Investing Ideas, Key Highlights to Watch. Week ending 9 September.

What to watch in markets right now...

1 - Welcome to the first trading week of September. September is the worst month for equities. Is it a buying opportunity? Depending on how you want to look at it, the ninth month of the year, is the worst month for share market returns, because it's when companies transfer dividend rights to shareholders and out pay out dividends. While there is a lot going on in markets, savvy investors might be taking a forward-looking approach and using dips in the share market in September, as opportunities to buy into long-term positions they want to be holding.

2 - The S&P quarterly rebalance has been announced for the ASX200 and the S&P500 and takes place in two weeks, with effect and prior to open of trade on September 18 2023.

...so investors and traders will prepare themselves for this, and look to profit on arbitrage. What do you need to know about rebalance? As companies are added to the key benchmark index, we typically see institutions, fund managers and index providers who manage ETFs buy companies being added to the ASX200, and S&P500 and sell down or out of companies being removed from the ASX200 $S&P/ASX 200(.XJO.AU)$ and S&P500 $S&P 500 Index(.SPX.US)$.

" So ahead of the rebalance, you may see investors take advantage of the arbitrage or either simply buy or sell stocks being added or removed.

In Australia; companies being added to the ASX100 include Liontown Resources ($Liontown Resources Ltd(LTR.AU)$), which will rebalance the ousted Harvey Norman ($Harvey Norman Holdings Ltd(HVN.AU)$).

As for companies being added to the ASX200, they include: Data#3 ($Data3 Ltd(DTL.AU)$), Genesis Minerals ($Genesis Minerals Ltd(GMD.AU)$), Neuren Pharmaceuticals ($Neuren Pharmaceuticals Ltd(NEU.AU)$), Ramelius Resources ($Ramelius Resources Ltd(RMS.AU)$), Weebit Nano ($Weebit Nano Ltd(WBT.AU)$).

Companies being removed from the ASX200 include: Abacus Group ($Abacus Group(ABG.AU)$), Abacus Storage King ($Abacus Storage King(ASK.AU)$), BrainChip Holdings Limited ($BrainChip Holdings Ltd(BRN.AU)$), Imugene Limited ($Imugene Ltd(IMU.AU)$), Lake Resources ($Lake Resources NL(LKE.AU)$) and Syrah Resources Limited ($Syrah Resources Ltd(SYR.AU)$). For more information, click here.

In the US, the S&P Dow Jones Indices quarterly rebalance will result in Blackstone Inc. ($Blackstone(BX.US)$) and Airbnb Inc. ($Airbnb(ABNB.US)$) beind added to the S&P 500,and also replacing ousted Lincoln National Corp. ($Lincoln National(LNC.US)$) and Newell Brands Inc. ($Newell Brands(NWL.US)$) in the S&P 500. This is effective prior to the open of trading on Monday, September 18.

- Other changes to take note include that Deere & Co. ($Deere(DE.US)$) will be added to the S&P100, and replace ousted Walgreens Boots Alliance Inc. ($Walgreens Boots Alliance(WBA.US)$). So although Walgreens Boots Alliance is not technically representative of the mega-cap market space, it will remain in the S&P 500. For more click here.

__________________________________________________________________________________________

Potential trading and investing ideas with a look at lithium stocks in the best of index...

Australian lithium miner Liontown Resources ($Liontown Resources Ltd(LTR.AU)$) shares jumped 9% on Monday, Sept 4, taking its YTD gain to 99%. Today's 9% jump came after Liontown received a new A$6.6 billion ($4.3 billion) takeover offer from the world's top lithium producer metal, Albemarle Corp ($Albemarle(ALB.US)$).

" As such lithium companies are again cast into the spotlight. Although the lithium carbonate price is down 61% this year, causing a lot of lithium company's shares to produce lacklustre returns, as China's economy has been in contraction phase, many think lithium demand will pick up, from battery markers and global carmakers, with China expected to drive the bulk of EVs demand growth for the next 10 years, as the world transitions away from fossil fuel cars.

So it's worth reflecting on lithium producers, as many are deemed undervalued, when compared to consensus price targets.

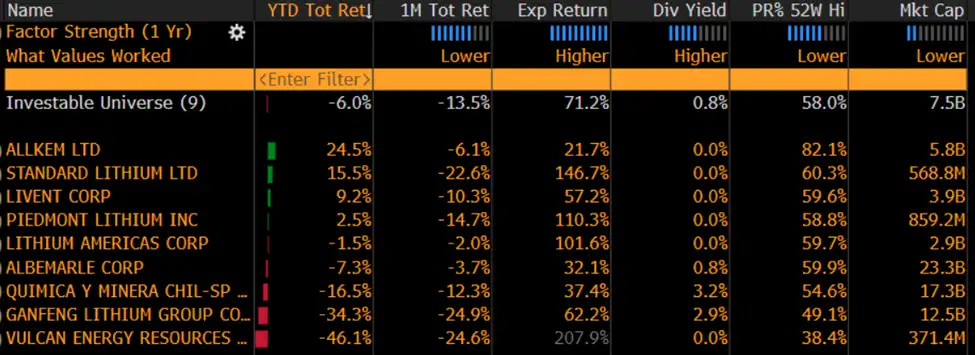

Below are some lithium stocks to watch that make up the Best of Lithium Index (in the Solactive Global Lithium Index) . Each quarter fund managers typically top of these stocks. However consider the major driver of returns will be a change in the lithium price, once China's economy returns to growth phase.

Below are the aforementioned lithium companies in the best of lithium index, showing their returns year to date and expected returns-based consensus price targets, showing Vulcan Energy ($Vulcan Energy Resources Ltd(VUL.AU)$), Standard Lithium ($Standard Lithium(SLI.US)$), and Piedmont Lithium ($Piedmont Lithium(PLL.US)$) have the greatest consensus expectations for share price growth.

Also keep your eyes on lithium ETFs including the Lithium and Battery Tech ETF ($Global X Lithium & Battery Tech ETF(LIT.US)$) that tracks the Solactive Global Lithium Index.

Major economic news to watch includes, a likely RBA hold, weak China data and more catalyst for the Fed to pause rate hikes

- In Australia; the RBA meeting is on Tuesday. The cash rate is expected to hold at 4.1% following a string of soft economic data. Australian economic growth numbers will be released and likely show the Aussie economy flat-lined in the second quarter, with weak consumption to be offset by strength in the housing sector.

- In China; thier trade data for August will likely show exports are continuing to sputter. Shipments are expected to fall from July and Bloomberg expects a steeper decline in imports. All in all, across the board weakness is expected, which underlines the need for policymaker and forceful support to the economy.

- In the US, is an economic storm brewing? The latest Beige Book (released on Wednesday) should confirm that temporary factors have been supporting spending growth and job gains, but it's with a cautious tone. The ISM Services PMI (Wednesday) will likely show they steadied in Augus. It is expected that consumers' urgency and want to spend on live events and discretionary services will decline in the fall and winter, which sets the stage for slowing consumption and growth. Following suit, the Fed is likely to hold rates steady at the Sept. 19-20 meeting — and thereafter — as policymakers attempt to hold off on a big storm building on the horizon.

___________________________________

This is general in nature and observations are not investment advice. Consider the appropriateness of this information in light of your personal circumstances before making investment decisions.