What is the Dow Jones Industrial Average?

Key Takeaways

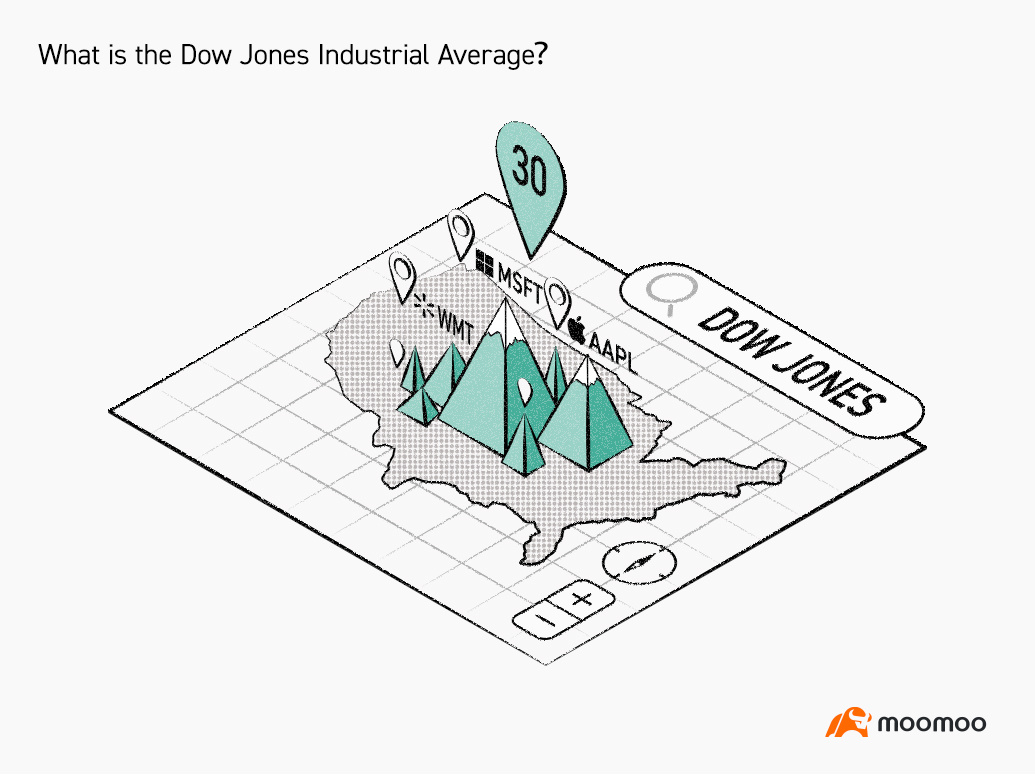

The Dow Jones Industrial Average (DJIA) is a stock index that tracks the performance of 30 large U.S. companies

The DJIA is one of the oldest U.S. market indexes and has returned more than 7% annually on average (1896-2020).

The DJIA is a price-weighted index, not a market capitalization-weighted.

Understanding the DJIA

When you think of the U.S. stock market or want to know how the stock markets are performing today, you can look at the DJIA, which tracks the performance of 30 large U.S. companies trading on the New York Stock Exchange and the NASDAQ.

The Dow Jones Industrial Average is one of the oldest U.S. market indexes. It was created by Charles Dow and Edward Jones on May 26, 1896. At first, it only contained 12 companies and was mostly composed of railroad, energy and food stocks. Today, it has already expanded to 30 companies and includes many other sectors such as technology and health care. From its inception in 1896 up until the end of 2021, the index has returned more than 7% annually on average.

Unlike the S&P 500 and the Nasdaq Composite, which are weighted by market capitalization, the Dow Jones Industrial Average is a price-weighted stock market index. Market capitalization-weighted means that large-cap stocks like Apple can have a bigger effect on those indexes when their shares' prices move up or down. And price-weighted means stocks with higher share prices are given greater weights in the index. So Goldman Sachs at $400 a share has more influence on The Dow Jones Industrial Average than Apple at $150 a share.