Introduction to Level II Quotes

Level II offers insights into bid scope and price levels. It can tell you detailed information about the 5-10 highest bids and lowest asks, including sizes, and much more.

Keep reading to find out how Level II works and how it can help you understand the stock's open interest.

Key Takeaways

Level II displays the stock order book along with the best bid.

Level II discloses the trader's identity, the price offered and the order size.

Traders who sell and buy stock, electronic communication networks (ECNs), and wholesalers who work directly with brokers are three main players in the stock market.

What Is Level II?

Level II is a trading service that offers real-time access to individual market makers registered in Nasdaq stocks. Orders are placed through different market makers and market participants.

Through level II, different participants can see the best bid for a particular stock. In this way, you can get a thorough understanding of price action. All this information could be quite helpful for you.

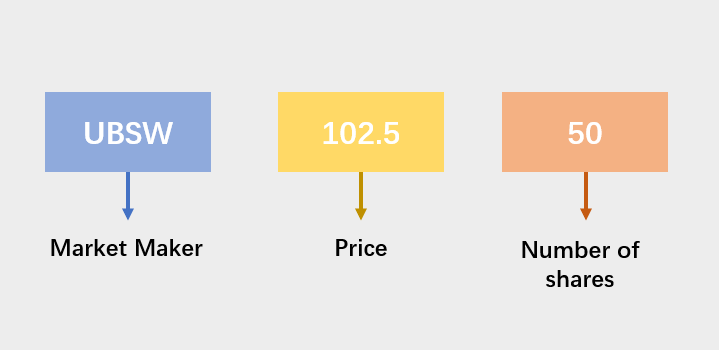

An example of a level II quote is as follows:

The diagram indicates that UBS securities want to buy 5,000 shares for 102.5. Notably, there are hundreds of claims (x100). Let's investigate the players in the market.

The Players

Three different players in the marketplace are:

market makers

Electronic communication networks

Wholesalers

Market Makers (MM)

Market makers provide liquidity in the stock market. They make the market and trade when no one is buying or selling.

Electronic Communication Networks (ECN)

Electronic communication networks refer to computerized order placement systems. Anybody, even large institutional traders, could trade through ECNs.

Wholesalers (Order Flow Firms)

Wholesales buy order flow from online brokers. They then execute these orders for retail traders and online brokers.

A four-letter ID is assigned to each market participant. This ID number is also present on the level II quotes. The following table highlights the four-letter ID of some well-known market participants. [1]

The Ax

Ax is one of the well-known market makers that control the stock's price. You can identify ax by carefully observing the level II action for a few days. The consistent leader of the market will be the ax.

Why Should You Use Level II?

Level II offers you insights into stock trading activity. For instance, you can

Examine the type of market participants to know the type of buying—institutional or retail.

Identify that institutional players are trying to conceal their buying by carefully examining the irregularities in the ECN order sizes.

Better understand a stock's price trend by analyzing the trades between the bid and ask.

moomoo trading app provides traders and investors with free real-time level 2 data. It will help users to understand real-time order placement and real-time pending orders, making order viewing and trading more efficient and aiding investing decisions. Sign up and download moomoo today to get the free real-time level II now!

Images provided are not current and any securities are shown for illustrative purposes only.

Deceptive nature of Level II

Indeed Level II offers you deep insights into the stock market. But it is also deceptive. Below are some most common tricks that market makers play:

Hiding Order Size

Most market makers hide their order sizes. They do so by placing small orders and updating them as soon as they get filled. This trick helps them pick up large orders without scaring other traders.

Order Sizes and Timing

Market makers also use their order size and timing to deceive other traders. For instance, JPMS may make a huge offer to trap short sellers from placing a large bid. This trick can convince new short sellers to cover.

Trading Through ECNs

Market makers also use ECNs to hide their actions. Since anyone could use ECN, you can't identify the type of ECN orders.

The Bottom Line

Indeed Level II offers you deep insights into the stock market. But it is also deceptive. So, if you're an average trader, you shouldn't rely on level II entirely. Instead, you can use it with other forms of analysis while trading a stock.