Discovering Protective Puts: A Beginner's Guide

Some investors can pursue options strategies when they have a cautiously bullish outlook. One strategy they may consider is protective puts. Investors may use this when they believe in a stock's long-term prospects but want to potentially protect against either short-term volatility or downturns.

Here's a deeper look into protective puts.

What is a protective put

A protective put is an options trading strategy that may allow investors to safeguard their stock investments against potential declines in value. This involves buying a put option for a stock that the investor already owns. The put option gives the investor the right, but not the obligation, to sell the stock at a predetermined price (the strike price), before the option expires.

By implementing a protective put, investors can manage risk associated with owning the underlying stock. If the underlying stock price falls below the strike price, the put option can help limit losses by enabling the investor to sell the stock at the higher strike price.

How protective puts work

Protective puts can function as a form of "insurance" for stock investors. When they own shares of a stock, they can buy a put option to seek protection against potential losses instead of liquidating their shares.

If the underlying stock price falls below the strike price, the investor can exercise the option and sell their shares at the strike price, minimizing their potential losses. But if the underlying stock performs well and the investor chooses not to exercise the option, the put may expire while still benefiting from the stock's appreciation. The cost of buying the put option (the premium) is the trade-off for this potential protection.

Protective put example

Let's say an investor owns 100 shares of a company currently trading at $50 per share. Concerned about a potential market downturn, the investor purchases a protective put option with a $48 strike price, expiring in one month, for a premium of $2 per share. The total cost for the put option will be $200 (100 shares x $2 + potential commissions and/or fees).

If the stock price falls to $40 before the option expires, the investor can exercise the put option, selling their shares at the strike price of $48 and limiting their potential loss to $2 per share ($2 x 100 multipler = $200) plus the $2 paid for the premium (100 shares x $2). This would be a total loss of $400. If they did not purchase the $48 put option they would in fact lose $10 a share or $1,000.

Here's a few additional scenarios:

If the stock stayed at 50, the put expires worthless and they lose a total of $200.

If the stock went up to $52 they would break even.

Protective put potential profit and loss

For a protective put strategy, its potential maximum profit is theoretically unlimited if the stock price rises significantly, since there is no cap on the stock’s potential gains. The protective put only limits possible losses, ensuring that they do not exceed the cost of the put option plus any decline in the stock’s value as long as it is in place.

The theoretical maximum loss occurs when the stock price falls below the put option’s strike price; it is capped by the total cost of the put option premium plus the decline in the stock value relative to the strike price.

If by the expiration date the underlying stock price has stayed the same or increased, the investor you would only lose the cost of the long put as it expires worthless.

Theoretical max profit

Here's a few scenarios:

If the stock price rises significantly, the theoretical maximum profit is unlimited as the potential profit comes from the stock itself; there’s no upper limit to how high the stock price can go. The put option would expire worthless, but the gains from the stock can continue indefinitely.

If the stock price is below the put option's strike price but still above the stock's initial purchase price, the potential profit is limited to the gain from the stock price increase minus the cost of the put option (premium paid).

If the stock price falls below the put option's strike price, the theoretical maximum loss is limited to the cost of the put option (premium paid) plus any loss incurred from the decrease in the stock's value; the put option will cover losses below the strike price.

Theoretical max loss

Here's a few scenarios:

Suppose you own a stock bought at $100 per share, and you buy a put option with a $90 strike price for a $5 premium. If the stock falls to $80, the put option allows you to sell at $90, limiting your loss to $10 (the $10 difference from $100 to $90) plus the $5 premium, totaling a $15 loss per share. Without the put, the loss would be $20, so the protective put limits your downside.

If the stock remains at or above the $90 strike price by expiration, the put option will expire worthless, and your only loss is the $5 premium paid. In this case, your theoretical loss is limited to the premium paid, while you continue to hold the stock.

Breakeven

The breakeven point for a protective put is the initial stock purchase price plus the premium paid for the put option.

If the stock price is above this breakeven point, an investor can potentially make a profit.

If the stock price is below this breakeven point, the protective put can help limit losses, but an investor will account for the total cost of the option.

How to manage a protective put strategy using moomoo

For a step-by-step guide to trading option on Moomoo, see here:

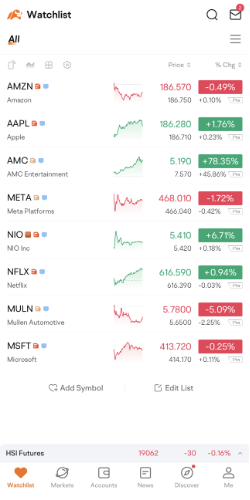

Step 1: Navigate to your Watchlist, then select a stock's "Detailed Quotes" page.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

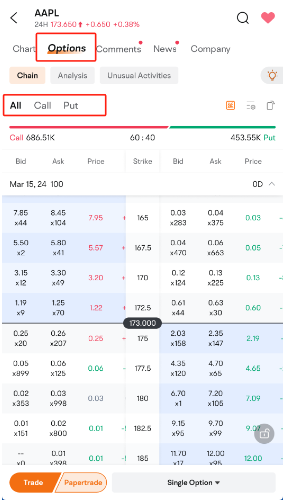

Step 2: Navigate to Options> Chain located at the top of the page.

Step 3: By default, all options with a specific expiration date are shown. For selective viewing of calls or puts, simply tap "Call/Put."

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

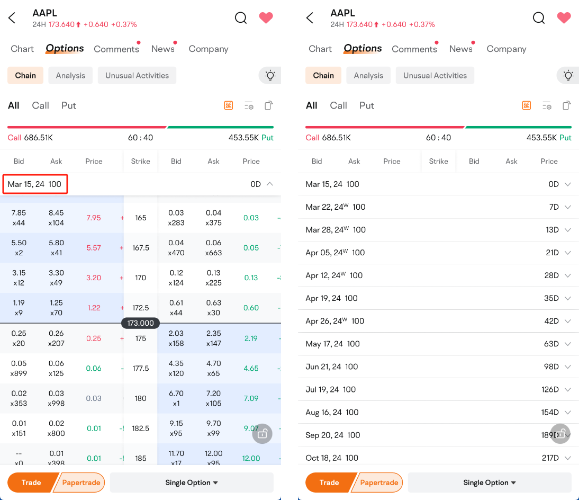

Step 4: Adjust the expiration date by choosing your preferred date from the menu.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

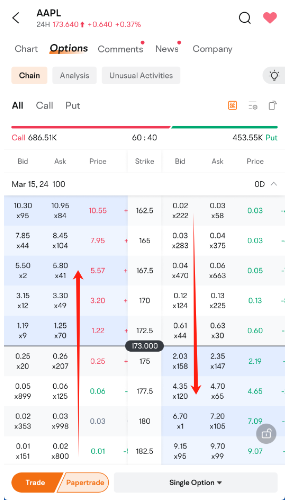

Step 5: Easily distinguish between options: white denotes out-of-the-money, and blue indicates in-the-money. Swipe horizontally to access additional option details.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

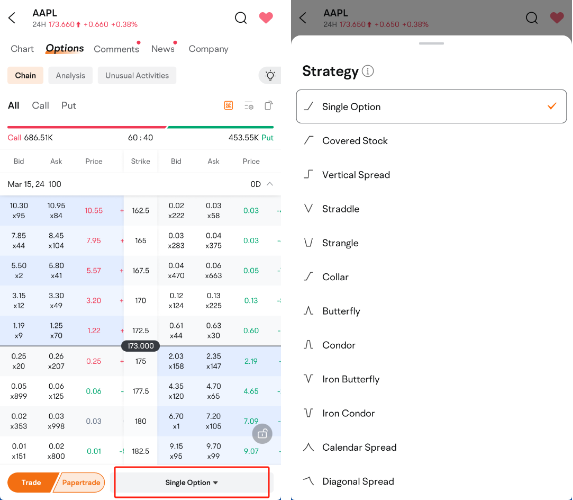

Step 6: Explore various trading strategies at the screen's bottom, offering flexibility for your investment approach.

Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Managing a protective put

Effectively managing a protective put requires ongoing attention and may require adjustment to help ensure it continues to meet an investor's risk needs and investment goals. Here's a few ways to do so.

Regularly assess how the stock price is performing relative to the strike price of the put option.

Consider the impact of changing volatility and time decay on the value of the put option.

Be responsive to changes in investment objectives, market conditions, and stock performance.

Continuously evaluate whether maintaining the protective put aligns with an investor's overall investment strategy and whether it provides value relative to its cost.

When to consider closing a protective put

When an investor decides to close a protective put, it will depend on the underlying asset's price at expiration and their goals. Here's a few scenarios.

Stock price above strike price: The put will expire worthless.

Stock price below strike price: The investor can exercise the put option to sell 100 shares per contract at the strike price and close the position.

Investor no longer wants to hold the position: Can sell the underlying asset and close the put option position to realize potential gains or losses.

Investor wants to extend protection: Can sell the put and buy another put.

Potential pros and cons of protective puts

Potential pros

Provides downside protection and can help limit potential losses

Allows for unlimited upside potential if the stock price rises

Offers flexibility in choosing strike price and expiration

Potential cons

Involves the cost of the put option premium

Subject to time decay, which can erode the option’s value

Protection lasts only until the option expires

If the stock doesn’t decline, the put option may expire worthless.

Requires an understanding of options and their impact on the investment

Protective put vs. covered call

The main difference between a protective put and a covered call is that a protective put is a strategy that helps protect against potential losses, while a covered call is an income strategy that limits upside potential but can create potential returns through the premiums received for the sale of the call option. There's more.

Protective put: Involves buying put options to hedge against potential stock declines. Protective puts can be used to potentially maintain ownership of a stock while helping protect against possible losses resulting from a decrease in the stock's price.

Covered call: Involves selling call options on an underlying asset that is owned. Covered calls limit upside potential but can provide income while your stock is trading sideways.

With a covered call, the theoretical maximum profit potential is achieved if the stock price is at or above the strike price of the call at expiration. With a protective put, a possible profit can be secured by placing the put above the original purchase price of the stock if the underlying asset has increased in price.

FAQs about protective put options strategy

Is a protective put bullish or bearish?

A protective put is generally considered a bullish strategy. It involves buying a put option while holding a long position in an underlying asset. This strategy allows the investor to protect against potential losses if the asset's price falls, while still benefiting from any upside potential. Essentially, it acts as "insurance" for a bullish position, providing downside protection while allowing for profit if the asset increases in value.

What is the difference between a protective put and a married put?

A married put is just a protective put that is purchased at the same time as the underlying stock.

Protective put: An investor buys a put option to hedge a stock that's already in their portfolio. Investors can use this strategy when they want to try to maintain long-term ownership of a stock, but are concerned about a short-term price drop.

Married put: An investor buys a put option at the same time as the stock.

Is protective put a hedging strategy?

Yes, a protective put is a hedging strategy; it's designed to help protect investors from potential losses in their stock holdings by allowing them to offset declines in the underlying stock price with gains from the put option. By purchasing a put option, investors can create a safety net that helps insulate their portfolios against market volatility and downturns. This strategy can effectively limit downside risk while still permitting the investor to participate in any upside appreciation of the stock.

How to calculate profit on a protective put?

To calculate a potential profit on a protective put, an investor needs to assess the underlying stock's performance and costs related to the put option. Here's a calculation.

Profit = Sale price of the stock - purchase price of the stock - put option premium

In case the stock's value declines below the strike price and an investor chooses to exercise their put option, the sale price will equal the strike price. Or if the stock appreciates, an investor can sell at the market price. Remember to always factor in the premium paid for the put option, as it impacts the overall profitability.