What is Thematic Investing?

When an investor engages in thematic investing, they concentrate their investment efforts not on individual firms or industrial sectors but on anticipated long-term trends.

Thematic Investing: What It Is

The phrase "thematic investing" refers to an investment strategy that, rather than focusing on a particular company or industry, emphasizes trends that are anticipated to be profitable over the long term. Investors have the option to acquire exposure to structural and one-time movements that have the potential to affect the industry as a whole when using this strategy since it examines movement over a long time across an entire market.

Why do some investors find the concept of theme investing to be so appealing? It is an original approach to investing in the future, at the same time as investing in the principles that might contribute to improving our planet. In addition, an investment portfolio will be exposed to megatrends, and providing a chance of acquiring businesses positioned for longer-term development in various industries and geographical locations.

How Are The Themes Formed?

The definition of a theme is when things start to get interesting. The traditional industrial sectors and traditional indexes both select companies based on their market capitalization (or other fundamental or technical measures). However, thematic strategies begin with an idea or trend and then search for publicly traded companies that appear relevant to that idea or movement.

Because of this, it is an investment that requires a lot of studies. Why? A company's name or primary business line may not immediately reveal the company's thematic significance. For instance, placing a business that manufactures solar panels under "renewable energy" may not be challenging, but other types could be more muddled. How can potential investors choose companies that will be leaders in the field of workplace diversity in the future? Similarly, the primary activities of a video game firm could not provide any indication that the corporation has a minor division working on, for example, potentially game-changing robotics technology.

Thematic investing solutions should be able to distinguish themselves without relying on traditional classifications or measurements of relevance. Instead, they need to demonstrate that they can recognize investable themes and locate assets consistent with them. Depending on professional fund managers' skills, this might mean declaring a piece and then selecting and choosing stocks, or it can mean utilizing technology such as AI to scan company reports and other information to gather potentially thematically connected firms together into a bundle.

After that, it is the responsibility of the fund manager or the researchers to evaluate if the compiled portfolios are performing as expected while staying true to the themes that were intended for them. Establishing standards for thematic relevance that are distinct from more conventional performance measures, like returns or volatility, may be one way to do this.

Comparing Sector Investing With Thematic Investing

Because sector investing and thematic investing operate in a manner comparable to one another, it is simple to get these two strategies clear from one another. Investing in a sector involves focusing on businesses that operate within distinct subsets of the economy, such as the information technology or energy industries. On the other hand, a thematic investing approach can touch multiple sectors to align with a market opportunity or specific objective.

Let's take a look at an example to see how these two techniques compare when applied to assets in comparable industries:

Investing in a sector is an investment in a company that operates in a particular industry, such as producing semiconductors, managing mobile phone towers, or creating social media platforms.

Investment in any or all of the following industries simultaneously because they are aligned with the subject of disruptive communications is an example of thematic investing.

These industries include firms that create semiconductors, mobile phone tower operators, and social media companies.

What Criteria Should Be Used To Evaluate A Themed Investment?

Investors, of course, also have a watchdog role in ensuring that their thematic investments continue to suit their goals—whether in terms of returns, thematic exposure, or the enactment of their personal values—and complement their broader portfolios.

When analyzing a theme investment or purchasing stocks from a thematic list, the following are some factors that should be taken into consideration:

Is there going to be a sequel? In this context, it is essential to distinguish between trivial fads and significant technical advancements or societal forces that are likely to remain in the foreseeable future. Your timeline for the investment is another thing to take into consideration. You would only want to invest in a particular invention or societal change if you were confident that it would continue for the length of your exposure to it.

Do you understand the theme? At this point, you will want to study the process that underpins the theme investment. Is the method the fund manager and research team use to recognize recurring patterns and choose companies that fit those themes appropriately explained? Or is it more of a mysterious mechanism that requires you to put your faith in it? That doesn't mean you can't rely on trust; just make sure you're prepared to deal with the fallout.

Does the theme make sense when applied to the stocks? If the information is available, it is essential to analyze how a strategy weights the stocks it employs to bring a theme to life and the stocks it chooses to bring the theme to life. Certain companies may surprise you, or they may originate in industries that you wouldn't have thought to explore; in these cases, a themed investment may be able to provide value. However, consider doing a second check on the approach if a stock choice seems random, if it is based on a hunch, or if the explanation for the weighting is unclear.

Does the investment in the themed company work with your existing portfolio? Assuming you already have a diversified, strategic long-term portfolio allocation, the question that has to be asked about your theme investment is: how does it fit in with the rest of your holdings? Will it cause an unwelcome shift in the proportion of your portfolio allocated to stocks? Is there a need for both? For instance, if your stock allocation is determined by the S&P 500 Index, you may already have sufficient exposure to several large companies. You may not require additional holdings to conform to a theme if you already have enough exposure to those companies.

Similarly, you already have many growth or value companies in your portfolio. In that case, you should double-check that adding a theme investment won't make your core strategy more weighty than it currently is. Also, keep in mind that thematic investments are those that purposefully focus on particular trends or social forces. If these trends or social pressures do not develop as anticipated, your stock portfolio may be exposed to concentration risks due to the thematic investments' intentional focus.

Where do you see this investment taking you in the future? Again, because there are no standards to measure against, it will be up to you to decide what constitutes a successful thematic investment. Are you seeking a return that is more than usual? What standard will you use to evaluate how well things are going? Do you have a goal in mind for your return? How long do you anticipate this taking? Or are you interested in making a financial commitment that aligns with a personal value? Is the investment living up to expectations?

Is the plan achieving the results that were anticipated? Keep a watch out for anything dubbed style drift after you've made an investment. This is when a fund manager or research team looks to drift into market sectors that don't exactly suit their strategy, perhaps in quest of greater returns if their initial choices don't work out. On the other side, there is always the possibility that a theme investment will only adapt somewhat to the current environment in which it is held. Imagine, for instance, that the fictitious video game firm discussed earlier split out its brilliant robotics segment into a different company but that you kept your investment in the video game company.

Bottom Line

Investors have the ability, via thematic methods, to invest according to their views, whether those convictions pertain to the direction in which things are now heading or to the direction in which they ought to be heading. This strategy paves the way for new types of portfolio diversification and incorporates strategic research into an investor's overall investment strategy.

Remember that despite all the hype about innovation, the traditional guidelines for investing carefully should still be followed.

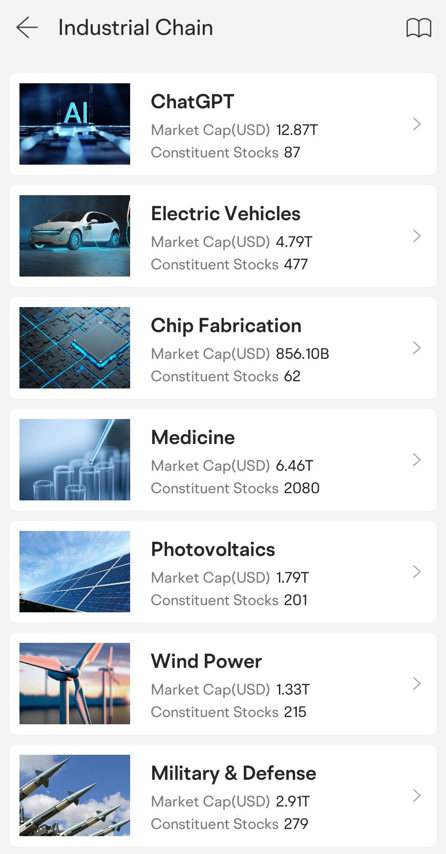

Moomoo stock trading app can help investors to identify trading opportunities from both upstream and downstream in a specific industry. Users can easily find the industrial chain on the 'Market' tab on moomoo stock investing app. Sign up and download the moomoo app today to check the segments involved in the industry and the companies included in each segment.

Images provided are not current and any securities are shown for illustrative purposes only.