What Is the Rate of Change (ROC)?

The rate of change (ROC) measures how quickly a variable alters over a predetermined amount of time. When discussing momentum, the "rate of change" (ROC) is one of the most commonly used indicators. It is typically defined as the ratio of a change in one variable to a comparable change in another. Visually, the rate of change is depicted by the slope of a line. The Greek letter delta (Δ) is frequently used to represent the ROC.

Understanding Rate of Change (ROC)

Mathematically, the rate of change is used to represent the percentage change over the specified period, representing the momentum of the variable.

Generally, the rate of change can be calculated as follows:

R = (D2 - D1)/T

where:

R = rate of change

D = distance (or some other variable) measured at the beginning and end of the period

T = the time it took for that change to occur

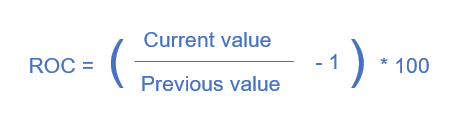

The ROC calculation in finance may also be done as a return over time by dividing the current value of an index or stock by the value from a previous period. To convert an integer to a percentage, subtract one and multiply the value obtained by 100.

Why There Is a Need for Measuring the Rate of Change

The rate of change enables investors to identify potential trends. Therefore, it's an important financial concept. For instance, a security with strong momentum or one with a favorable ROC typically performs better than the market in the short term. In contrast, a security with a ROC below its moving average or one with a low or negative ROC is expected to lose value and may be viewed by investors as a sell signal.

The rate of change is also another reliable sign of market bubbles. Although when momentum is strong and investors seek stocks with a positive return on capital (ROC), a sharp rise in ROC for a mutual fund, index, or broad-market ETF in the near term indicates an unstable market. Investors should be cautious of a bubble if the ROC of an index or other broad-market investment is greater than 50%.

How Do Traders Use the Price Rate of Change Indicator?

Technical analysis uses the price rate of change (ROC) indicator to calculate momentum. Positive ROC value confirms the bullish trend. On the other hand, negative ROC confirms the bearish trend. The ROC will be close to zero while the price is consolidating.

Limitations of Rate of Change (ROC)

There are several restrictions and limits to using the ROC indicator.

The calculation considers equal importance to the latest price and the previous price from n period ago. But in fact, more recent price movements may potentially be more helpful to determine the likely market trends in the future.

The ROC indicator is prone to whipsaws around the zero line. It may result in false signals for trend trading.

The divergence signal of the ROC indicator may occur very early, which will allow the price to run in the same direction even after the divergence signal.

Final Thoughts

The concept of rate of change (ROC) is crucial since it reveals the change of rates over a period of time and how fast these changes are occurring.

Technical analysis with moomoo

Moomoo stock trading app provides powerful stock charting tools to meet various investors' technical analysis needs and help to make investing decisions. Moomoo stock charting tools consist of 63+ technical indicators (like ROC), 38 types of charts, support for saving and synchronization of charts, and customized color patterns, etc. Download the moomoo app today to get access to these free charting tools!