Four Option Trading Mistakes to Avoid

Options are popular with investors due to their inherent leverage and hedges against adverse price moves. The investment required to benefit from price moves in the underlying asset is less than acquiring the asset directly, magnifying the percentage return. At the same time, all money invested in an option may be lost unless the underlying asset moves in the right direction within a specified period.

Long before the creation of the Chicago Board Options Exchange (CBOE), speculators and traders bought and sold stock options on an unregulated, negotiated basis. The SEC and CBOE standardized the practice, bringing options trading to Main Street America. Today, there are listed options exchanges worldwide. In 2021, the SEC reported more than 10,000 stocks with more than 1 million option series with over 30 million contracts traded per day. With so many options being traded daily, there are different mistakes you need to recognize, so you can try to avoid their pitfalls.

• Lack of preparation

• Insufficient time awareness

• Inconsistent strategy use

• Poor discipline

Keep reading to find out why options are such an appealing trading avenue for so many investors and how to manage your risks and potential losses.

Benefits and Risks of Option Trading

Options trading is a high-risk, high-return activity due to options'

• Derivative nature - the value of an option is derived from its underlying asset

• Finite life - a fixed exercise period

• High leverage - the ownership of a right to buy or sell stock rather than buying the stock directly, maximizes returns and losses. For example, common stocks can be purchased or sold short in a brokerage margin account, allowing the account holder to borrow 50% of the market value. A fifty percent loan is 2:1 leverage, effectively doubling gains or losses (excluding interest, commissions, and other ancillary costs). Options typically provide leverage between 5-10 to 1.

The following table illustrates the profit and loss consequences of purchases of 100 shares, a call option, and a put option at Apple's market price of $147.82 per share (*Not necessarily the true current price) and the possible financial returns at the expiration of the options. If the market price is below the strike price of a call option at the expiration date, the option is worthless, and the cost of the option is lost. Conversely, when the market price is above the strike price of a put option, the option has no value and the premium is lost.

Images provided are not current and any securities are shown for illustrative purposes only.

Four Common Mistakes of Option Traders

New options traders are often tech-savvy and participate in investment forums, though they are financial novices. One study found that new traders favor calls (69%) in ultra-short options (less than one week before expiration) at-the-money or slightly out-of-the-money. New options traders generally prefer options on larger companies with lower share prices and higher recent trading volume (e.g., attention-grabbing tickers).[ii]

Many are attracted to options for their extraordinary profit potential, even considering an option purchase akin to a lottery ticket. Consequently, newcomers and casual option traders are especially vulnerable to losses. In 2021, shares of Gamestop, a video game retailer, reached a high of $185 as short sellers scrambled to cover their positions. The price activity and news reports attracted speculators anxious to participate in the potential profits. Bloomberg reported the purchase of more than 52,000 Gamestop call contracts with an $800 strike price in the 24 hours before expiration. The contracts expired worthless the following day.

Images provided are not current and any securities are shown for illustrative purposes only.

Options trading can be a lucrative activity when done in a business-like manner. It should not be approached as potentially a gamble or a get-rich scheme. Successful options traders constantly learn and apply their knowledge to the market. They act deliberately, not emotionally. Profitability results from due diligence and the constant application of proven trading principles, and you can still lose money to unforeseen circumstances.

The four most common mistakes of options traders are

1. Lack of Preparation

Many first-time options traders have experience buying and selling equity securities and mistakenly assume their experience prepares them to trade options. That assumption is wrong. Anyone hoping to trade options successfully should prepare by learning the fundamentals of an option, the relationship between an option and its underlying asset, and the traditional options trades. Understanding how factors such as volatility, probability, and how price movements of the underlying security affect option prices are critical. Similarly, recognizing that risk/reward opportunities differ between in-the-money (ITM) and out-of-the-money (OTM) options expand a trader's strategic portfolio. As the chart below illustrates, ITM options have less risk and lower profit potential than OTM options with reverse characteristics.

Images provided are not current and any securities are shown for illustrative purposes only.

Images provided are not current and any securities are shown for illustrative purposes only.

Knowledge is the accumulated result of preparation and experience. Too much preparation is rarely a mistake, too little an invitation to financial disaster. Traders should find reliable trading platforms with extensive data and versatile tools to analyze potential investments.

2. Insufficient Time Awareness

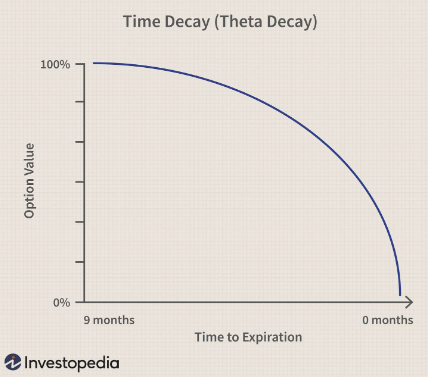

Warren Buffet, the legendary Sage of Omaha renowned for his investment success, stated that his favorite holding position is forever. Extended holding periods are not possible with options. Their values decay with time, the loss in value accelerating as their expiration dates approach. An investor who buys or sells an option and holds it without reference to the ongoing price movements of the underlying securities is likely to have a loss. Remember that keeping an option until maturity is not required; sometimes, a quick exit is the best choice.

Poor time awareness leads to :

• Failing to close open positions profitably: A volatile stock may move or exceed its probable range during the holding period, allowing the option owner to close the trade at a profit before its expiration date. Options owners must pay close attention to the market to avoid missing opportunities to close options when the option gets significantly profitable and before any reversals.

• Failing to collect dividends: Overlooking dividend payment dates when exercising a call option — allowing the option seller to collect the dividend — can reduce the total return of the trade.

• Failing to recognize spread option opportunities: Appropriately implemented spreads can enhance profit potential and reduce investment risk, and not using them can potentially lead to many lost potential profits.

3. Inconsistent Trading Strategy

Newcomers or occasional option traders typically acquire positions based on rumors or advice without an exit plan or strategy. The lack of financial objectives encourages emotional reactions, often leading to premature exits from potentially profitable positions and amplified losses. Many options traders limit their trades to a handful of volatile stocks, buying and selling options based on consistent movement between support and resistance levels.

Successful options traders generally employ focused strategies at one time. For example, a conservative investor seeking stock portfolio protection in a volatile market is likely to purchase put options on the individual securities. Another investor seeking to maximize current income typically sells calls against their portfolio securities. Some options traders limit their activity to OTM options, while others prefer ITM options. With experience, an options trader can select the trading strategy most compatible with their financial objective, personality, and pocketbook — avoiding unnecessary losses from emotional trading.

4. Poor Trading Discipline

There are no guarantees of profits when speculating on future price movement. The further one goes into the future, the more likely the outcome will be different than projected. Money management is risk management. It begins with understanding your risk tolerance. If you worry at night about your trades, you should avoid them. Investors typically range from those whose primary objective is to prevent losses to those seeking maximum profits despite the risk. Your investment philosophy should reflect your risk profile.

Conservative investors generally buy calls and puts so that profits are unlimited, profits are not unlimited on long puts, and losses are limited to the premiums paid. The time to use more aggressive, exotic options strategies is after you gain experience and confidence in your knowledge.

Objectivity and discipline are keys to successful options trades. If admitting mistakes is difficult for you, option trading will be agonizing. You will make mistakes in trading. Everyone does. Fortunately, their impact can be minimized by following a few simple principles:

1. Thoroughly research the underlying security before buying an option. Research should include fundamental and technical analyses. Avoid surprises by being aware of company news, including earnings projections, management changes, new products, and changes in capital. Identify price trends, support and resistance levels, and trading volume in the underlying security and its options.

2. Never exhaust your capital on a single position. Remember, there are no sure things. Money management requires maintaining the ability to act when an opportunity happens.

3. Don’t fight the market. Never fall in love with a position. Have a predetermined exit point and stick to it, especially if the trade goes against you. Using trailing stop orders to limit losses is good practice if available. Never double up on a loser, as the odds are you will lose more. Take your hit and move on. Take your hit and move on. Stay on the sidelines whenever the market is difficult to decipher until you are confident of your strategy.

4. Stay vigilant when you have an option position. Prices can move quickly in volatile markets. For that reason, many traders never keep a position open overnight. While such diligence may be extreme for part-time or occasional investors, being unaware of what's happening to your investment is never appropriate.

[i] https://www.sec.gov/files/staff-report-equity-options-market-struction-conditions- early-2021.pdf

[ii] https://dx.doi.org/10.2139/ssrn.4065019

Investment products and services are offered through Moomoo Financial, Inc., Member FINRA/SIPC. To use some features of the moomoo app, you must have an approved brokerage account with Moomoo Financial, Inc.

This information is provided for informational and educational use only and is not investment advice, a recommendation, or an endorsement of any particular investment or investment strategy. It is provided without respect to individual investors' financial sophistication, financial situation, investing time horizon, or risk tolerance.

All investing involves risk, including the potential loss of principal, and there is no guarantee that the use of any tools or data provided on the moomoo app or any investment strategy or approach discussed herein will result in investment success. Any images provided or securities referenced herein are strictly for illustrative purposes.