What Is Copy Trading?

In brief, copy trading is the practice of imitating the trading activity of a stock market veteran. However, there are advantages and disadvantages to taking this approach. What exactly is copy trading, how does it function, and what kind of results can you anticipate seeing from it?

The Definition of Copy Trading

The practice of copy trading is the same as it sounds. You start by selecting a seasoned trader to follow and then mimic their actions in the market. For example, a trader you are following has purchased 50 shares of a particular stock. Consequently, you would also purchase 50 shares of that stock. You should do the same if they invest 3% of their portfolio in a specific type of stock.

The most important thing is to find a trader to follow whose investment strategy and objectives are similar to your own. For instance, if you have a cautious approach to investing, you might model your trades after those of someone else who has a cautious approach to trading. Similarly, a growth investor should not replicate a value investor's trading patterns.

Copy trading can be done either on an individual basis or through a copy trading framework. The latter option enables you to choose a certain kind of trading activity to imitate. In the meanwhile, it will make investments on your behalf. Besides, you can decide which investor you want to follow. Also, check to see sufficient capital in the trading account to handle any transactions that may occur.

A Look at Some of the Potential Benefits of Copy Trading

The practice of copy trading offers investors the chance to potentially benefit from the expertise and experience of another investor. It is optional to research the movements or patterns of the stock market to choose which stocks to purchase, sell. You would just imitate the actions of an experienced investor. Imagine that you have selected an individual with a track record of producing positive returns on their investments. Therefore, mimicking what they do theoretically could produce similar results, though it's important to remember that past performance does not guarantee future results.

Copy Trading is a largely passive process. You are handing over the difficult task of deciding where to put your money to someone else through a copy trading platform.That means potentially less time studying the market.

There are a few factors to take into consideration while selecting an investor to model one's behavior after, including the following:

• The length of time that they have been in business.

• Investment history.

• The number of open positions.

• The average amount of time an investment is held.

• Preferred types of investments.

In addition, you need to consider what you want to accomplish with your portfolio. For instance, if you are interested in alternative investing, you may model your investment strategy after someone specializing in hedge funds, commodities, or foreign exchange (FOREX). On the other hand, if your objective is not to outperform the market but instead get close to its performance, you could incline toward a potential investor who favors an index approach. This is because attempting to match the market's performance is more accessible than outperforming it.

Disadvantages of Copy Trading

There are proponents of copy trading on both sides. However, it may not be right for every investor. Before you consider using this method, there are a few essential points that you need to keep in mind.

To begin, your level of success is directly proportional to the investors' whose trends you track. No investor can predict when it's the best time to buy or sell or where to invest. As a result, copy trading involves a certain amount of risks. You’re hoping the investor you're copying can perform well in the market, but no assurances can be made.

This is the section where you should invest some time investigating several traders. Find out more about their business model and determine whether or not their practices correspond with the objectives you have set for yourself.

Paying commissions on several trades while engaging in copy trading might add up quickly. If you use a copy trading platform, you may be required to pay the platform additional costs for management or administration. If you are serious about reducing your fees to a minimum, then before you trade, consider the charges carefully.

Mirror Trading: An Alternative to Standard Copy Trading

Mirror trading is a kind of trading comparable to copy trading but different. One way to think of it is as "copy trading on the light side."

You won't be duplicating an investor's actions trade for trade if you use this method; instead, you will be modeling your own investments after the investor's general approach to the market. For argument's sake, let's pretend that you are interested in investing for value. If this is the case, one option available to you is to model your investing strategy after that of Warren Buffett. You may not buy or sell every investment he makes or suggests. On the other hand, you would base your judgments on assets on the same criteria that he uses.

Conclusion

One method of automating your investing approach is copy trading. It removes the element of deciding where to put your money to work. On the other hand, it may work out better for some investors than for others. If you are aware of the possible downsides and upsides, it will be easier for you to choose whether or not to use the copy trading method.

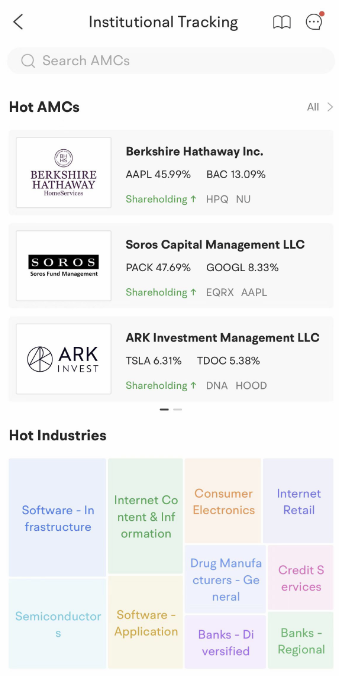

Moomoo stock trading app provides a collection of position reports from large institutions, providing users with quick access to insightful information, such as Warren Buffett's Berkshire Hathaway Inc., Tiger Global, High Tide Capital, etc. Sign up and download the moomoo app today to access the visualized holdings and portfolios from institutional funds to help develop your investing strategies.

Note: This is not related to copy trading. These are required quarterly position reports that have been provided to the SEC and made available to the public. Any portfolio composition provided is updated on a significant delay and may be incomplete. It is not possible to replicate the timing or exact holdings of institutional portfolios.

Images provided are not current and any securities are shown for illustrative purposes only.