Diagonal Spread Options Strategy: What You Should Know

For options investors seeking a trade that can potentially help them minimize the effects of time and enable them to take either a bullish or bearish position, they may want to consider a diagonal spread, an advanced options strategy. This strategy can be used to potentially generate income from an underlying asset’s price movements, without needing to own the asset itself.

Read on to learn more.

What is a diagonal spread strategy?

A diagonal spread is an advanced options trading strategy that involves buying and selling options contracts of the same type (calls or puts) with different expiration dates and strike prices, on the same underlying asset. It combines elements of both vertical spreads and calendar spreads.

The goal of a diagonal spread is to potentially profit from the difference in the rate of time decay between the two options. The longer-term option that the trader buys will typically have a slower rate of time decay compared to the shorter-term option that they sell. If the underlying asset's price remains relatively stable or moves in a favorable direction, the trader can potentially profit from the decay of the sold option while holding onto the long option for potential further gains.

How a diagonal spread works

To construct a diagonal spread, an investor typically purchases a longer-term option and sells a shorter-term option. For example, an investor might buy a call option with a strike price of $50 that expires in six months and simultaneously sell a call option with a strike price of $55 that expires in three months. The primary goal of this strategy is to capitalize on the differences in time decay (theta) and potential price movements of the underlying asset.

Diagonal call spreads

Diagonal spreads can be used for various market outlooks, including bullish or bearish. The specific strike prices and expiration dates chosen will depend on the trader's expectations for the underlying asset's price movement and volatility. Additionally, risk management techniques such as setting stop-loss orders or adjusting the spread as market conditions change are often employed with diagonal spreads to help mitigate potential losses.

Theoretical maximum profit

The theoretical maximum profit potential can be achieved if the stock price is at or slightly above the strike price of the short call (the call sold) at expiration and the stock price has increased to such a degree that the long call (the call bought) has gained in value. This is the width of the spread, plus any remaining extrinsic value of the longer term call option. And from that value, then initial debit paid to open the position is subtracted.

Theoretical maximum loss

The theoretical maximum loss can occur if the price of the underlying asset at expiration is below the strike price of the long call option (longer-term option). The long call option expires worthless, as its strike price is higher than the market price of the underlying asset. The loss would be the initial premium paid to open the position.

It's important to note that the potential loss can be significant, especially if the net debit paid is substantial and the underlying asset's price moves unfavorably. Additionally, transaction costs such as commissions and fees should be considered when determining the overall loss of the spread.

Maximum potential loss and profit for options are calculated based on the single leg or an entire multi-leg trade remaining intact until expiration with no option contracts being exercised or assigned. These figures do not account for a portion of a multi-leg strategy being changed or removed or the trader assuming a short or long position in the underlying stock at or before expiration. Therefore, it is possible to lose more than the theoretical max loss of a strategy.

Breakeven

For a diagonal call spread, the breakeven point can be estimated as follows: Strike price of long call + net debit paid. The net debit paid is the total cost of establishing the spread (difference between the cost of buying the long call option and the premium received from selling the short call option).

At expiration (the expiration date for the short call), if the price of the underlying asset is equal to than the breakeven price, the spread will break even. Any price above the breakeven price represents a potential profit, while any price below it represents a potential loss.

Diagonal call spreads example

Here's a diagonal call spread with a trader bullish on a stock currently trading at $50.

Buy a long call: Purchases a call option with a longer expiration date (2-month call option) and a lower strike price ($55) with a $4.00 premium.

Sell a short call: Simultaneously, sells a call option with a nearer expiration date (1-month call option) and a higher strike price ($60) and receives a $1 premium.

Net debit: The initial cost of entering the diagonal call spread is calculated as the difference between the premium paid for the long call and the premium received for the short call.

Potential outcomes:

If the stock rises past $60 by the short call's expiration: If the stock price is at or above $60 at expiration, the short call will be in the money. The holder of the short call will likely exercise it, requiring the trader to sell the stock at $60. As a result, the trader will be in the position to achieve theoretical maximum gain, but they may miss out on the gains above this price.

If the stock rises to $58 by the short call’s expiration: The short call will expire worthless; the trader retains the $1 premium received. As the stock price rises closer to the $55 strike price, the long call generally gains value depending on the remaining time value and implied volatility. The trader can then choose to sell another short call with a higher strike price or a different expiration date, thereby continuing to reduce the cost basis.

If the stock falls or remains flat around $50 by the short call's expiration: The long call will likely have decreased in value, but the trader's theoretical maximum loss is limited to the net debit of $3.00 initially paid. The short call expires out of the money and the trader would need to decide to either close the longer-dated option at a loss or keep it open if it still has time value left hoping for the value to increase.

Diagonal put spreads

A diagonal put spread is an options trading strategy that involves buying and selling put options with different strike prices and different expiration dates, similar to the diagonal call spread but using put options.

In constructing a diagonal long put spread, an investor typically buys a long-term put option with a higher strike price and simultaneously sells a shorter-term put option with a lower strike price. For instance, an investor might purchase a put option with a strike price of $55 that expires in six months and sell a put option with a strike price of $50 that expires in three months.

Theoretical maximum profit

The theoretical maximum profit potential profit can be achieved if the price of the underlying asset is equal to the strike price of the short put option at expiration (expiring out of the money). The short put would expire out of the money (worthless) and the long put can be sold for its intrinsic value and any remaining extrinsic value. The realized profit is the credit received from selling the long put, minus the original net premium paid.

Theoretical maximum loss

The theoretical maximum loss is limited to the net premium paid for the spread. The width of a put diagonal spread (the difference between the strike prices of the long and short put options), can potentially impact the theoretical maximum loss potential. A wider spread can possibly result in higher maximum profit potential, but also a higher maximum loss potential while a narrower spread can result in lower maximum profit potential, but also a lower maximum loss potential.

Breakeven

The breakeven point for a diagonal put spread is estimated as the strike price of the long put (strike price of the option you bought) — net debit paid (total cost of establishing the spread). At expiration, if the price of the underlying asset is equal to the breakeven price, the spread breaks even but any price below the breakeven price represents a potential profit, while any price above it represents a potential loss.

Diagonal put spreads example

Here’s an example of a diagonal put spread that has a trader bearish on a stock currently trading at $80.

Buys a long put: Buys a 2-month put option with a strike price of $75, paying a premium of $5.00.

Sells a short put: Sells a 1-month put option with a strike price of $70, receiving a premium of $1.50.

Net debit: The initial cost is the difference between the premium paid for the long put and the premium received for the short put.

Potential outcomes:

If the stock drops to $72 by the short put’s expiration: The short put will expire worthless, and the trader retains the $1.50 premium received. As the stock price drops past the $75 strike price, the long put will potentially increase in value depending on the remaining time value and implied volatility. The trader can then choose to sell another short put with a different strike price or expiration date, thereby further reducing the cost basis.

If the stock rises or remains flat around $80 by the short put's expiration: The long put likely will have decreased in value, but the trader's theoretical maximum loss is limited to the net debit of $3.50 initially paid. The short put expires out of the money and the trader would need to decide to either close the longer dated option at a loss or keep it open if it still has time value left hoping for the value to increase.

Managing a diagonal spread strategy

This can involve monitoring the position and making adjustments or closing it out entirely based on changes in market conditions, underlying asset price movements, and other relevant factors.

Price movement: If the price of the underlying asset moves significantly in the desired direction, causing the spread to potentially reach a profit, you might consider closing out the position to lock in the gains. Or, you could adjust the spread to possibly capture additional profit potential if you believe the price movement will continue.

Time decay: If time decay accelerates or decelerates more than anticipated, it might affect the potential profitability of the spread. Managing the position by adjusting or closing it out could help mitigate potential losses or capture potential profits before expiration.

Volatility changes: If volatility increases, it might increase the value of both the long and short options, potentially benefiting the spread. Conversely, if volatility decreases, it might reduce the value of the options, leading to potential losses.

Early assignment risk: In some cases, the short option in a diagonal spread might be assigned early, particularly if it becomes deep in the money. Managing the position by closing out or adjusting the spread before expiration could help avoid potential losses associated with early assignment.

Adjustment opportunities: If market conditions change or your outlook on the underlying asset shifts, you might identify opportunities to adjust the spread by rolling the short option to a different strike price or expiration date, or by adding or removing legs from the spread. Adjusting the spread might help optimize potential profitability and manage risk.

Stop-losses: Implementing stop-loss orders can potentially help protect against significant losses if the price of the underlying asset moves against your position. If the spread reaches a predetermined loss threshold, you might consider closing it out to limit further losses.

Profit targets: Establishing profit targets based on your trading plan or risk-reward preferences can help guide your decision-making process. If the spread reaches your profit target, you might choose to close it out to realize the gains.

How to manage a diagonal spread on Moomoo

For a step-by-step guide to trading option on Moomoo, see here:

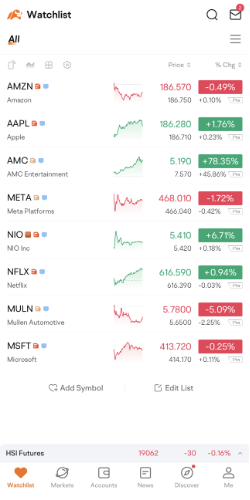

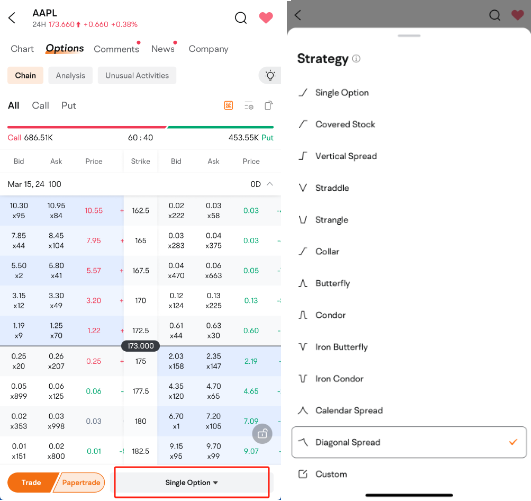

Step 1: Navigate to your Watchlist, then select a stock's "Detailed Quotes" page.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

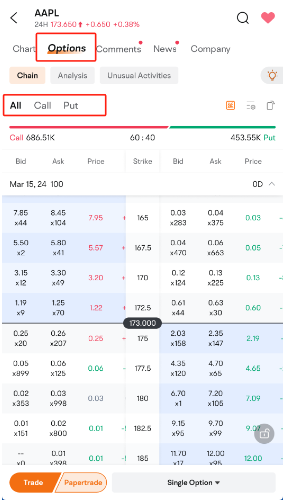

Step 2: Navigate to Options> Chain located at the top of the page.

Step 3: By default, all options with a specific expiration date are shown. For selective viewing of calls or puts, simply tap "Call/Put."

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

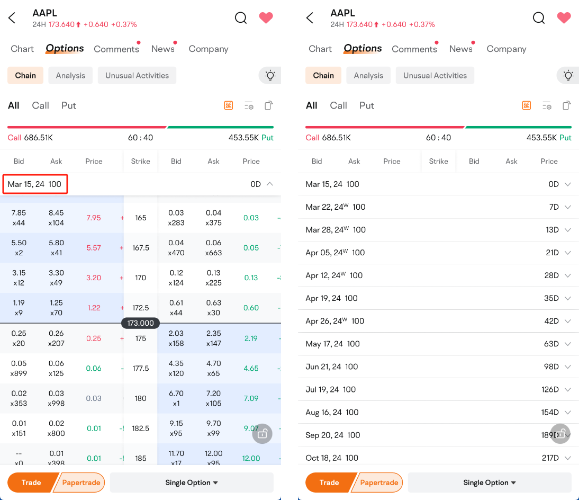

Step 4: Adjust the expiration date by choosing your preferred date from the menu.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

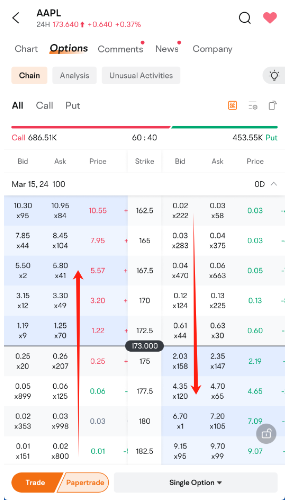

Step 5: Easily distinguish between options: white denotes out-of-the-money, and blue indicates in-the-money. Swipe horizontally to access additional option details.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 6: Explore various trading strategies at the screen's bottom like diagonal spread, offering flexibility for your investment approach.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Closing a diagonal spread strategy

Deciding when to close a diagonal spread strategy involves considering various factors such as market conditions, the underlying asset's price movement, the remaining time until expiration, and your profit or loss objectives. Here are some situations to possibly consider:

Achieving profit targets: If the spread has reached your predefined profit target or has generated a satisfactory return based on your trading plan, you might choose to close it out to lock in the gains.

Near expiration: As the expiration date of the short option approaches, the spread's risk profile can change, especially if the short option is deep in the money or there's a significant move in the underlying asset's price. Closing the spread before expiration can help avoid potential losses associated with early assignment or unfavorable price movements.

Avoiding assignment risk: If the short option in the spread is at risk of early assignment due to being deep in the money, particularly if there's a dividend payment or other corporate event approaching, you might consider closing the spread to avoid potential losses after assignment.

Managing losses: If the spread is experiencing significant losses and it's unlikely that market conditions will improve before expiration, you might choose to close it out to limit further losses and preserve capital.

Changing market conditions: If there's a significant change in market conditions, volatility levels, or your outlook on the underlying asset, closing the spread may be warranted to adapt to the new environment and mitigate potential losses or capture new opportunities.

Opportunity costs: If there are more attractive trading opportunities available elsewhere or if the risk-reward profile of the spread is no longer favorable, closing it out to free up capital for other trades might be prudent.

Rebalancing portfolio: If the spread no longer aligns with your overall investment objectives or portfolio strategy, closing it out to rebalance your portfolio may help reallocate resources more effectively.

Potential pros and cons of a diagonal spread

Potential pros

Income generation: By selling the shorter-term option, traders can collect premiums and reduce the net debit.

Risk management: The initial net debit caps the theoretical maximum potential loss, providing a defined loss limit. This structure allows traders to participate in some stock movements while managing downside risk.

Flexibility: Diagonal spreads offer the ability to adjust positions as market conditions shift such as traders can roll the short-term leg to a later date if the stock price nears the strike price upon expiration, maintaining the position while continuing to collect premiums.

Volatility adaptability: These spreads can be configured to benefit from different volatility scenarios. The long-term option holds value in an increasing volatility environment, while the short-term option provides some protection against time decay and volatility changes.

Potential cons

Complexity: Diagonal spreads are more complex than straightforward options strategies, making them unsuitable for novice traders. Paper trading these strategies can enable less experienced traders to first become comfortable with the strategy's structure and learn how to manage them.

Moderate profit potential: Unlike some other options strategies, the potential for profit in a diagonal spread is generally modest, as it's designed to achieve steady, moderate gains rather than large windfalls.

Time decay: While selling the short-term option provides income, the long-term option is still subject to time decay. If the market does not move as expected, the value of the long-term option can erode.

Transaction costs: Engaging in diagonal spreads involves multiple transactions, which can incur higher trading fees and potential slippage (the expected price of a trade and the actual price at which it executes).

Diagonal spread vs. vertical spread

A diagonal spread and a vertical spread differ in their structure and purpose; their major difference is vega's impact (the rate of change of the price of the derivative with respect to the volatility of the underlying asset).

A diagonal spread is established by simultaneously entering into a long and short position in two options of the same type (two call options or two put options) but with different strike prices and different expiration dates. This enables traders to create a trade that aims to minimize the effects of time, take a bullish or bearish position and gain leveraged exposure to an underlying price movement over an extended period.

A vertical spread's options have the same expiration dates but different strike prices. While they also are used for directional sentiments (bullish or bearish), vertical spreads are less concerned with time decay effects.

Diagonal spread vs. calendar spread

A calendar spread and a diagonal spread both involve buying and selling options with different expiration dates. However, they differ in the strike prices of the involved options.

In a calendar spread (also referred to as a horizontal spread), a trader buys an option (call or put) that expires farther out in time and sells the same kind of option (call or put) with an earlier expiration, but they share the same strike price. This strategy allows traders to potentially take advantage of the elevated premium in near-term options with a neutral market bias.

In a diagonal spread, the put options sold typically have a lower strike price (for call options, the strike price would be higher) and closer expiration date than the options bought; the strike price of the sold options are further away from the the underlying asset's current price. A diagonal spread can potentially benefit from time decay similar to the calendar spread, but these trades take a directional bias.

FAQs about diagonal spread options strategy

What is the margin requirement for diagonal spread?

The margin requirement for a diagonal spread varies depending on the broker and the specific details of the spread, but it generally involves calculating the risk associated with the position. Since a diagonal spread involves both long and short options positions, the margin accounts for the potential theoretical maximum loss that could occur if the trade does not go as planned. Typically, the margin requirement is determined by the net debit — the difference between the premium paid for the long option and the premium received from the short option — plus any additional margin needed to cover the risk of the sold option.

It's essential to check with your brokerage firm for specific margin requirements for diagonal spreads and to understand how margin is calculated for options trading in general. Margin requirements can vary between brokers and may change based on market conditions and regulatory requirements.

What is a double calendar spread?

A double calendar spread, also known as a double time spread, is an options trading strategy that involves simultaneously buying and selling two calendar spreads on the same underlying asset with different expiration dates. It combines elements of both a calendar spread and a straddle or strangle strategy.

The goal of a double calendar spread is to potentially profit from changes in volatility and time decay. It's a neutral strategy that benefits from an increase in implied volatility while limiting risk due to the defined-risk nature of calendar spreads.