3 (net cost) = $53

What it means:

If the stock price is $53:

The call you bought ($50 strike) is worth $3.

The call you sold ($60 strike) is worthless.

The value of your position ($3) matches the cost you paid ($3).

At $53, you don't make any money, but you also don't lose any. That's your breakeven point.

Understanding the breakeven point helps traders assess the viability of the strategy and manage their risk effectively.

How to manage a bull call spread strategy

Managing a bull call spread strategy involves understanding its construction and implementing appropriate adjustments.

We will begin by introducing the strategy's construction, which entails buying a call option at a lower strike price while simultaneously selling a call option at a higher strike price. It's important to monitor the underlying asset's price movement and expiration dates to assess potential profitability and adjustments.

Moomoo provides tools and resources for analyzing market trends, executing trades, and adjusting positions to help optimize potential returns and manage risks more effectively.

Moomoo provides a user-friendly options trading platform as well. Here's a step-by-step guide:

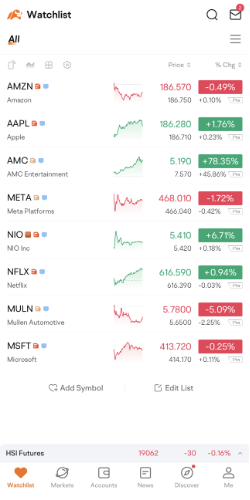

Step 1: Go to your Watchlist, then select a stock's "Detailed Quotes" page.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

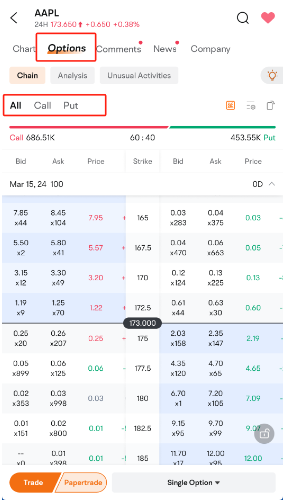

Step 2: Navigate to Options> Chain located at the top of the page.

Step 3: By default, all options with a specific expiration date are shown. For selective viewing of calls or puts, simply tap "Call/Put."

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

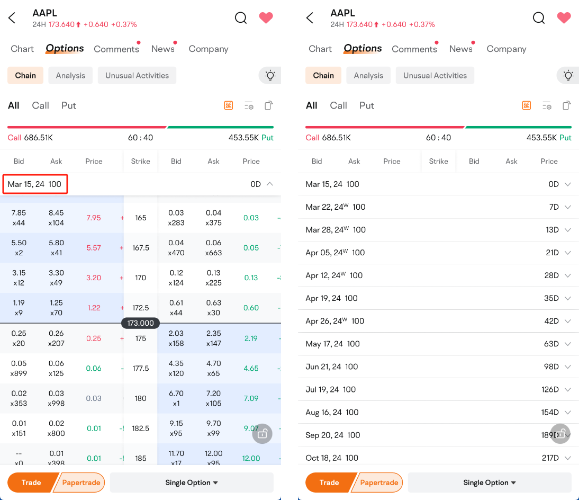

Step 4: Adjust the expiration date by choosing your preferred date from the menu.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

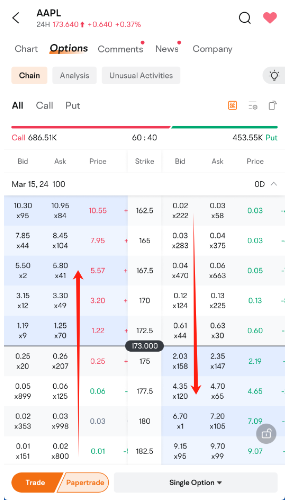

Step 5: Easily distinguish between options: white denotes out-of-the-money, and blue indicates in-the-money. Swipe horizontally to access additional option details.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 6: Explore various trading strategies at the screen's bottom, offering flexibility for your investment approach.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Factors affecting bull call spread

Factors impacting a bull call spread include changes in the underlying asset's price, implied volatility, time decay, and interest rates. Significant shifts in any of these variables can affect the profitability and risk profile of the spread strategy.

Underlying price change

In a bull call spread, if the underlying asset’s price rises above the lower strike price, you start to recover your costs. Your potential profit begins to build after surpassing the breakeven point and can increase up to the maximum profit, which is reached when the asset's price hits or exceeds the higher strike price.

If the price exceeds the higher strike, your profit is capped.

If the price remains or falls below the lower strike price, both options expire worthless, and you lose the net premium paid.

The breakeven point is the lower strike price plus the net premium paid.

Volatility

In a bull call spread, increased volatility generally raises the premiums of both the bought and sold call options. This can increase the net premium paid initially but also usually enhances the potential for the underlying asset to move into the profitable range between the strike prices.

Higher volatility can improve the chances of reaching maximum profit, but since both legs are affected similarly, the spread’s overall profitability might not change drastically. Conversely, lower volatility reduces premiums, making the spread relatively cheaper to enter but also less likely to achieve significant gains.

Time decay

Time decay, or theta, negatively impacts a bull call spread because the value of both the bought and sold call options decreases as expiration approaches. The option you bought (lower strike) loses value faster, especially if it's out-of-the-money, reducing potential profits. However, the option you sold (higher strike) also loses value, which partially offsets this loss.

Overall, time decay hurts the position if the underlying price doesn’t move into the profitable range quickly enough. The net effect is a gradual erosion of the spread’s value, emphasizing the need for timely upward movement in the underlying asset’s price.

Other factors

In a bull call spread, early assignment risk, typically on the sold call, can force an unexpected sale of the underlying asset, impacting the strategy profitability profile. Dividends might lower call option prices, as the underlying stock price drops on the ex-dividend date. Transaction costs reduce overall returns and should be considered when establishing and closing positions. The expiration date is also crucial; if the underlying price doesn't move into the profitable range by then, the spread's value diminishes, leading to potential losses.

Potential pros and cons of bull call spread

A bull call spread offers limited risk since the theoretical maximum loss is just the net premium paid, making it more cost-efficient than buying a single call. It also provides defined profit potential, potentially providing more predictable returns if the stock rises.However, potential profits are capped, and it requires accurate forecasts of stock movement. Additionally, it's more complex to execute and manage compared to single options.

Pros | Cons |

Limited risk due to defined loss (assuming no exercise of the option) | Limited profit potential |

Reduced upfront cost compared to buying a single call option | Potential for losses if stock price falls |

Can potentially profit from moderate bullishness | Limited flexibility in adjusting positions |

Clear potential profit and loss potential | Potential for diminished returns in highly |

volatile markets |

Bull Call Spread vs. Bull Put Spread

We've covered how a Bull Call Spread works: you buy a call option at a lower strike price and sell another at a higher strike price. This strategy lets you potentially profit from a moderate rise in the underlying asset's price, with both gains and losses capped.

Now, how does a Bull Put Spread differ? Instead of call options, it uses puts. You sell a put option at a higher strike price and buy another at a lower strike price. Both strategies aim for gains from a rising asset price, but the Bull Put Spread usually needs less upfront capital and gives you a credit right away, making it a bit different in terms of setup and financial dynamics.

FAQ about bull call spread options strategy

Why should I consider the bull call spread strategy?

You might use the bull call spread strategy for its defined risk-reward profile, offering limited risk exposure (assuming no exercise of the option) while still allowing for potential profit in moderately bullish market conditions. It provides a way to potentially profit on upward price movements in the underlying asset while capping potential losses. This strategy may be appropriate for option investors seeking to mitigate losses but also cap potential gains with a bullish outlook.

How to calculate a bull call spread?

To calculate a bull call spread, subtract the premium paid for the purchased call option from the premium received for the sold call option. This yields the net cost or debit of the spread. The maximum profit is the difference between the strike prices minus the net cost, while the theoretical maximum loss is the net cost itself. Breakeven occurs when the stock price equals the lower strike plus the net cost.

What is the difference between a bull put and a call spread?

A bull put spread involves selling a put option with a lower strike price and buying a put option with a higher strike price, profiting from bullish market moves. Conversely, a bull call spread consists of buying a call option with a lower strike price and selling a call option with a higher strike price. Both strategies aim for profit in rising markets, but they differ in the type of options used and the direction of trades.

What is the difference between a vertical spread and a bull call spread?

A vertical spread is a general term encompassing both bullish and bearish strategies where options of the same type (either calls or puts) are simultaneously bought and sold with different strike prices but the same expiration date. A bull call spread is a specific type of vertical spread where a call option is bought at a lower strike price and another call option is sold at a higher strike price, aiming to profit from upward price movements.