Covered Calls and Covered Puts Options Strategies

Covered calls and covered puts are an important concept to understand for options traders. By utilizing covered calls and puts alongside your stock investments, traders may be able to create an avenue for potential returns.

Here's why: Regardless of whether the options you've sold hit the exercise price, you'll pocket a premium for hedging against potential financial risks associated with the underlying stock.

This strategy may benefit two types of investors:

For those ready to sell: Investors looking to offload their stock if it climbs to a specific target price can benefit from both the premium received and the stock's appreciation if it goes up in value. By selling a covered call, you agree to sell your stock at this predetermined price within a given timeframe, collecting a premium in the process.

For those covering a short: This typically involves selling puts against shares you are already short. This can help mitigate potential losses from the short position as you've collected premium from selling puts.

What is a covered call?

A covered call is a option strategy that combines stock ownership with selling call options. This tactic allows investors to potentially generate additional income while owning the underlying stock.

Here's how it works: when you sell a call option against your stock holdings, you receive a premium, irrespective of whether the option is exercised or not. This approach could appeal to investors who are open to selling their stock if it reaches a specific target price. On the other side, investors who buy these call options are speculating that the price of the underlying stock will rise, potentially seeking capital appreciation or hedging against short positions.

Depending on their investment strategy and goals, covered call options may complement an investor's portfolio, adding a layer of risk management and potential profit.

Why and when should I consider using a covered call or a long call strategy?

The covered call strategy may offer an opportunity to enhance your investment portfolio by potentially generating additional income while maintaining ownership of the underlying stock. Depending on your investment goals and strategy, it could enable you to profit from a stock you already own or speculate on its future price movement.

For instance, let's consider two scenarios:

Selling side (Covered Call): You own 100 shares of Company X, currently trading at $50 per share. You decide to sell one call option with a strike price of $55, expiring in one month, for a premium of $200. If the stock remains below the $55 strike price, you keep the premium and can sell another call option in the following month. However, if the stock surpasses the $55 mark, you may need to sell your shares at the agreed price of $55, but you still keep the initial premium.

Buying side (Long Call): As a buyer of call options, you pay the premium to acquire the call option, granting you the right to purchase the underlying stock at the specified strike price within a designated timeframe. This strategy allows you to potentially benefit from a rise in the stock's price. If the stock surpasses the strike price, you have the option to exercise your right to buy the stock at a price lower than the current market value, potentially profiting from the price difference.

The covered call strategy provides potential benefits for sellers, offering potential income generation for sellers, while the long call strategy allows speculative opportunities for buyers. It may align with your investment goals and risk tolerance, and could be employed as a risk management strategy while allowing for profit potential based on market conditions.

Potential pros and cons of covered calls and long calls

Pros

Income generation: By selling call options against owned stocks, investors can generate additional income through premium collection.

Profit in neutral or bullish markets: Call options, including those purchased by investors, offer the potential for profit in neutral to bullish market conditions. Investors who buy call options speculate on possible price increases of the underlying stock and can potentially profit if the stock price rises above the strike price. The fact that the call option is covered by the seller is not particularly relevant to the buyer of the call.

Selling price above current stock price: Investors can set a selling price above the current stock price in rising markets, potentially locking in profits for sellers and offering profit potential for buyers.

It's important to note that covered calls require the interrelation between the call options and the underlying stock. Both must stay paired for the strategy to play out as described. Typically, the quantity of stock should match the quantity of call options sold, such as one call contract per 100 shares of underlying stock.

Cons

Limited profit potential: Covered calls restrict the potential for profit on the underlying stock for sellers, as they are obligated to sell the stock at the strike price if the option is exercised. While sellers receive a premium for selling the call option, it caps their potential profit at the strike price. Conversely, buyers face the risk of losing the premium paid as their theoretical maximum potential loss if the option expires out of the money.

Risk of decreasing asset value: There is a risk of the underlying asset decreasing in value, potentially resulting in unrealized losses for both sellers and buyers.

Premium cost: Sellers receive a premium for selling the call option, but buyers incur an upfront cost for purchasing it, which affects their overall investment return.

Foregone profit opportunity: Sellers may miss out on the opportunity to realize higher profits if the stock's price surges, while buyers face the potential loss of the premium paid as the theoretical maximum downside risk.

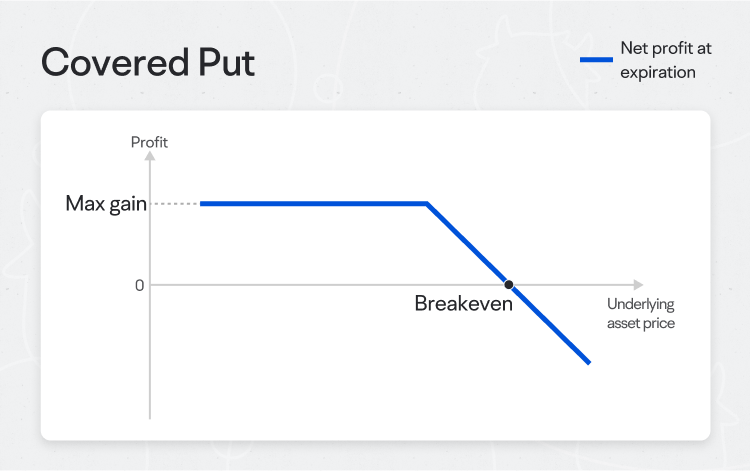

What is a covered put?

A covered put is a strategic options trading position where an investor holds a short position in the underlying security and simultaneously sells a put option against it. This strategy is commonly employed by experienced investors who hold a neutral to moderately bearish view on the underlying asset.

The primary purpose of selling covered puts is to help generate income. By selling put options against an existing short position in the underlying stock, investors potentially generate income through the premiums received from the option.

Employing the covered put options strategy allows investors to benefit from the time decay of the put options and potentially profit from a stable or slightly declining market in the underlying shares.

Why and when should I consider using a covered put?

You should consider using a covered put when you're feeling neutral to slightly bearish about a specific stock. This is because they offer a way to potentially earn income through the premiums from selling put options.

How? The income from the premiums could possibly offset potential losses incurred on the short position of the underlying asset. However, as the price of the underlying asset increases, the potential profitability of selling covered puts decreases and the maxiumum loss of a covered put position is still unlimited.

And if the stock price remains above the strike price, the put option will expire worthless; you keep the premium received.

Potential pros and cons of covered puts

Pros

Income generation: Covered puts offer the potential to generate income through premium collection.

Capitalizes on time decay: Investors can benefit from the time decay of the put options.

Can be beneficial for investors with a neutral to slightly bearish perspective of the market for the underlying stock.

Covered puts rely on the relationship between the put options and the underlying stock. The two need to remain connected for the strategy to function as intended. Generally, the number of put options sold should correspond to the quantity of underlying stock held.

Cons

Limited upside potential: The strategy restricts potential gains to the premium received from selling the put options, along with the difference between the strike price and the stock price of the shorted shares at the time of the put option sale.

Risk of put option sale: This could result in the closing out of the existing short position in the underlying stock.

Risk of unlimited loss potential: The potential loss is unlimited. If the stock price rises significantly, the short position’s losses can be substantial.

Margin requirements: Covered puts may entail higher margin requirements compared to other options strategies or compared to simply holding the underlying stock.

How to Create Covered Calls and Covered Puts

Moomoo provides a user-friendly options trading platform. For a step-by-step guide to trading options on Moomoo, see here:

Step 1: Navigate to your Watchlist, then select a stock's "Detailed Quotes" page.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 2: Navigate to Options> Chain located at the top of the page.

Step 3: By default, all options with a specific expiration date are shown. For selective viewing of calls or puts, simply tap "Call/Put."

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 4: Adjust the expiration date by choosing your preferred date from the menu.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 5: Easily distinguish between options: white denotes out-of-the-money, and blue indicates in-the-money. Swipe horizontally to access additional option details.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 6: Explore various trading strategies at the screen's bottom, offering flexibility for your investment approach.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

FAQs about covered calls and covered puts

What's the difference between covered calls and covered puts?

Covered calls and covered puts are both options strategies, yet they differ in their market outlook approach rather than in their profit potential.

Covered calls involve selling call options against owned stocks, aiming for income generation in neutral to bullish markets. This strategy allows investors to earn premium income while holding onto their stock positions.

On the other hand, covered puts entail selling put options against short stock positions, focusing on income generation in a neutral to bearish market. By selling puts, investors may generate income while potentially balancing their existing short position. This can offer a limited amount of relief should the underlying stock increase in value.

While both strategies aim for income generation, the key distinction lies in the directional outlook for the underlying stock.

What's the difference between selling a covered call and buying or selling a call option?

The difference between selling a covered call and buying or selling a call option lies in their underlying strategies.

Selling a covered call involves selling call options against owned stocks, aiming for income generation while holding the underlying stock.

In contrast, buying a call option entails purchasing call options with the expectation of profiting from an increase in the underlying stock's price, while selling a call option involves receiving a premium in exchange for the obligation to sell the underlying stock at the strike price upon exercise. Sellers of call options typically anticipate that the underlying stock's price will remain below the strike price, allowing them to keep the premium as profit.

An investor could also sell a call option without owning the underlying stock, which presents a different risk profile compared to covered calls and is often referred to as "naked" or "uncovered" calls," which is far riskier.

The covered call strategy integrates stock ownership with the options market, offering a unique approach to income generation.

Are covered calls a worthwhile investment?

Based on market research and insights, covered calls can be a worthwhile investment strategy for some investors under specific circumstances. For instance, they provide potential income generation, which may make them appealing for investors not emotionally tied to the underlying stock.

Still, like any other investment, it's crucial to carefully consider your individual risk tolerance and market conditions. While covered calls do offer potential returns, their profit potential is capped. For that reason, traders should always take a balanced approach when considering this strategy as an investment option.

Are covered puts bullish or bearish?

Covered puts are typically associated with a bearish market outlook. This strategy involves selling put options against a short position in the underlying stock for investors looking to potentially profit from a neutral to bearish trend in the underlying stock's price. If investors believe the stock price will decline, they can sell put options while simultaneously short selling the same amount of the underlying asset.

If the asset's price falls, as expected, investors can potentially profit from both the income generated by the sale of the put option and the decline in the stock price up to the strike price of the put option.

Selling put options is a way to earn premium income, which offsets the costs of short selling. However, it does not inherently limit losses if the stock price falls.