How to Analyze Stock Market Trends: Technical Analysis vs. Fundamental Analysis

When making trading decisions, you can use a stock’s revenue and valuation, but those alone are not enough data. If you truly want the complete picture, you should also look at the overall market trend for a broader picture. Analyzing stock market trends is an important part of using both technical and fundamental.

In this article, we will discuss:

1. What a market trend is

2. Different types of market trends

3. How to analyze stock market trends

4. Events and factors that can affect market trends.

Knowing the stock market direction and trend is important for all traders and investors. Let's start by understanding exactly what a market trend means.

What is a Market Trend?

Investing in stocks can be a wild ride that triggers our emotions and controls our decisions. When stocks are rising or falling quickly, we might become impulsive and react accordingly. However, investing like this can be risky. Rather than making decisions based on emotions, the best thing you can do is take time to analyze market trends.

A market trend lets you see the usual ups and downs and see how a stock has performed over time., helping you to understand typical movements, consumer habits, and behaviors over a set period. Properly analyzing the data may reveal an overall historical trend of that stock. Perhaps the stock always falls after an earnings report before building back up. If you can see how a stock performed during a particular economic climate, you can get a glimpse of how it might react under those same conditions in the future and be prepared in case history repeats itself as it often does.

Three types of market trends

Stocks do not always continuously move up and down. Instead, stocks typically rise to new highs and fall to new lows while the price follows an overall trend. There are three types of market trends that investors tend to watch in the market.

Upward Trend

Uptrends include peaks (tops) and troughs (bottoms) of a stock while the price continues to increase over a longer period of time. Periodically the stock price may touch a new high before it falls lower than it did previously. However, looking at the larger trend can prevent many traders from selling off during momentary troughs. If the stock price continues to rise despite short-term peaks and troughs, it can indicate a positive market sentiment.

Downward Trend

A downtrend is where a stock continuously falls. Typically, the successive peaks and successive troughs are lower and convince investors that the stock will continue to fall. Even with the slightest rise, investors tend to sell their shares instead of buying more because they do not expect the price to recover.

Horizontal / Sideways Trends

With a sideways trend, the stock doesn’t move upward or downward. However, peaks and troughs tend to be consistent over an extended period, making it hard for investors to determine whether to buy or sell.

What can affect market trends?

Many factors can affect market trends. The main influence is economic activity, but whether we like it or not, geopolitical and government actions factor into a stable or unstable market. Supply and demand also affect market participation. While these factors are closely related, they also create and cause short and long-term market fluctuations.

Investors and traders need to identify trends to determine the momentum in the market price or security, whether the trend is up or down so that they can buy during the early stages of a rise and sell before it falls too low to make a profit.

Let’s look at ten ways you can better analyze stock market trends:

How to analyze market trends

The two main ways to analyze stocks are fundamental analysis and technical analysis. With these two approaches, there are several tools and calculations to analyze stock prices and whether to buy or sell.

Using fundamental analysis

Fundamental analysis refers to analyzing financial statements, rations, and economic factors that affect a business's fair market value of stocks and securities.

Study Overall Earnings

Earnings might be the leading indicator of the health of a company, and you want to invest in something healthy and growing. If that same company is not pulling in the expected earnings, it can tank its stock price.

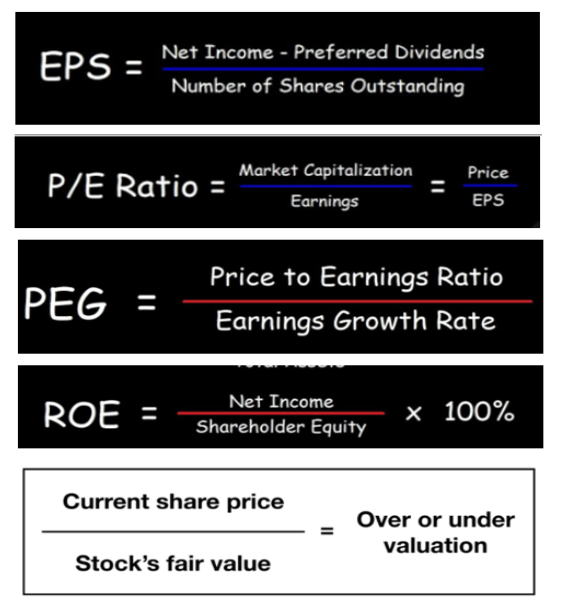

Calculate Earnings Per Share

Once you determine a company's earnings, you might want to do some math to figure out the earnings per share. Divide the income by the number of available shares to figure out earnings per share.

Determine Net Margins

Determining value doesn’t require a company to rake in earnings alone, but how efficiently they are doing so. You can determine their net margins by dividing net income by the number of sales. Some companies are expected to have higher revenue streams than others, so this is a great way to get a better financial view.

Cash Flow Indicator

Cash flow is an excellent indicator of how efficient the company is with their cash on hand: the more cash remaining, the greater the ability to buy back stock or pay dividends.

Price-to-Earnings Ratio

Once a company makes its yearly earnings available, you can then determine its price-to-earnings ratio. You divide the earnings by the number of shares, allowing you to see the full market value of each share.

Determine Price-to-Earnings Growth

To get an even better view of a company's price-to-earnings ratio and how well it is performing, you can divide the earnings ratio by the growth rate over a period of time.

Return on Equity

You can measure a company's return on equity by dividing the net income by the equity held by the shareholder. This number will tell you how great they are at generating income using a stockholder's money.

Determine Over or Undervalued Stock

When trying to determine a company's value, you can look at what the company itself has written down in the books. Looking at the balance sheet is a great way to tell if a stock is undervalued or not. A stock is thought to be overvalued when its current price doesn't line up with its price-to-earnings ratio or earnings forecast.

There are multiple reasons a stock may be perceived as undervalued, as it does not go on price alone. It could be a new company in an emerging field or new technology or service that causes it to be undervalued because it is a new concept. The growth potential could turn in either direction. If you feel that the company is producing large-scale products or services, the stock price could rise when others feel the same. If this happens, you could make above-average returns on your investment. Determining if a stock price is undervalued could feel like a catch-22 situation because if the company does not prosper, the stock is properly valued after all.

Keep in mind that markets move in cycles, and when the market declines, it is often based on negative reactions that keep pushing the stock in a downward trend. Sometimes this may be the perfect time to buy stocks at a lower price, and as the market rebounds, it can produce profits.

Return on Assets

Finally, you will want to know how well a company uses its assets to create a nice profit. Return on Assets (ROA) is calculated by dividing a firm's net income by the average of its total assets. What's a good ROA? Generally, 5% is a good ratio; however, it may vary depending on the industry.

Applying Technical Analysis

Technical analysis helps consider the statistics around the market activity based on the stock's historical changes. Historical trends may help predict future changes in the stock price and changes in the trading volume.

Technical indicators

Technical indicators are calculated from historical stock market data through statistic algorithms.

When you can utilize technical indicators, you can see whether the market is following a trend or in a state of consolidation by providing market signals, trend reversals, and overbought or oversold.

The most used trend indicator types include moving average (MA), moving average convergence divergence (MACD), exponential moving average (EMA), overbought/oversold indicators (KDJ, RSI, BIAS), pressure/support indicators (BOLL), etc. In addition, there are special indicators, such as the Ichimoku Cloud, which can help you better judge stock trends.

A stock's moving average

A moving average is one statistic used to determine a market trend in a particular stock's price. A quick increase or decrease in the moving average can often indicate a good time to buy or sell. If the stock price reverses the moving average line, it may be considered broken.

Trading volume

Trading volume is the number of shares that trade during a specific day, week, or month. If the price movement does not have volume, typically, it will have little value.

Short interest and support, and resistance levels

While short interest measures stock shares that have been sold short, support and resistance levels are the price; beyond that, it will not go in a specific direction. These three areas can help define buying and selling prospects.

The importance of analysis

When it comes to making smart trading decisions, analyzing stock market trends in conjunction with other indicators is essential. Whether you’re using fundamental analysis, technical analysis, or both, you need to make informed choices and trade based on data. Taking time to analyze can help you avoid emotional trading, especially if you understand how the market behaved in the past and may behave in the future.

Analyzing the market with moomoo

Evaluating stock market trends is certainly its own type of science. Every part of a stock’s life is analyzed, from past performances to future projections. With an advanced stock screener that includes over 100 indicators and charting tools as well as 60 levels of level 2 data, all for free, you can find all the information you need close at hand.

The moomoo app makes it easy for investors to discover market trends to make informed investing decisions. Download the app today to start building your portfolio with a strong, data-driven strategy.