Why Short Selling Can Be Dangerous

Short selling has a reputation for helping investors make decent profits despite a downturned market. This type of strategy was even featured in the movie The Big Short.

Traders need to realize, however, that there are dangers associated with this investing strategy. The better you understand the factors that impact successful short selling and how people can effectively make money in a bear market, the more prepared you will be to make the best possible decisions.

A short seller who doesn’t understand the risks can easily lose money and find themselves in financially dangerous positions. We want to make sure you understand the risks and strategies associated with short selling.

Let's explore the factors that impact short selling.

Before you gamble with a short sale, know this

With a short sell, the process typically works like this:

• You borrow stocks from a broker-dealer when you expect the stock value to fall by a significant amount.

• You sell the stock at a high price before the stock falls.

• When the stock falls, you buy the stocks back at a low price.

You return the stocks to the lender and pay any fees you owe from the trades. Your profit comes from the difference between the price you initially sold the stocks for and the low price for which you purchased them.

Since the investor wants to make their money off a significant fall in stock price, they have to be sure that their belief that the stock will fall within a particular window is highly accurate.

When this process goes smoothly, short-sellers can potentially make healthy profits. However, it is impossible to predict whether a stock will fall or by how much. It is very easy for a stock that was expected to fall to do the opposite. When this happens, an investor can find themselves having to buy the stock back at a higher price than they sold it, resulting in potentially serious losses.

An infamous example

The dangers of short selling, even for large-scale investors became a common topic in early 2021 when many sellers decided to short sell stock for the video game retailer GameStop. When individual traders involved in various online forums took offense for a number of reasons, they decided to purchase the stock en masse. This situation was exacerbated by the fact that approximately 140 percent of the shares in the hands of the public were sold short. As hedge funds joined individual traders in buying stock, the price significantly increased and short-sellers were left scrambling to purchase stocks before their losses became exponential, and a short squeeze developed. At the height of the short squeeze, GameStop’s stock price reached a pre-market value of over $500, almost 30 times the $17.25 price valuation it had at the beginning of the month. Losses were so significant that Melvin Capital a major investment fund that had significantly short sold GameStop lost 30% of its value and 53% of its investments. In fact, the company required $2.75 billion from outside investments before they announced they had closed their position.

How can investors improve their short sale odds?

Investors interested in short selling need to make their decisions wisely, acknowledging that it is impossible to fully predict whether or not a stock will fall as expected. The best they can do is use tremendous amounts of data to bolster their understanding of the stock that interests them and its past performance to make the best possible decisions about short selling. Data-informed decisions can help investors improve their potential to generate profit, even during a bear market.

There are a few key types of data that can help investors most.

Industry-related data

Understanding how the industry performs, including the latest news and events impacting the industry and the stock market, can help investors understand the factors that are likely to affect the stock market. They can start to see trends and make predictions regarding the behavior of the different securities.

The stock history and level II market data

Investors want to be able to drill deeply into the stock in question. The ability to look at the latest purchase prices for stocks can help investors gauge how investors feel about this particular stock and look for patterns and signals of impending changes. With the moomoo app, investors can see the complete historical K line data for specific stocks after the stock goes public.

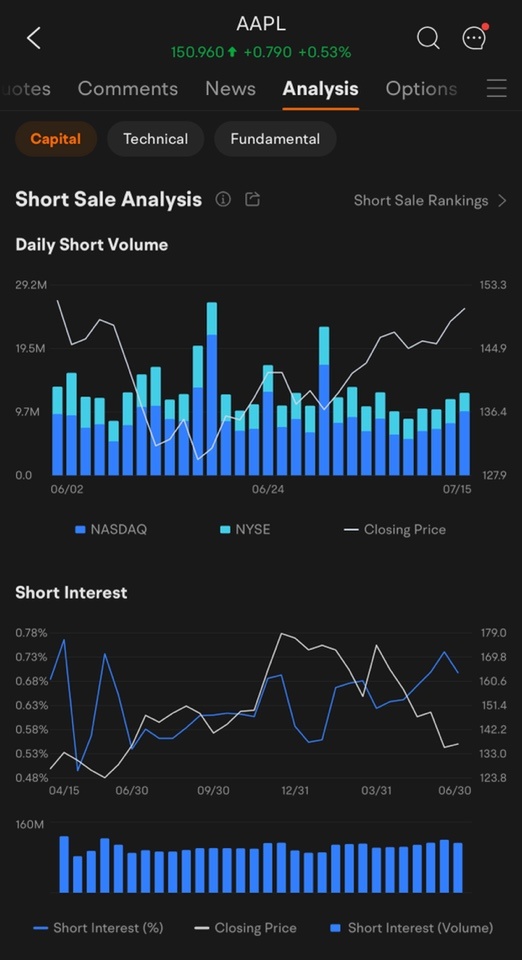

Short sale data

Data surrounding the short sell volume will provide insight into how many other traders seem to be interested in shorting the stock as well. However, sometimes, if too much interest is generated in shorting, the trades can push the price higher, which is also not a guarantee. Therefore, the decision to short a stock should never be made based on a single criterion.

Using technology to assist your short selling strategy

Computer-generated algorithms have the power to bring together vast amounts of data surrounding a particular stock to help you analyze potential future trends and patterns for a stock. Of course, predictions are not perfect, and changes in investor behavior, company announcements, and numerous other factors can impact the actual price.

Community of investors

Surrounding yourself with like-minded peers well versed in the stock market can also help offer additional data to determine whether or not the stock market price may rise or fall. Community and peer discussions can help those interested in shorting a stock gauge whether the stock is in a position to fall. Having a location where you can reach out to other investors for tips and advice is always welcome.

Short selling in a bear market

When the market earns a 'bear' designation, it signifies rates have begun to fall, and the potential for generating profits in traditional investing strategies becomes significantly reduced. Investors looking for strategies to build profits despite a bear market need to understand the potential risks associated with attempting to short a stock. Short selling carries the potential for unlimited losses. Short selling is typically done using margin, which comes with margin interest. No matter how much the data points to a company stock price dropping, unexpected events could change that expectation. Those who understand the risk and want to use data and best practices to increase their odds of generating profits may find many opportunities in a bear market.

Using data-driven decisions for short selling

With strategies like short selling to build income during downturns, the key lies in understanding the risk and making the best possible investment decisions. Research leading industry data that can help you.

• Drill down in different industries to see stock trends and how other stocks within that industry perform, analyzing and looking for patterns

• Check the latest news and updates related to the stock and industry to see if current events may impact market predictions

• Analyze level 2 market data to gain an intricate look at how other investors are buying and selling a particular stock

• Review short sale analyses with daily short sale data, short interest, and short sale ranking

• Find a community of investors to see how other people feel about the stock and gauge overall sentiment

This data makes it possible for investors to make data-driven decisions for their bear market investing. While there are no guarantees surrounding stock prices or behavior, using this data and information can improve the decision-making process and help traders find the best possible investment options to increase their chances of earning profits.

Build your assets with moomoo

If you’re looking for a robust suite of tools and data to help with your short selling strategy, look no further than moomoo. With advanced technology supporting our features, you can get the pro-level analyses you need. For example, we offer daily short sale volume for each stock.

Images provided are not current and any securities are shown for illustrative purposes only.

Our app features advanced technology for predictive data and over 100 technical indicators and charting tools. See how the data available through the moomoo app can help guide your decisions and get started building your portfolio today.