US New Users' Guide

How to access index options on moomoo?

Are you familiar with index options? How do they differ from stock options? Index options use "indexes" as underlying assets, not just individual stocks. This unique feature provides index options with higher liquidity and more transparent fill prices, making it a popular choice among experienced investors. With moomoo, investing in US index options is simple and straightforward.Join us and learn how to access US index options on moomoo!

1. How to access US index options on moomoo?

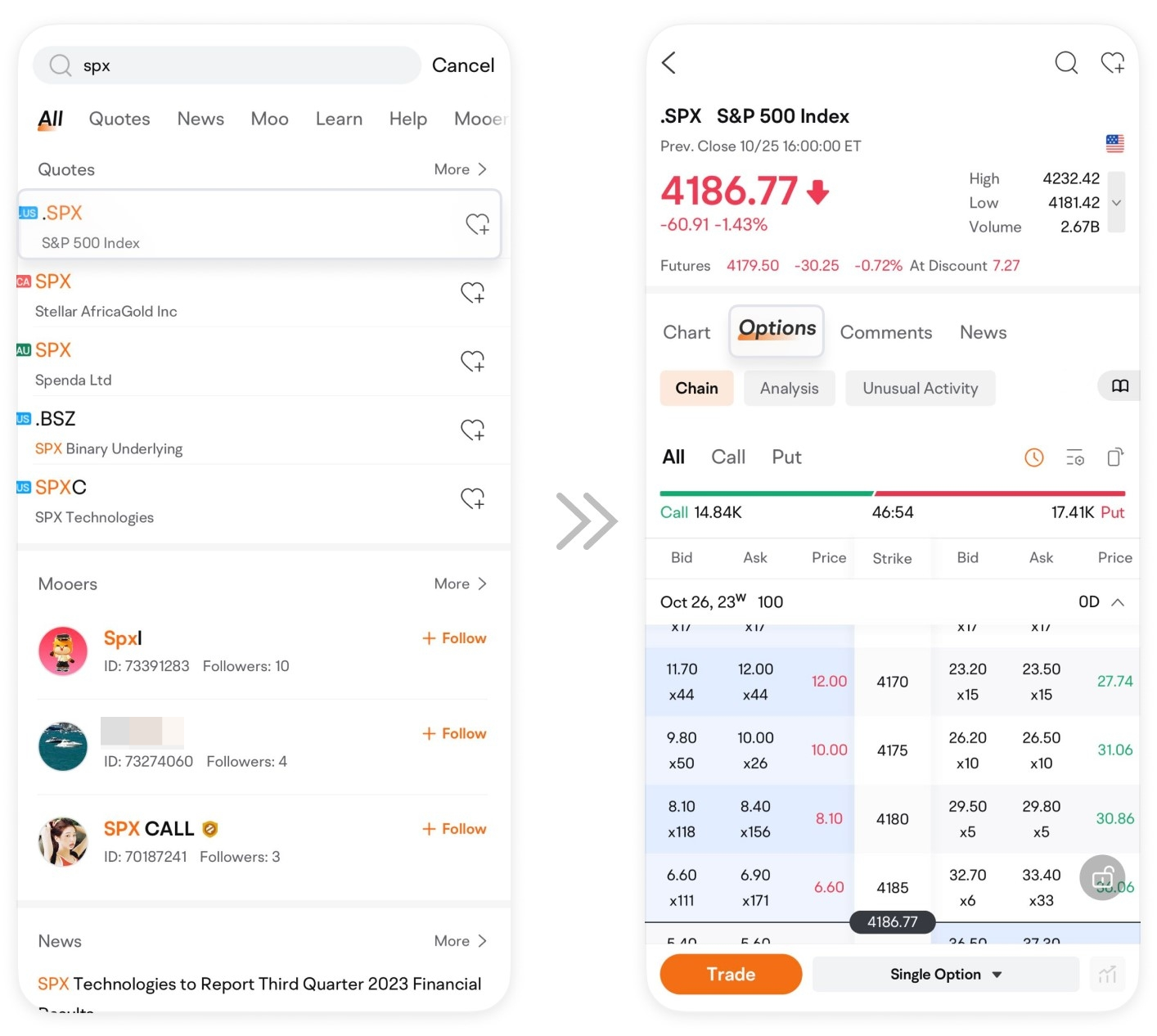

Pathway 1: Open moomoo and search for the index that you're interested in. Let's use SPX as an example for illustrative purposes.

Pathway 2: Go to the Market page, click on Options, select Index to view an overview of index options and information on popular indices, option rankings, and more.

As of October 26th, 2023, the US index options available for trading on Moomoo include SPX (S&P 500 Index), VIX (VIX Volatility Index), XSP (Mini S&P 500 Index), DJX (Dow Jones 100 Index), RUT (Russell 2000 Index), and NDX (Nasdaq 100 Index). More index options will be available for customers to trade in the future.

2. How to enter a trade for US index options?

Tap on your desired index option to enter its detailed quotes page for trading. Then you can use features such as Analysis and Unusual Activities to help you make more informed decisions.

The steps for entering a trade for index options are the same as stock options. On the options chain page, select Call or Put, choose a trading strategy, select an expiration date and price, and tap on the trade button to place your order.

3. Fee structure

The trading fees for index options include contract fees, transaction fees, platform usage fees, and trading regulatory fees. Compared to US stock options, the trading regulatory fees for index options include a special proprietary fee imposed by the exchange. Other regulatory fees, transaction fees, and platform usage fees are structured similarly to the related fees for US stock options.

a. Transaction fees and platform usage fees

For information on the fee structure for trading index options, including transaction fees and platform usage fees, please refer to the US Stock Option Fees and US Stock Multi-Leg Options Fees sections.

b. Exchange proprietary fees for index options trading

Many index options are only listed for trading on CBOE, which are exclusive products of CBOE. For opening and closing trades on these index options, CBOE charges an additional exchange proprietary fee.The exchange proprietary fee originates from the additional fees set by exchanges such as CBOE for exclusive products.

c. Trading regulatory fees: other fees

Other fees within the regulatory fee structure for index options are similar to those of US stock options. For further details on these fees, please refer to the "US Stock Option Fees" section.

It's important to note that options trading carries significant risks and may not be suitable for all investors. Prior to engaging in options trading, you should carefully consider your investment capabilities, risk appetite, and gain a full understanding of the fundamentals of options trading, trading rules, and market conditions. We strongly advise that you select an investment product and trading strategy that suits your individual circumstances, and adopt a disciplined approach while implementing proper risk management practices.

Exchange traded Index options are similar to exchange traded equity options in that all options involve risk and are not suitable for all investors. For a better understanding of the differences between index options and equity option please visit the resources available through the OCC’s Options Industry Council here: Equity versus Index Options.