Swing Trading vs. Day Trading: What's the Difference?

There are many fundamental distinctions between swing and day trading, although both are considered comparable trading approaches. The frequency with which transactions are carried out is the primary distinction. Both day trading and swing trading have the potential to be profitable. However, your success will be largely determined by the amount of cash you have at your disposal, the available period, your approach to trading, and the marketplace you are trading in.

Trading Frequency

Day traders are investors who initiate and close many positions during a single trading day. On the other hand, swing traders enter into transactions that continue for many days, weeks, or even months.

Number of Transactions

Although it includes making deals for a few days, weeks, or even months, swing trading is still considered a sort of trading that takes place rapidly. Swing trading, on the other hand, tends to result in a more gradual accumulation of profits and losses than day trading does. Nevertheless, there are still opportunities for swing trading that can rapidly result in significant wins or losses.

Day trading is popular among investors searching for rewards that can be quickly compounded. The practice of buying and selling assets inside the same trading day, sometimes on many occasions during the trading day, is where the phrase "day trading" originates.

In day trading, sticking to the 1% risk guideline is the common rule of practice. According to this guideline, you should never put more than one percent of your whole portfolio at risk on a single deal.

Time Horizons

The term "swing trading" refers to a trading method that includes making deals over a period of time that is more than a few days, weeks, or months. The objective is to secure earnings in the short- to medium-term despite market trends constantly shifting.

Day trading is a strategy that involves making many transactions over one or two trading days in order to generate as many small profits as possible from daily price swings.

How You Trade

Swing traders may utilize their online brokerage accounts to open positions and make trades due to the greater length of time over which they operate. They don't have to respond to a price adjustment within milliseconds; therefore, they're under considerably less pressure.

You need to use the latest tools and programs to maximize your profits from day trading. Because of the possibility that prices may shift before you can even determine whether to execute the transaction, automation is essential to have the possibility of making trading lucrative. Even with these tools, quick market reversals can result in substantial losses.

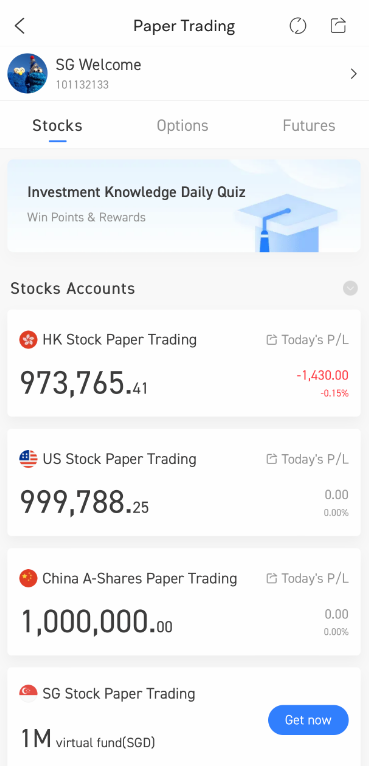

If you are new to trading, you can try the paper trading on moomoo app. The paper trading process is exactly the same as the real scenario, with real-time data, which will help you familiarize yourself with the trading rules without using real money, getting $1,000,000 virtual balance today by downloading and using moomoo paper trading! Sign up with moomoo now to practice paper trading today!

What Does a Day Trader Do?

A day trader engages in business in a frenetic and exciting atmosphere, and their goal is to profit from extremely short-term price fluctuation. The typical strategy of a day trader is to complete all of their open positions before the market closes for the day, engage in a high trading volume, and work toward generating a profit via a succession of smaller deals.

What Does a Swing Trader Do?

When pinpointing the optimal times to enter and exit a position, a swing trader will rely on technical analysis. When trading using a swing strategy, it is common practice to maintain open positions for at least a few days to capture bigger price movements and maximize profits with a reduced number of transactions.

Summary

There is no one trading method that is superior to another; rather, each one caters to a unique set of requirements and preferences.

In order to trade successfully in various markets, one may need varying amounts of capital. Day trading demands far more time than swing trading, but being consistent requires a significant amount of experience. Day trading is the activity that more effectively caters to those who are action lovers. Swing trading could be a better option for those looking for a way to invest their money that requires less time and effort and less stress.