Buy to Open and Buy to Close: How They Work in Options Trading

In the options market, when an investor wants to enter the market with an order, they can purchase a call or put by initiating the position with a buy to open action. This order signals to market participants that the trader is setting up a new position. When it's time to exit and close the position initiated with a buy-to-open, an investor can execute a sell to close order.

Read on to learn more about this strategy.

Options basics you should know

An options contract is a financial product known as a derivative, meaning that it takes (or "derives") its value from an underlying asset. There are two parties to every options contract: the buyer (holder) and the seller (writer). The buyer of a contract is the party who bought it and has the right to exercise that contract's option. The writer of a contract is the party who sold it and has the obligation to fulfill the option contract's terms if necessary.

Options contracts

An options contract is an agreement between two parties that gives one party the right, but not the obligation, to either buy or sell a specific underlying asset (such as a stock) at a predetermined price (strike price) on or before a specificed date (expiration date). If the owner of an options contract doesn't want to exercise the option, they don't have to.

Call options

A buy to open call gives the buyer the right, but not the obligation, to purchase a stock or other underlying financial asset at a specific price (the strike price), by a specific date (expiration date). The buyer pays the seller a premium for this right, but is not obligated to exercise the option. If the buyer decides to exercise the option, the seller is assigned and obligated to sell the asset to the buyer.

Put options

A buy to open put gives an investor the right, but not the obligation, to sell a security at a predetermined price (strike price), by a specific date (the expiration date). The owner pays the seller a sum of money called a premium for this right. The seller (writer) of a put option is speculating that the stock price will increase. However, if the option is exercised, they are assigned and obligated to buy the stock at the strike price.

What is buy to open

Buy to open occurs when an investor purchases a new financial instrument, such as a stock, bond, or options contract, to establish a new long position in the market. This can apply to both call and put contracts.

For a buy to open call option, this is used by investors who believe that the price of the underlying asset will increase over time and they aim to profit from that increase. For a buy to open put option, investors use this when the sentiment is bearish and they believe the price underlying asset will decline over time, which they aim to profit from that decresae.

Example of buy to open

If a trader believes the price of a stock will increase, they can buy call options for that stock. For example, a trader might buy to open a call option for a stock with a $50 strike price and an expiration date of six months in the future.

What is buy to close

A buy to close is where an investor buys back a financial asset to close out an existing short position. It is also known as "short covering" or "covering a short position." This action can be used with different assets including stocks, bonds, or options contracts and its goal is to eliminate exposure to the asset and potentially lock in a profit or limit losses.

Example of buy to close

An investor can buy to close an options contract position by buying back the options contracts at either a lower or higher price, depending on the current market price of the option. This can help the investor potentially realize profits or cut losses. For example, if a trader wrote puts on a stock with a current price of $100 and the price remains flat or increases, they might buy to close the position to secure premium.

Buy to Open vs Buy to Close: Understanding the differences

Understanding the difference between buy to open and buy to close is critical for options traders. These two types of orders serve different strategic purposes and are fundamental to effective options trading.

Buy to open | Buy to close | |

Action | Establishes a new options contract position | Closes an existing options contract position |

Position | Creates a long position | Covers an existing short options contract position |

Contract type | Calls or puts | Calls or puts |

Using buy to open vs buy to close

An investor can use buy to open when they are purchasing a new options contract; this will be done by taking a long position. For buy to close, an investor can purchase an existing options contract that matches the contract they previously sold. This will offset the existing sold contract and exit (close) the position.

How to buy to open or buy to close options using moomoo

Moomoo provides a user-friendly options trading platform. Here's a step-by-step guide to get you started:

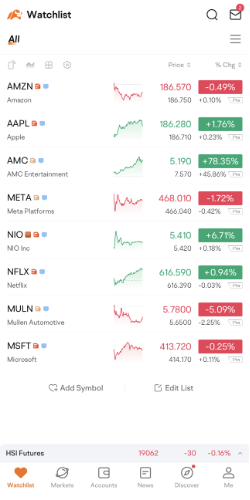

Step 1: Navigate to your Watchlist, then select a stock's "Detailed Quotes" page.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

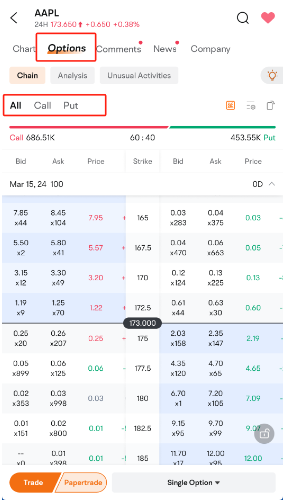

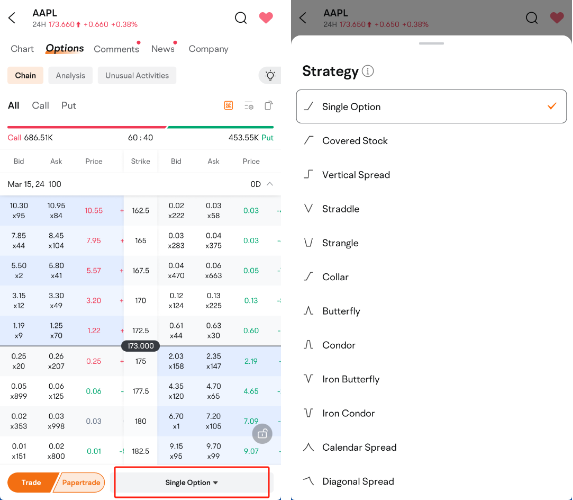

Step 2: Navigate to Options> Chain located at the top of the page.

Step 3: By default, all options with a specific expiration date are shown. For selective viewing of calls or puts, simply tap "Call/Put."

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

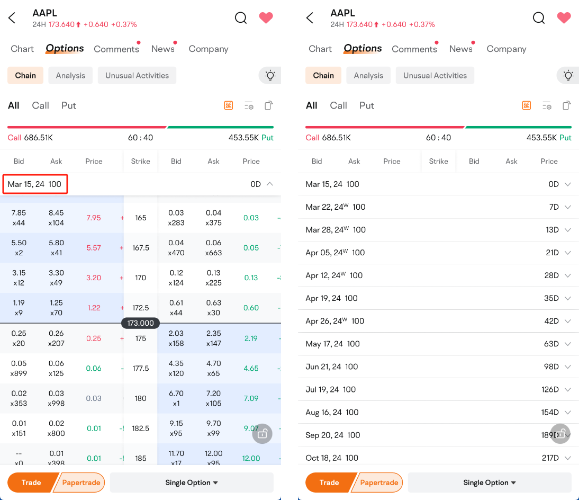

Step 4: Adjust the expiration date by choosing your preferred date from the menu.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

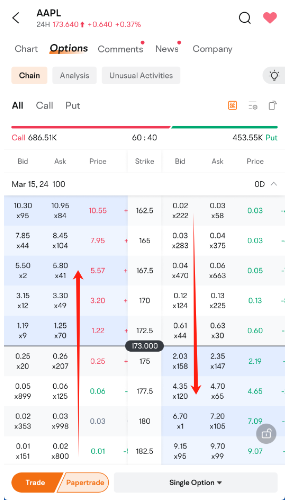

Step 5: Easily distinguish between options: white denotes out-of-the-money, and blue indicates in-the-money. Swipe horizontally to access additional option details.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 6: Explore various trading strategies at the screen's bottom, offering flexibility for your investment approach.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

FAQs About Buy to Open and Buy to Close

What's the difference between call options and put options?

Call options give the holder (buyer) the right, but not the obligation to buy an underlying asset from the writer (seller) at a predetermined price (strike price) on or before a specific date. This represents a long position as the holder thinks the underlying asset's price will go up. If they exercise the option, they'll have a long position in the underlying stock.

Put options give the holder the right, but not the obligation, to sell an underlying asset at a predetermined price (strike price), on or before a specific date. This represents a long position as the holder thinks the underlying asset's price will decrease. If they exercise the option, they'll have a short position in the underlying stock.

When should you buy to close an option?

An investor may consider buy to close when they want to buy an options contract to offset a contract they previously sold (wrote), enabling them to exit their position. An investor may also buy back the options contracts at a lower price if they have decreased in value and potentially secure a profit.

What is the risk of buying to open puts?

Buying to open put options provides leverage which may lead to greater potential profit compared to short selling if the stock's value significantly decreases. However, the put buyer risks losing their entire investment if the stock fails to drop below the strike price by expiration. The theoretical maximum loss is limited to the initial amount invested.

With short selling, this strategy is risky and involves borrowing a security and selling shares an investor doesn't own in the open market, with the goal of buying it back at a lower price. The difference between the two prices is the short seller's potential profit or loss. Potential profit is limited but potential loss is unlimited as the stock can continue to rise in price.