Vertical Spread Strategy: How It Works and When It Can Be Used

Exploring different trading strategies gives traders a toolkit to navigate the ever-changing finance landscape effectively. One key strategy in this toolkit is the vertical spread.

Vertical spreads offer some traders a structured way to handle risks and potential rewards in the options market. Understanding how vertical spreads work can help traders make more informed decisions, providing the opportunity to take advantage of market movements while staying more in control of their investments.

Read on to learn more about vertical spreads.

What is Vertical Spread strategy

A vertical spread strategy in option trading involves simultaneously buying and selling a call or put option of the same underlying asset with different strike price within the same expiration date.

This strategy helps investors potentially profit from the directional price movement of the underlying security. The goal is to try to potentially profit on the market price direction whether its neutral to bullish or bearish while limiting its potential losses.

By understanding the basics of vertical spreads, option traders can position themselves strategically to potentially profit from trending markets with a directional market bias.

How Vertical Spread works

When a trader utilizes a vertical spread strategy, they begin by selecting options on the same underlying asset with different strike prices at the same expiration date. Here's how it works step by step:

Select your option contracts: Choose two options on the same asset — an option is bought while another one is sold simultaneously.

Decide on strike prices: Opt for different strike prices to establish a price range where the asset's movement is expected.

Take precautions to manage risk: Aim to potentially profit from the price difference between the options while limiting potential losses.

Consider market outlook: Anticipate both bullish and bearish scenarios.

Implement your strategy: Implement the vertical spread and monitor the performance.

By following these steps, traders can leverage vertical spreads to make better informed decisions tailored to their market outlook and risk tolerance.

Types of Vertical Spreads

There are several different types of vertical spreads. These spreads — like the bull call spread, bear put spread, bull put spread, and bear call spread — give traders versatile ways to navigate market changes.

Each type has its own unique features and profit potential, allowing traders to customize their strategies based on specific market conditions and outlook. Let's explore some of these types.

Bull Call Spread

The Bull Call Spread can be used when traders expect a bullish market. This strategy involves buying an in-the-money (ITM) call option and simultaneously selling an out-of-the-money (OTM) call option on the same underlying asset with the same expiration date.

However, these strategies don't require one ITM and one OTM options contract; both can be ITM or OTM.

The key elements are:

ITM Call Option: Bought at a lower strike price.

OTM Call Option: Sold at a higher strike price.

Profit Calculation: The maximum profit is the difference between the strike prices minus the net premium paid (premium of ITM call - premium received from OTM call).

Theoretical Maximum Loss: Limited to the net premium paid.

Example: If you buy a call option with a $50 strike price and sell a call option with a $55 strike price, your potential profit is capped at $5 per share minus the net premium paid.

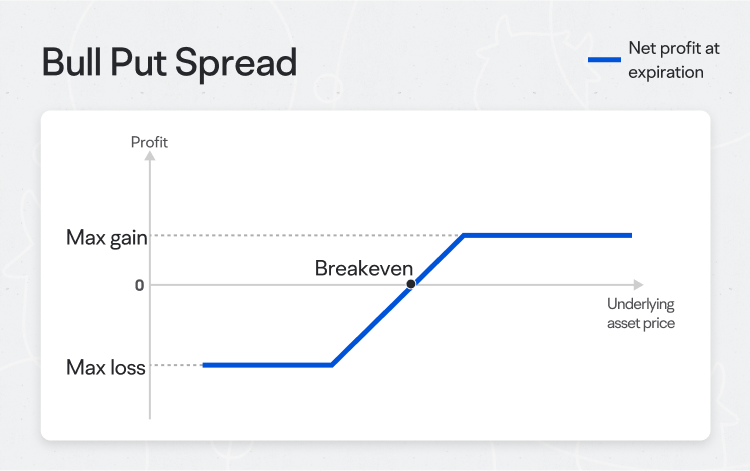

Bull Put Spread

The Bull Put Spread can be used when traders have bullish market expectations and involves selling a higher strike put option and buying a lower strike put option. This approach targets a net credit, as the premium received from selling the put is higher than the premium paid for buying the put.

The key elements are:

ITM Put Option: Sold at the higher strike price.

OTM Put Option: Bought at the lower strike price.

Profit Calculation: The maximum profit is the net premium received.

Theoretical Maximum Loss: Limited to the difference between the strike prices minus the net premium received.

Example: If you sell a put option with a $45 strike price and buy a put option with a $40 strike price, your maximum profit is the net premium received, and your potential loss is capped at $5 per share minus the net premium received.

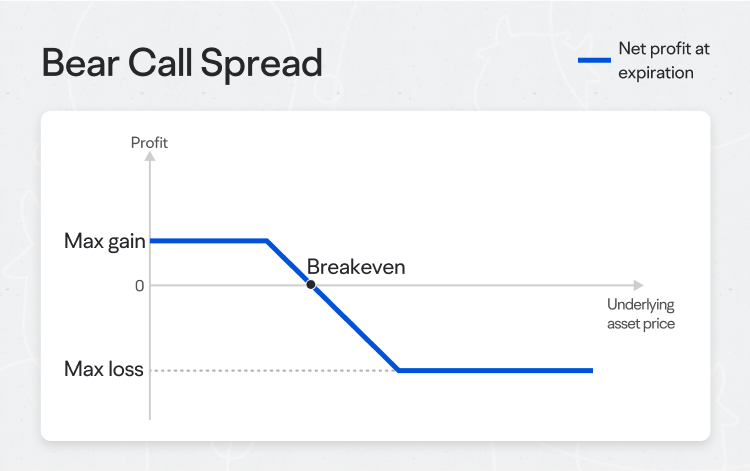

Bear Call Spread

The Bear Call Spread can be used in bearish market conditions. It involves selling an ITM call option and buying an OTM call option. This strategy aims for a net credit, potentially benefiting from the premium received from the ITM call sale.

The key elements are:

ITM Call Option: Sold at a lower strike price.

OTM Call Option: Bought at a higher strike price.

Profit Calculation: The maximum profit is the net premium received.

Theoretical Maximum Loss: Limited to the difference between the strike prices minus the net premium received.

Example: If you sell a call option with a $60 strike price and buy a call option with a $65 strike price, your maximum profit is the net premium received, and your potential loss is capped at $5 per share minus the net premium received.

Bear Put Spread

The Bear Put Spread can be used when traders anticipate a bearish market. This strategy involves buying an ITM put option and selling an OTM put option. It aims to capitalize on a decline in the underlying asset's price.

The key elements are:

ITM Put Option: Bought at a higher strike price.

OTM Put Option: Sold at a lower strike price.

Profit Calculation: The maximum profit is the difference between the strike prices minus the net premium paid.

Theoretical Maximum Loss: Limited to the net premium paid.

Example: If you buy a put option with a $50 strike price and sell a put option with a $45 strike price, your maximum profit is capped at $5 per share minus the net premium paid.

When to use Vertical Spreads strategy: Factors to consider

When considering the strategic implementation of vertical spreads, several key factors come into play in an effort to optimize trading decisions effectively.

Bull Call Spread:

Market Conditions: This strategy may be appropriate for a moderately bullish market outlook.

Option Delta: Use when you want a net positive delta, indicating sensitivity to upward price movements.

Gamma: Monitor gamma to gauge how delta will change as the underlying price moves.

Theta: Consider the impact of time decay; bull call spreads can be negatively affected by theta.

Vega: Assess how changes in volatility impact your spread; higher volatility can potentially benefit the spread initially but hurt it as expiration nears.

Risk Factors: Limited risk, with a maximum theoretical loss capped at the net premium paid.

Bull Put Spread:

Market Conditions: This strategy can be used in a neutral-bullish market with sideways or rising prices.

Option Delta: Seek a net positive delta but lower than a bull call spread.

Gamma: Lower gamma exposure, typically providing more stability in delta changes.

Theta: Can benefit from positive theta as time decay works in favor of the strategy.

Vega: Can potentially benefit from falling volatility.

Risk Factors: Limited risk, with maximum theoretical loss occurring if the underlying price falls below the lower strike.

Bear Call Spread:

Market Conditions: This strategy can be used in a moderately bearish market expectation.

Option Delta: Use when you want a net negative delta, indicating sensitivity to downward price movements.

Gamma: Relatively low gamma exposure, potentially providing more stability.

Theta: Can benefit from positive theta as time decay works in favor of the spread.

Vega: Can potentially benefit from falling volatility.

Risk Factors: Limited risk, with maximum theoretical loss occurring if the underlying price rises above the higher strike.

Bear Put Spread:

Market Conditions: This strategy can be used in a neutral-bearish market with sideways or falling prices.

Option Delta: Seek a net negative delta, indicating sensitivity to downward price movements.

Gamma: Higher gamma can increase risk if the market moves unexpectedly.

Theta: Negatively affected by time decay; closer to expiration can erode value.

Vega: Higher sensitivity to volatility changes; rising volatility can potentially benefit the spread.

Risk Factors: Limited risk, with the theoretical maximum loss capped at the net premium paid.

Keep in mind: Maximum potential loss and profit for options are calculated based on the single leg or an entire multi-leg trade remaining intact until expiration with no option contracts being exercised or assigned. These figures do not account for a portion of a multi-leg strategy being changed or removed or the trader assuming a short or long position in the underlying stock at or before expiration. Therefore, it is possible to lose more than the theoretical max loss of a strategy.

By weighing these factors thoughtfully, traders can navigate market dynamics with greater confidence and more precision, leveraging vertical spreads strategically to potentially capitalize on various market conditions.

How to manage Vertical Spread using Moomoo

Moomoo offers an intuitive way to manage vertical spread. Here's how to access this feature on the moomoo app:

Step 1: Open the app and navigate to the stock you want to analyze. Click on "Options."

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 2: Click "options strategy", then click "Vertical Spread".

Step 3: Set your strike width and manage your trades.

Potential pros and cons of Vertical Spread

Pros of Vertical Spreads:

Risk management: Offers a clear risk management strategy, which may be attractive to some option traders with a relatively lower risk tolerance.

Methodical approach: Provides a methodical approach to market exposure enabling traders to adapt the strategy for use in different market conditions.

Clearer profit loss parameters: Defines potential profit and loss parameters upfront, potentially enabling better risk management for the trades.

Cons of Vertical Spreads:

Lower potential for profit: Restricts profit potential compared to more aggressive trading strategies.

Up-front premium costs: Involves initial premium costs for debit spread and margin requirements for credit spreads that can tie up trading capital.

Need for careful monitoring: Requires traders to monitor the changes in theta (time decay) and vega (volatility) that can affect the vertical spread value.