ACH Transfer: How it Works and How Long it Takes

For consumers, electronically transferring money via an ACH transfer is a popular way to move money. It can be used for different purposes, whether it's for a direct deposit, bill payments, person-to-person transfers, unemployment payments or tax refunds. ACH transfers are usually free or have very low fees and the ACH network can also accommodate same-day processing.

But there's more, as investors can also use ACH transfers when investing. Keep reading.

What is ACH

ACH stands for Automated Clearing House, a nationwide network that facilitates electronic funds transfers (EFTs) between banks in the United States. ACH is commonly used for transactions such as direct deposits, bill payments, and payroll processing, enabling secure, reliable, and efficient movement of funds between accounts. It’s a fundamental part of the U.S. payment system that enables businesses and individuals to make and receive payments electronically.

What is an ACH transfer

An ACH transfer is an electronic bank-to-bank transfer that moves funds through the ACH network within the U.S. This network is regulated by the National Automated Clearing House Association (NACHA), which establishes standards to ensure safe and efficient processing across the U.S. ACH transfers differ from wire transfers, which are typically faster (completed the same day) and more expensive, often used for high-value or time-sensitive transactions.

How does an ACH transfer work

The process involves a series of steps, typically completed in 1-3 business days:

Initiation: The sender (individual, business, or government entity) initiates the ACH transfer request by providing their bank details and specifying the recipient’s bank account information. ACH transfers can be either credit or debit transactions.

Submission to ACH Network: The initiating bank collects ACH requests in batches and submits them to the ACH network, typically operated by the Federal Reserve or a private ACH operator. At this stage, the transfer request is sorted and sent to the appropriate receiving banks.

Batch processing: The ACH network processes transactions in scheduled batches, which generally run multiple times each day. In this batch process, the transactions are aggregated and sent to the receiving bank.

Delivery to the receiving bank: The receiving bank accepts the ACH transfer and verifies that it meets all the necessary requirements, including the availability of funds in cases of ACH debits and not in excess an ACH transfer limit. Once approved, the receiving bank credits or debits the recipient's account accordingly.

Final settlement: The Federal Reserve or the ACH operator settles the transaction between banks. The funds are finally transferred to the recipient’s account, completing the ACH process.

Main types of ACH transfer

ACH credit transfers

In an ACH Credit (or push), the sender (or originator) initiates the transfer to send money to a recipient’s account. This is known as a "push" transaction because the sender pushes funds out of their account to the recipient. Common uses include direct deposit, tax refunds, person-to-person payments (e.g. Individuals can send money to friends or family through ACH credit via apps or bank transfers).

ACH debit transfers

In an ACH Debit (or pull), these transactions are initiated by the recipient (or payee) to pull funds from the sender’s account. These are "pull" transactions, as the recipient requests funds from the payer’s account. Common uses include bill payments, loan payments, and recurring payments like gym memberships.

How long do ACH transfers take

ACH transfers typically take 1 to 3 business days to process, though the exact timing can vary based on several factors, such as the time the transaction was initiated, bank policies, and whether same-day processing is used.

Most standard ACH transfers take 1-3 business days. Transactions initiated before a bank’s cutoff time (often in the late afternoon) are generally processed faster, while those initiated after may begin processing the next business day.

Same-day ACH transfer allow funds to be processed within the same business day. However, same-day ACH is subject to cutoff times and may incur additional fees. Many banks process same-day transfers in multiple settlement windows, typically around 9:30 a.m., 1:00 p.m., and 4:45 p.m. ET.

Keep in mind that each bank may have different processing times and cutoff hours for ACH transfers, which can impact the speed.

How much is the fee for ACH transfers

ACH transfer fees vary depending on the type of transaction and the financial institution involved; they can range from free to a few dollars per transaction. For consumers many banks offer free ACH transfers between accounts within the same bank or between accounts at different banks. However, some institutions may charge a fee ranging from $1 to $3 for outgoing ACH transfers to external accounts.

Business accounts often incur fees for ACH transfers, with outgoing ACH transfers ranging from $1 to $10 depending on the bank, although bulk ACH transfers or payroll processing might come with volume discounts.

Same-day ACH transfers generally involve an additional fee due to faster processing. Fees can range from $0.50 to $5 per transaction. Business accounts may face higher fees for same-day services.

When using companies like PayPal, Venmo, and Stripe may charge fees for ACH transfers in certain cases, such as instant transfers or commercial transactions. These fees usually range from 0.5% to 1.5% of the transaction amount, with a typical cap around $10.

Incoming ACH transfers are often free, particularly for consumer accounts, but some banks charge for outgoing transfers, especially when moving funds to external accounts.

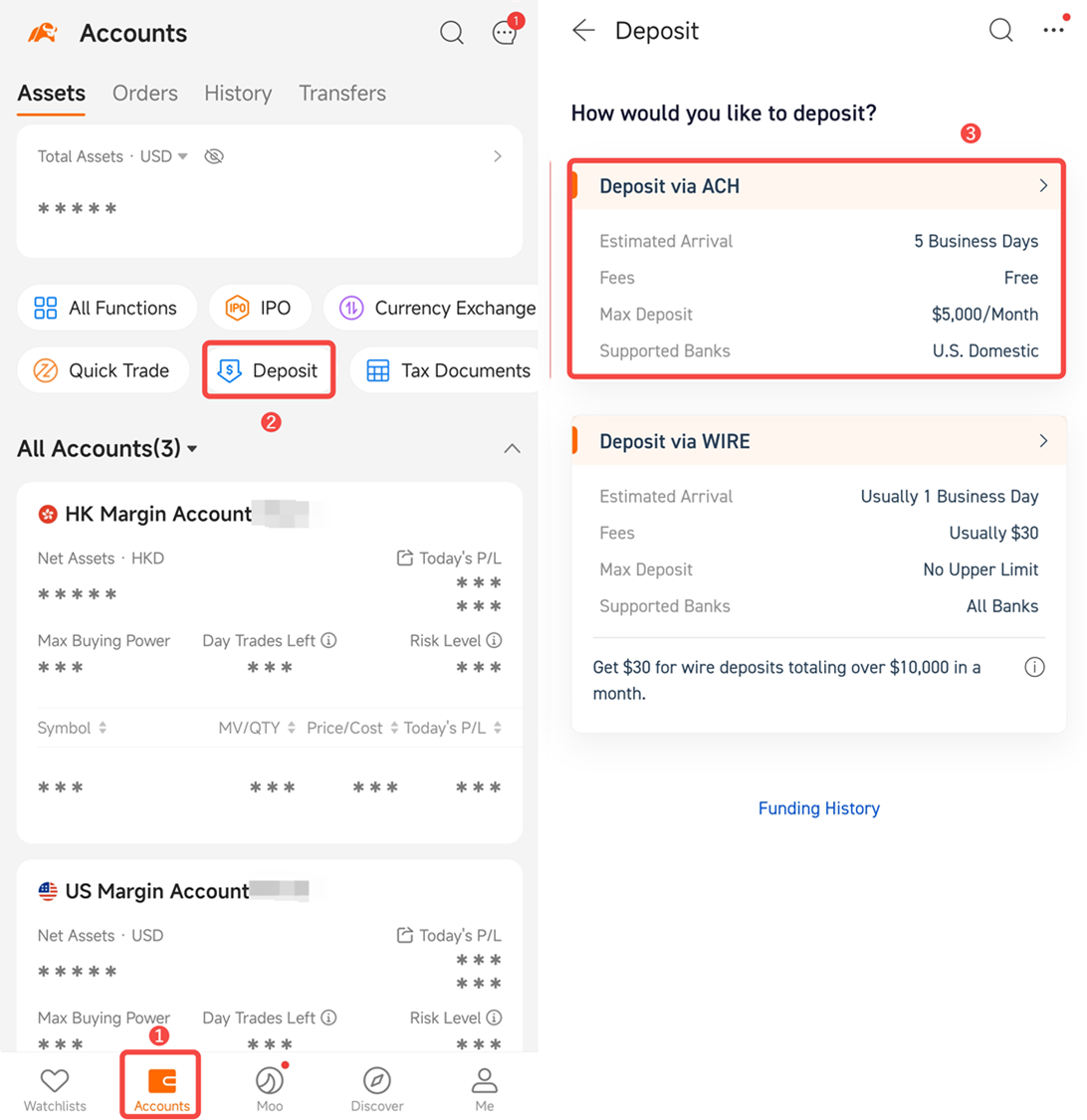

How to deposit funds to moomoo via ACH

To deposit funds via ACH, tap Accounts> Deposit> Deposit via ACH in the moomoo app. After submitting the transfer request, you will be given instant buying power based on your ACH transfer status.

Keep in mind, that investors can only deposit funds via ACH from US bank accounts. How much they can deposit is subject to adjustment based on the records of your assets, transactions, etc. Investors may not be able to use instant buying power in some cases. For details, please check Why can't I use my instant buying power.

But once the funds have hit the account, investors can begin trading stocks and options.

Potential benefits and restrictions of ACH transfers

Potential benefits of ACH transfers

ACH transfers are typically less expensive than wire transfers. Many banks and credit unions offer free ACH transfers for standard processing, while others charge a minimal fee, generally much lower than the fees for same-day wires.

ACH is ideal for recurring payments, such as payroll, bill payments, and monthly subscriptions, as transfers can be set up to automatically repeat, saving time and reducing the likelihood of missed payments.

ACH transfers are secure, with strict NACHA guidelines that protect both the sender and recipient. The system minimizes errors and fraudulent activity by implementing verification measures and encryption.

ACH transactions typically settle within 1-3 business days, providing a predictable timeline for many types of transactions. Same-day ACH has increased flexibility, allowing faster processing if needed.

Compared to credit card payments, ACH transfers carry a lower risk of fraud because they often require bank account verification. This makes ACH transfers a trusted choice for businesses collecting payments from customers.

Potential restrictions with ACH transfers

Standard ACH transfers take 1-3 business days to process, and transfers don’t process on weekends or federal holidays. Same-day ACH speeds up this timeline but it comes with potentially additional fees and cut-off times, which might not be ideal for urgent transactions.

Many banks impose limits on the amount that can be transferred through ACH, both daily and monthly. This can restrict ACH transfers for high-value transactions, especially for personal accounts, and may require customers to split larger transfers across several days.

ACH debits (used for pulling payments, like bill payments) can be reversed under certain conditions, such as errors or insufficient funds. While this is a safeguard, it can create uncertainty for businesses that rely on ACH payments for revenue.

The ACH network primarily operates within the United States, so it’s not ideal for international transactions. For cross-border payments, options like wire transfers or SWIFT are typically required.

While ACH is generally more cost-effective, wire transfers are often faster, usually settling on the same day. ACH might not be the best choice when immediate fund transfer is critical.

ACH vs. wire transfer: what's the difference

ACH | Wire transfer | |

Processing time | Typically, it takes 1-3 business days to process. Some banks offer same-day ACH services, but even this can take several hours and may incur additional fees. | Generally processed within hours or on the same day, often immediately for domestic transfers. International wires may take longer, usually 1-2 business days. |

Cost | Often low-cost or free, especially for consumer accounts. When fees do apply, they’re usually minimal (around $1-$3). Businesses might pay slightly more for outgoing ACH transfers, particularly for bulk or payroll services. | Typically range from $15 to $30 for domestic wires and $30 to $50 for international ones, making them better suited for high-value or time-sensitive transactions. |

Security and reversibility | Governed by NACHA, ACH transactions have built-in security features and can be reversed under certain conditions (e.g., errors or unauthorized transactions). This makes them safer for recurring payments or situations where disputes might arise. | Typically considered final once sent, and reversals are rare, making them a secure choice for large, one-time payments but also requiring greater caution from the sender. |

International reach | Primarily limited to the U.S., with few options for international payments. Some banks use other methods for cross-border transactions, but ACH itself is mostly domestic. | Work both domestically and internationally, making them suitable for cross-border payments. International wire transfers go through the SWIFT network, providing a global reach that ACH doesn’t offer. |

Use case | Best for recurring payments like payroll, utility bills, and subscriptions due to their low cost and ease of setup. They’re also suitable for transferring funds between personal accounts at different banks. | Good for large, urgent, or high-value transactions, like closing on a home purchase or sending an international payment. They’re commonly used by businesses for major one-time transactions. |

FAQs About ACH transfers

What is an ACH payment transfer?

An ACH payment transfer is an electronic funds transfer made through the Automated Clearing House (ACH) network. This network enables individuals, businesses, and government agencies to move money between U.S. bank accounts securely and cost-effectively. ACH payments are widely used for recurring payments, direct deposits, and bill payments.

What are the general steps for making an ACH payment?

The following steps may vary slightly depending on your financial institution’s procedures, but the general flow remains the same across most banks and payment services.

Gather the necessary information including sender and receive details, bank account numbers, routing numbers, the name associated with each bank account and in some cases, verifying the identity of the recipient or authorize the transaction.

Choose the ACH payment type by determining if it’s an ACH Credit (pushing money to another account) or ACH Debit (authorizing a business to pull funds from your account).

Initiate the transfer by logging in to your bank account (or use a third-party payment processor, if allowed) and select “ACH transfer” or similar from the payment options, then enter the required details and the amount to transfer.

Review and authorize the transaction by double-checking the information, especially bank account numbers, as errors can delay or prevent processing. With the transaction authorization, this may involve a digital signature, pin, or two-factor authentication.

Allow processing time as ACH transfers typically take 1-3 business days to complete, depending on bank policies and the type of ACH transaction. Some banks offer same-day ACH transfers, though these might incur extra fees and must meet certain cutoff times.

Monitor and confirm the transfer by checking your bank account to confirm the transaction went through as expected. Businesses often notify you when an ACH debit has been processed.

What is the difference between a direct deposit and an ACH transfer?

The main difference between ACH and direct deposit is that ACH is a network and process for electronic funds transfers, while direct deposit is a specific type of ACH transfer. ACH transfers can be used for a variety of purposes, including direct deposits, bill payments, and online purchases. ACH payments can be either credits or debits.

A direct deposit is a type of ACH transfer that moves funds directly into a recipient's bank account. Direct deposits are typically used for payroll, tax refunds, and other regular payments and they are are always ACH credit payments.

Is ACH only in the US?

Yes, the ACH network is primarily a U.S.-based system designed for electronic funds transfers between banks. It enables various financial transactions, including direct deposits and bill payments, primarily within the United States.