Watching oil here folks and the largest oil ETFs. Why?

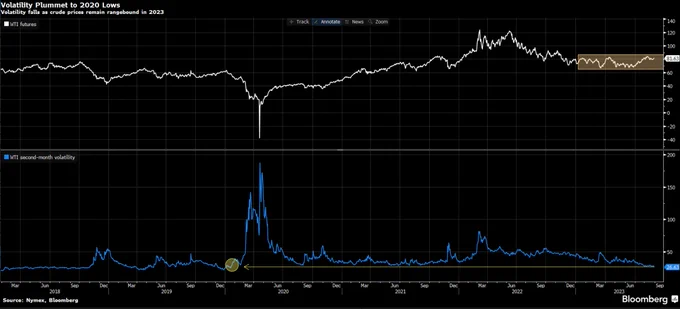

1 - Oil's volatility has plummeted to the lowest since 2020 as market participants are on holiday and liquidity has dropped.

2 - Beware that volatility could pick up if Hurricane Idalia hits and impacts US oil supply.

3 - Technical trading could pick up if oil volatility drops below 20%, which is when traders suggest they will stop shorting volatility. That could signal bigger swings in prices and more activity in options' (Source: Bloomberg).

4 - However, an oil rally could be short-lived...for a couple of reasons.

5 - One of the reasons a potential oil rally could be short-lived is that China, the biggest oil consumer could be on the brink of a credit crunch, as China's property developers, which account for 15% of GDP, are having a hard time.

6 - If China's property developers can't raise capital to fill their gaps, solvency could be at risk, and that would likely lead to widespread defaults, and further slowing of China's economy, and thus oil demand.

7- Watch the largest oil ETFs;

-United States Oil Fund ETF $USO +7.8% YTD.

-Invesco DB Oil Fund ETF $DBO +8.8% YTD.

-United States Brent Oil Fund, LP ETF $BNO +6.2% YTD.

-ProShares Ultra Bloomberg Crude Oil ETF $UCO +6.3% YTD.

#Oil #energy #stocks #ETF #brent #WTI

This is general in nature and observations are not investment advice. Consider the appropriateness of this information in light of your personal circumstances before making investment decisions