How to Find A Stock's Number of Shorted Shares?

What Is Shorting?

Short selling is a trading method often utilized by professionals who use anticipation to purchase and sell shares in the hope that the cost will decline at a future stage. This kind of trade is known as speculative trading. It includes taking out loans to purchase shares and then selling those stocks on the marketplace. The investors then buy the same shares, pay off the loan, and pocket the gains themselves.

You can generally get generic short selling statistics on any website that provides a stock quotations service, like the proportion of the short interest (which represents the proportion of a remaining stock that has been short-changed divided by the average daily volume). This ratio indicates the level of shorting activity in the market. Websites devoted only to finance are a good choice; alternatively, you might look for the information you need on websites devoted exclusively to stock exchanges.

In case you are unfamiliar with the process or need a reminder, we have emphasized some of the most important sources where you can get the knowledge you want regarding short interest statistics for individual companies.

Main Points

Small investors borrow money to buy stocks and then sell them on the public markets for a profit. The money they make is used to buy more shares at a lower price, thereby paying off their debt.

The number of shares sold "short" but not yet bought back or closed out is referred to as "short interest."

Over time, a significant shift in the number of short positions in a company suggests that investors are either getting more optimistic or negative about the stock.

You can often get broad shorting details about a firm's stock by visiting any website that offers a stock quotation service. This will allow you to sell shares of the company.

You will need to travel to the stock market where the firm is listed to get more information on short interest.

Shorted Stocks and Short Interest

It is necessary to have a basic understanding of this specific trading approach when we look at a few locations where you may get data on short interest.

Shorted Stocks

As was said earlier, taking a short position implies selling stocks or other assets that you do not already own. This may also apply to other types of investments. People who use this trading method are under the impression that the price will fall over time; hence, they borrow stocks and then sell them to other investors. After that, the borrower will repurchase the stocks at a more affordable price and then hand them back to the lender. This enables the short trader to earn a profit by closing their short position and ending their short position.

The practice of shorting is not one that new investors, or those with little experience, should approach lightly. Only those who are both seasoned investors and knowledgeable about the market should even consider it. When leverage or borrowed funds are involved in making the first acquisition, investors need to endure a higher level of risk to succeed. However, there is also the possibility that the asset's cost may increase rather than decrease; if this occurs, the investor will suffer a loss instead of a gain.

Short Interest

The number of stocks that have been traded "short" but have not yet been either covered or closed out is what is meant by the phrase "short interest." The ratio of stocks that are reduced to the number of shares outstanding is a common way to measure short interest. For instance, a corporation with a short interest of 10% would have 10% of its outstanding shares, or 10 million shares, sold short out of 100 million shares.

The level of interest in selling short is a leading predictor of market mood. Large shifts in the number of short positions open in a company are another red flag since they indicate that investors may be becoming more pessimistic or optimistic about the stock. A very high level of short interest indicates that investors have a highly pessimistic view, or maybe an overly pessimistic one.

As a kind of technical analysis, day traders often make use of short interest. Traders can scurry to cover their short positions if there is a large level of short interest in a specific asset and a breakout occurs. This results in a snowball effect, which day traders may employ to multiply their winnings. In the lingo of finance and investments, this situation is referred to as a "short squeeze."

Finding the Data Regarding Short Interest for a Particular Stock

You can check some websites that don't require a fee to get more specific information on the shared shares of a certain company. For example, you can do so if you want specific figures regarding volume, daily average sharing volume, or days to cover. Examples of this information include days to cover and the average daily volume of shares. The following is a list of some of the most prominent websites you should visit to get the information that will assist you in guiding your shorting strategy.

Stock Exchanges

Each stock market publishes monthly summary statistics, providing investors with a broad short-selling baseline. In most cases, the free information is updated every other week or every other month. The most recent two reporting dates are often shown in the information seen in tables dealing with short interest. Data on daily short interest is accessible, but the only way to get it is to subscribe to the service and pay for it.

● New York Stock Exchange (NYSE): According to the New York Stock Exchange (NYSE), all of this information is obtained from broker-dealers to fulfil the exchange's regulatory obligations. However, the precise website you must go to relies on the stock market that trades the asset you are looking for information about. If you want to find out more about that stock, you should check the stock exchange. The New York Stock Exchange (NYSE) computes its short interest ratio for the whole exchange. This ratio might be a helpful statistic for evaluating the general mood of the market. If the company you're researching is traded on the NYSE, you may access archives of uncovered shorts going back to 1988 by consulting the NYSE Group Short Interest File, which is updated monthly. To get the details, however, you'll need to buy the report. [1]

● Nasdaq: The short interest reports from Nasdaq are released twice monthly, in the middle of the month and at the end. This implies that the data used by traders is always a little stale, and the true level of short interest may already be quite different from what is reported. If the stock is traded on the Nasdaq, you will need to access Nasdaq Trader's Trading Data, where you'll access Nasdaq's Monthly Short Interest Tool. [2]

What Is Short Interest Data?

Short interest information is collected that pertains to the overall number of shares sold short for a certain company by investors who have not yet closed or covered the position. This position has not yet been closed or covered. This information may also be stated as a percentage, which is calculated by dividing the number of shares that are current by the number of shares that have been borrowed.

Who Publishes Data Regarding the Short Interest?

The Financial Industry Regulatory Authority requires all short interest transactions to be reported (FINRA). Broker-dealers are expected to provide the exchanges with information on short positions that have been taken in customer accounts twice a month in accordance with the rules imposed by the agency. They need to be reported no later than six o'clock in the evening Eastern Standard Time on the second trading day following the settlement date specified by FINRA. [3]

Is a Short Interest Rate Beneficial or Problematic?

An increase or decrease in short interest indicates whether investors are optimistic or pessimistic about a company's future. When it comes to a company's future, investors may be getting considerably more pessimistic if they see a significant increase in the amount of its stock being sold short.

Why Should I be Concerned About Short Interest Information?

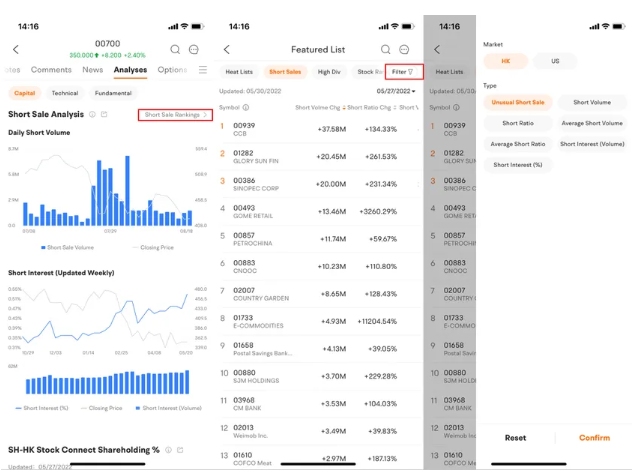

You can determine how people feel about the market by looking at statistics on short interest. The short interest ratio is another name for the short interest data when presented in the form of a percentage. It is calculated by taking the entire number of shorted shares for a corporation and dividing that number by the number of currently outstanding shares. You can easily identify the long and short sentiment on moomoo's short sell analysis function and then find out more investment opportunities. Download moomoo app today to know more about short selling trends.

[1] NYSE. "NYSE Group Short Interest." (Registration and purchase required.)

[2] NasdaqTrader. "Short Interest Report."

[3] FINRA. "Short Interest Reporting."