What Is the National Best Bid and Offer (NBBO) in US Equities?

In the United States, the National Best Bid and Offer (NBBO) offers profound insights into the highest bid, and lowest ask price from all trading venues. Therefore, NBBO stands for the tightest composite bid-ask spread in a security.

The Securities Exchange Commission's (SEC) Regulation NMS requires brokers to guarantee the best possible ask and bid price for customer's trade, or at least the NBBO quoted price at the time of the trade. [1]

Understanding National Best Bid and Offer (NBBO)

NBBO is the highest buying and lowest selling prices offered across various security trading exchanges. Brokers must quote the highest bid and lowest ask a the time a customer places a trade. The brokers do not have to provide all the potential bids and asks on various exchanges.

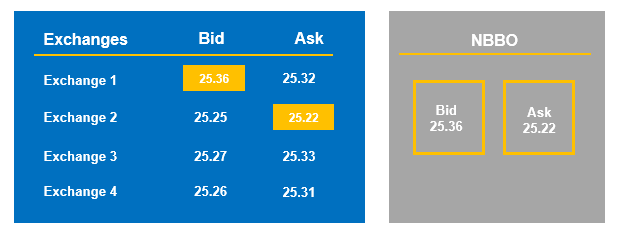

Let's analyze the quotes offered by various exchanges on shares of ABC stock:

On Exchange 1, the highest bid is $25.36 per share. It is the amount that someone would like to spend for that share.

On Exchange 2, the lowest ask is $25.22 per share. It's the lowest amount that someone is willing to sell that share at.

NBBO is the lowest asking price and highest buying price.

NBBO: Advantages and Disadvantages

Advantages:

The NBBO ensures that all investors execute trades through their broker at the best price without having concerns about compiling quotes from several exchanges. Retail traders may only sometimes have the tools to look for the cheapest pricing across many exchanges; thus, this plays that role for them.

Disadvantages:

The disadvantage is that the NBBO system might not represent the most current data, so investors might not receive the expected prices. It is a challenge for high-frequency traders (HFT), who will rely on quotes to make their techniques work.

Because dark pools and other alternative trading systems might not have posted bid/ask prices, investors should be aware that the prices could have the potential for occasional inconsistencies and may only reflect some prices.

NBBO and High-Frequency Trading (HFT)

High-frequency traders typically invest in infrastructure to connect directly to exchanges and process orders faster than other brokerages. In practice, they may not rely on the data of the Securities Information Processor (SIP) for their buy/offer bids and instead profit from the delay between the NBBO's calculation and publication.

[1] https://www.sec.gov/rules/final/34-51808.pdf