Put Options: Hedging Your Portfolio

As the stock market becomes more volatile, put options can be a way for investors to potentially protect their portfolio. However, put options are commonly misunderstood due to the unique traits of options.

In this article, we break down how put options can be used to hedge portfolios during uncertain economic times.

What Are Put Options?

A put option is a contract made between a buyer and a seller. The contract gives the buyer of the put the right to i) sell a certain stock at a ii) certain price iii) within a certain time.

Let's use a hypothetical scenario to explain how put options work:

● An investor buys 100 shares of XYZ stock at the price of $15.5.

● The investor also buys 1 put option contract on XYZ stock at a strike price of $15.

● 1 contract = 100 shares.

● This put option has a premium price of $0.5.

● The stock price falls to $10 and the options contract expires. (This is a hypothetical example to help you better understand that options can hedge risks under some certain circumstances. It does not stand for any investment suggestions or strategies.)

In this situation, here is how the investor’s portfolio losses would be mitigated.

● Underlying stock final P/L: 100 x (10 - 15.5) = -$5,50

● Put option final P/L: 100 x (15 - 10) - 100 x 0.5 = $4,50

● Final P/L for portfolio: -550 + 450 = -$1,00

By purchasing one put option, the investor only loses $1,00 instead of $5,50. Therefore, put options can limit the downside risk on an investor’s portfolio. Used correctly, put options can produce profits as well.

Here is a hypothetical scenario where put options can generate good returns:

● XYZ stock is at the price of $15.5.

● The investor buys 1 put option on XYZ stock at a strike price of $15.

● 1 contract = 100 shares.

● This put option has a premium price of $0.5.

● The stock price falls to $7 after some bad news about the company.

Assuming the stock price stays the same and the put option reaches expiry, the investor can gain the following returns:

● Put option P/L: 100 x (15 - 7) - 50= $7,50

In the options market, investors can buy or sell put options. Let's talk about the pros and cons of both.

Buying Put Options

Put options can be used when the stock price is likely to go down. Alternatively, buying a put option can act as insurance against a sudden drop in the stock price.

There are three situations which can happen after that:

● Should the price of the underlying stock go down, the put option will increase in value. The buyer of the put option can profit.

● However, if the price of the underlying stock goes up, the put option will decrease in value. The buyer of the put option will take losses.

● Finally, if the price of the underlying stock remains the same, the put option will also decrease in value (due to time decay, which we explain below). The buyer of the put option will take losses.

Selling Put Options

However, put options can be used another way. Put options can be sold if there is a belief that the stock price is likely to go up. By doing so, investors may collect the premium instead of paying for it.

There are three situations which can happen after that:

● If the price of the underlying stock goes down, the put option will increase in value. The seller of the put option will make losses. This is because the option has to be bought back at a higher price than what it was sold for. In this case, if the put buyer exercises the option at the specified strike price, the put buyer can potentially make profits.

● If the price of the underlying stock goes up, the put option will decrease in value. The seller of the put option will make profits because the option can be bought back at a lower price than what it was sold for.

● If the price of the underlying stock remains the same, the put option will decrease in value. The seller of the put option will make profits because of time decay.

Put Option Strategies

Due to the unique traits of put options, there are strategies which investors can potentially use to reduce their portfolio risk or even profit from a market crash.

Let’s go through five basic to immediate option strategies which newer investors can use.

Protective Put

A protective put refers to buying a put to protect a part of an existing stock position. Let’s use a simple example:

● An investor owns 100 shares of stock XYZ.

● An investor buys 1 put option for stock XYZ. 1 option = 100 shares.

The protective put ensures you can profit if the underlying stock goes up. However, your downside is also protected if the underlying stock goes down. This is the most basic put option strategy you can use.

Married Put

The married put is a variation of the protective put. A protective put is bought after the underlying stock is bought. However, the married put is bought at the same time that the underlying stock is bought.

Hence, the risk and rewards of the married put are the same as the protective put.

Cash Secured Put

The cash secured put is a different strategy that aims to profit from a rise in a certain stock. However, the investor does not need to own the stock to execute this strategy.

Instead, the investor only needs to set aside a certain sum in their portfolio to maintain a cash secured put.

Here is a simple example:

● An investor sells 1 put option for stock XYZ. 1 option = 100 shares.

● An investor will have to keep enough capital to buy 100 shares at the strike price of the put option.

Bull Put Spreads

Put options can also be combined to execute intermediate to advanced trading strategies. Intermediate strategies include the bull put and bear put spread.

A bull put spread involves buying one put option at a lower strike price and selling a put option at a higher strike price. This results in a net premium generated.

As the name implies, the bull put strategy is used when a trader expects the underlying asset to increase in value.

Bear Put Spreads

On the other hand, a bear put spread can produce a profitable trade if the underlying asset decreases in value.

A bear put spread involves buying a put option at a higher strike price and selling a put option at a lower strike price. This results in a net debit to the position when initiated.

Risk of Put Options

Despite their benefits for investors, there are certain risks which investors need to be aware of.

Time Decay

Unlike stocks, options are assets with a fixed time duration. As time passes, the value of the option will decrease. This is also known as time decay. It is important to note that time decay happens regardless of how the stock price moves.

If an investor buys an option with six months until expiry, the option will be worth more in the first month as compared to the fifth month.

Time decay helps option sellers to generate returns, but causes option buyers to lose money.

Changes In Implied Volatility

When the price of an underlying stock moves quickly, the implied volatility of a put option goes up. This can cause put options to become more expensive.

As the stock price becomes more stable, the implied volatility of a put option goes down. This can cause a put option to be worth less even if the underlying stock price is dropping slowly.

Assignment Risk

When a put option expires, two situations can happen:

● The stock price is the same or above the strike price of the put option. In this scenario, the put option expires worthless. There is also no assignment risk.

● The stock price is below the strike price of the put option. In this scenario, the put option is worth a certain amount. There is an assignment risk.

Assignment risk happens to option sellers. When the stock price is below the strike price of the put option, the put option buyer has the choice to exercise their right to sell the shares at the strike price.

This means the option seller has to buy the underlying shares at the strike price of the option. The whole transaction is also called being assigned the shares. In this case, the option seller may potentially take losses.

Loss of Capital

When investors purchase a put option, there is a chance the option could be worth zero upon expiry. Hence, there is a risk that all your capital can be lost. We recommend investors to allocate capital they are willing to lose and only use a part of their portfolio to purchase put options.

Consideration of Trading Put Options

In conclusion, put options are a versatile way to hedge your portfolio, especially when the markets are volatile.

There are different ways to combine put options and stocks together, some of which lie beyond the scope of this article (vertical spreads, combining calls and puts or synthetic equivalents to name a few).

However, all financial instruments come with risk and put options are no exception. If you are selling options, you have to be aware of the assignment risk if the stock price falls below the strike price of your put option.

But here comes the next question. How investors actually use put options?

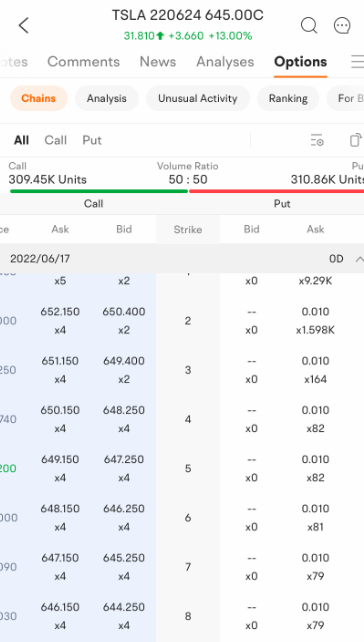

● Options chain

With real-time options quotes. Investors can find the national best bid and offer, transaction details, real-time options greeks and advanced display-mode settings and screening functions.

Images provided are not current and any securities are shown for illustrative purposes only.

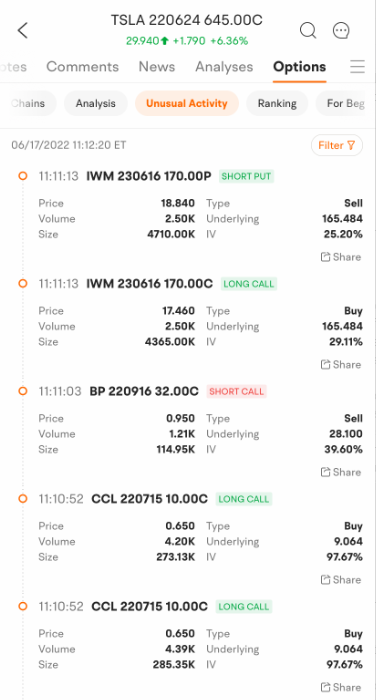

● Options Unusual Activity

Data is your edge in options trading. Through our platform, you get real-time data lists of large volume options transactions. This is often a sign a huge player like a bank or financial institution is buying or selling.

Images provided are not current and any securities are shown for illustrative purposes only.

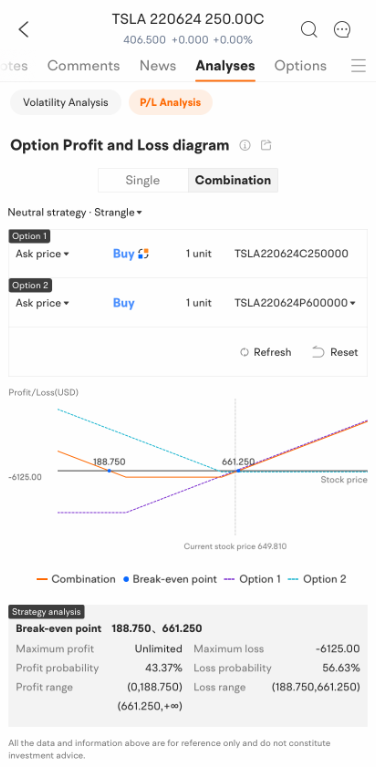

● P/L analysis

With P/L analysis, you will know the exact amount you could make or lose and the range of prices for that to happen. This is a useful tool to help you plan out your trades.

Images provided are not current and any securities are shown for illustrative purposes only.

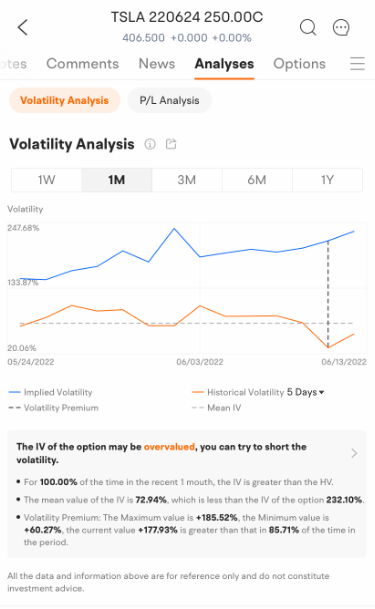

● Volatility analysis

The volatility analysis tool helps you view the relationship between the implied volatility of the current option and the historical volatility of each cycle.

Images provided are not current and any securities are shown for illustrative purposes only.