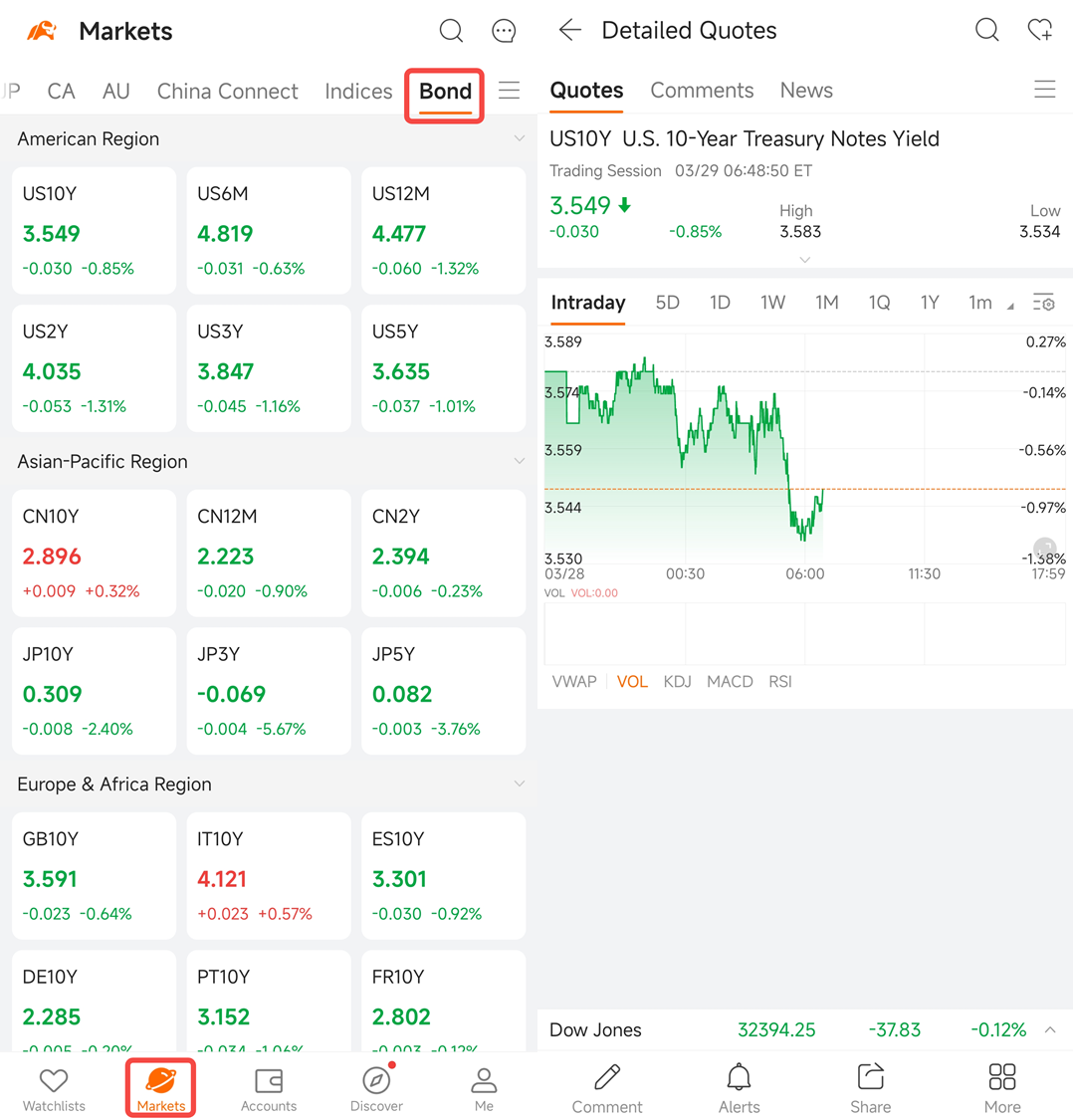

US treasury futures quotes

In US Treasury futures, the basis is the price spread, usually quoted in units of 1/32, between the futures contract and one of its eligible delivery securities.

In moomoo, the US Treasury futures are quoted in units of 1/10.

What is Basis?

Basis can be defined as the difference between the clean price of the cash security minus the converted futures price.

Basis = Cash Price – (Futures Price x Conversion Factor)

For example, consider a cash 5-year note, the 1.75% of November 30, 2021 versus the March 2017 5-year US Treasury futures contract (FVH7).

Assume the price of the cash security to be 99-10+ (1/32), the price of FVH7 to be 117-18+ (1/32), and the conversion factor (CF) of the cash security versus March 2017 5-year futures to be 0.8292. Because U.S. Treasury cash and futures products trade in full points and fractions of a 1/32 we must first convert our futures and cash prices to decimal then perform the math, then convert back to 1/32 form.

Step One: Convert prices from 1/32 to decimal

Pfutures = 117-18+ (1/32s) = 117.578125

CF = 0.8292, Pfutures = (117.578125 x 0.8292) = 97.49578125

Pcash = 99.10+ (1/32s) = 99.328125

Step Two: Perform the math in decimal

Basis = 99.328125 – 97.49578125 = 1.83234375

Step Three: Convert back to 1/32s

1.83234375 = 58.64 (1/32s)

Once this is done with all the securities eligible for delivery, traders can either trade the basis outright or use the gross basis as a starting point for deeper relative value analysis like calculating the cheapest-to-deliver (CTD) security of a given futures contract.

Trading of the US Treasury basis is active part of the U.S. Treasury securities market. Basis trades can be executed and submitted for clearing at CME Group via an exchange-for-physical (EFP) transaction under Rule 538 of the exchange.

Risk Disclosure This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.

Overview

- No more -