What is a Stock Split?

Key Takeaways

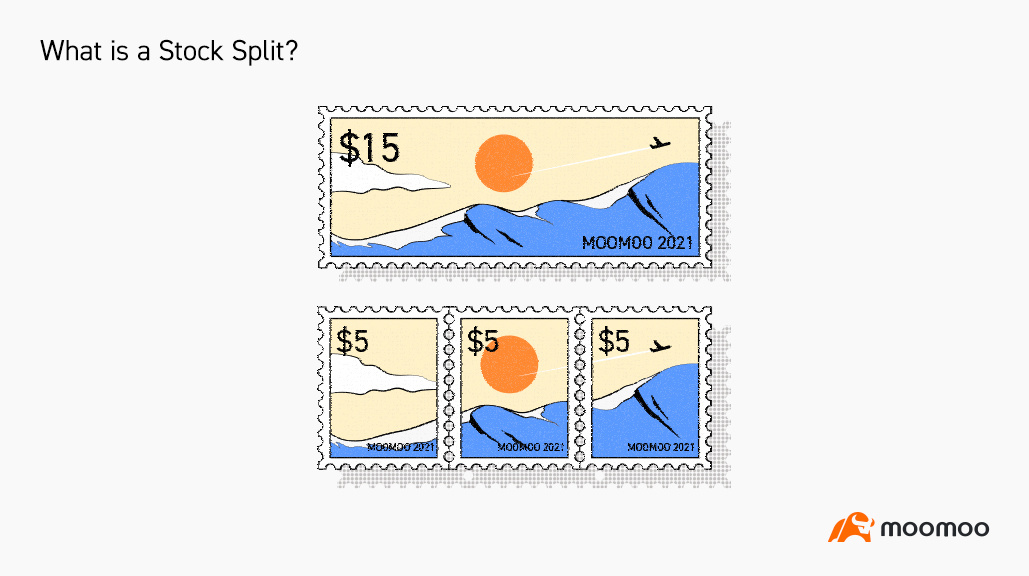

A stock split means that a public firm splits a share into several shares.

A stock split usually happens when the stock price is too high, and a reverse stock split may be executed when the stock price is too low.

A stock split will not change the total stock value and shareholding proportion owned by a shareholder, and the market cap of the company also remains the same. But it will lower the stock price, making the stock more affordable and improving the stock's liquidity.

A stock split may cause the stock price to rise, but there is no guarantee. Stock prices of different companies may not perform the same.

Understanding a stock split

A relationship can be split, and so can a stock. A stock split means that a public firm splits a share into several shares.

Why does the company do so? It often happens when the stock price is so high that it may affect many investors' desires to buy shares.

The split ratio can be anything, such as 2-for-1, 3-for-1 and 4-for-3. When the split ratio is 2-for-1, one share is split into two shares, and the stock price will be halved simultaneously.

If you have 100 shares for 20 dollars per share, then after the split, you will own 200 shares in total, and the price per share will be 10 dollars. Obviously, the total value you own is not changed.

Although the number of shares outstanding increases, the shareholding proportion of each shareholder and the company's market cap remain the same.

One more thing, many price charts will usually make some adjustments after a split to reflect the price trend more clearly. Therefore, we usually can't see a price plunge caused by the split.

In addition, some public firms may execute a reverse stock split when the stock price is too low. They combine several shares into one, and the stock prices are adjusted accordingly.

Effects

What effects will a stock split have? It will lower the stock price, which may make the stock more affordable and will possibly enhance the stock's liquidity. The split doesn't cause the stock price to rise directly, but it may reflect that the company is confident about the future.

For these factors, the stock price may rise. But there’s no guarantee. Even if it rises, maybe the price reduction will come soon. So we should treat it rationally.

Example

In August 2020, Apple Inc. (AAPL) announced a 4-for-1 split after announcing its third-quarter financial statement. The stock price was up by 6% after the news release and in the following month till the split happened it continued to climb by a total 37%. After the split, the price declined by 25% in the next half month.

In 2020, CSX Corp also executed a stock split. But its stock price showed a different pattern. From the announcement date to the split date, the stock price fell slightly. But after the split, it rallied slightly.

Another example is Berkshire Hathaway Inc. (BRK.A), which never executes a stock split. According to the book "The Essays of Warren Buffett", Berkshire wants to appeal to investors who wish to be with the company for the long term instead of paying much attention to stock prices.

The information contained herein is for educational purposes only. Nothing discussed should be considered investment advice.