- Account

- Funding

- Fee Schedule

- Trading in US Market

- Pattern Day Trading

- Margin Trading

- Cash Sweep

- Stock Transfer

- Trading in HK Market

- Trading in A-shares Market

- Position and P&L

- Promotions

- Free Stocks & Coupons

- IPOs Subscription

- Tax

- Corporate Action

- Getting Started

- App Features

- Market Introduction

- Paper Trading

- Technical Analysis

- Algo Trading

- OpenAPI

- Third-party platform

- Terms and Disclosures

- Contact Us

US Stock Multi-Leg Options Order

1. What is a multi-leg options order

2. How to place a multi-leg options order

3. Multi-Leg options order fees

1. What is a multi-leg options order

A multi-leg options order is an order where two or more option transactions are bought and/or sold simultaneously. This could mean the options selected could have more than one strike price and expiration date. Moomoo now supports 2- to 4-leg options orders. Each leg in a multi-leg options order is typically filled at the same time. However, if there are many option contracts under each leg, partial fill may occur, in which case the order will be filled in proportion to the leg ratio. For example, a long straddle strategy contains two legs, i.e. the long call option and the long put option, and the leg ratio is 1:1; if you place a multi-leg option order for 5 straddles that contain 5 call option contracts and 5 put option contracts under each leg, respectively, and 2 call option contracts are executed (i.e. partial fill), then only 2 put option contracts will be executed accordingly.

Multi-leg options orders allow investors to build complex strategies while potentially saving time to a certain extent. In the event where the general market trend is uncertain, investors may use certain multi-leg options orders to potentially benefit from significant fluctuations in the price of the underlying security.

2. How to place a multi-leg options order

2.1 Place a multi-leg options order

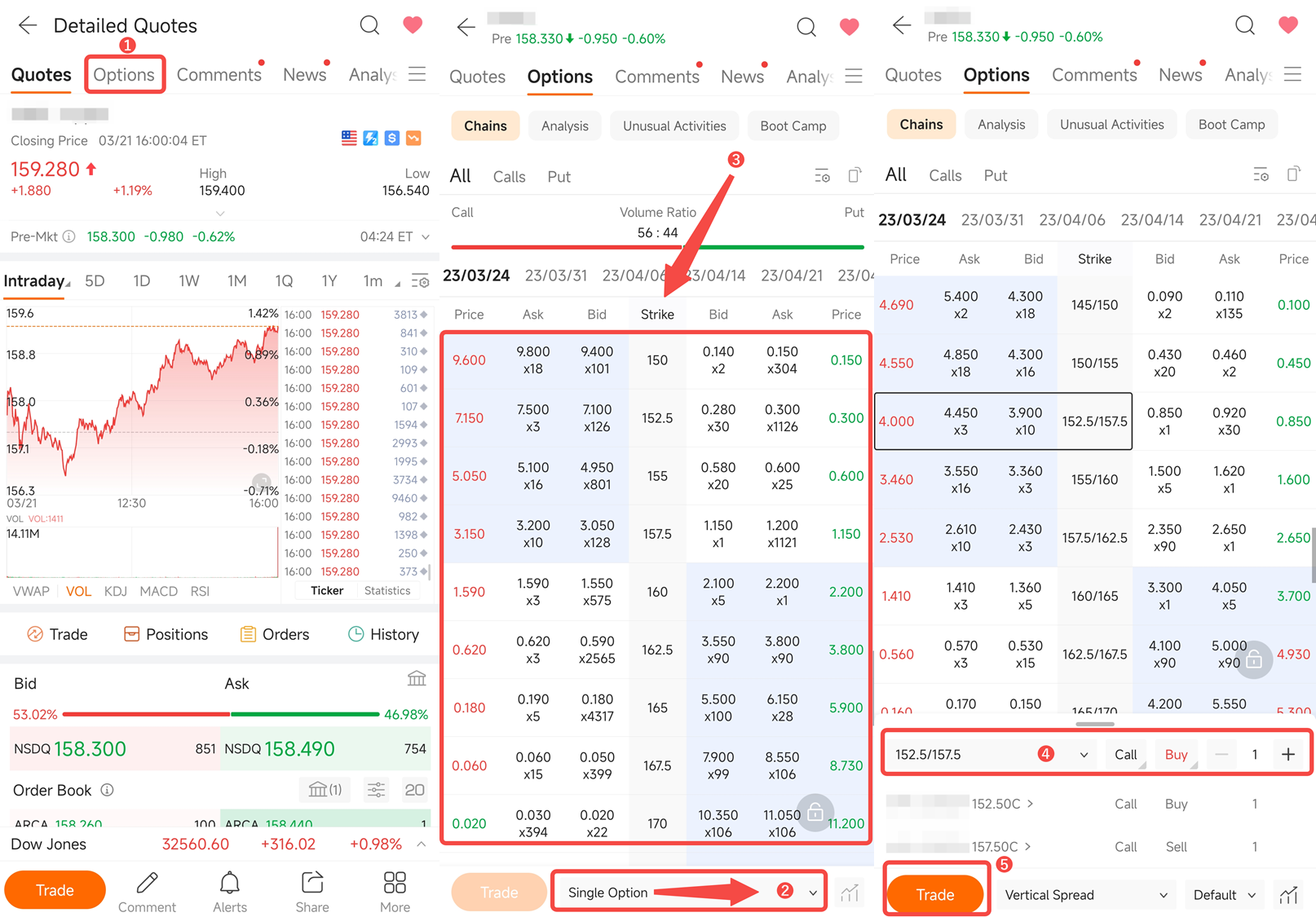

Tap Watchlist > a stock > Options > Chains, select the desired strategy, and tap the Trade button.

(Any app screenshots are not necessarily up to date, and all securities mentioned are for illustrative purposes only.)

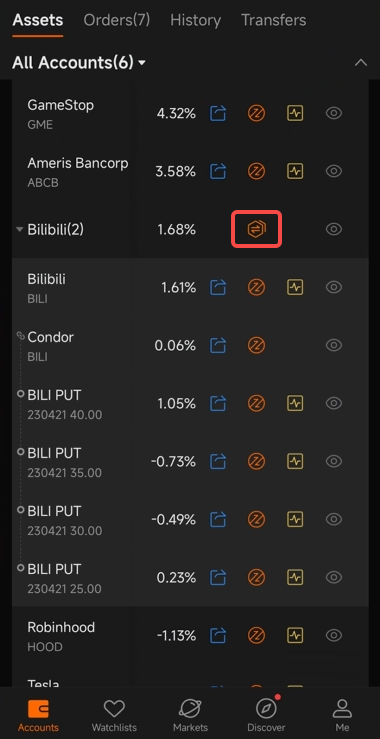

2.2 Open or close a position in an option strategy

Right-swipe on the position list, tap the icon indicated in the illustration below, and you can open or close a position in an entire option strategy (applicable only in the Option Strategy View).

(Any app screenshots are not necessarily up to date, and all securities mentioned are for illustrative purposes only.)

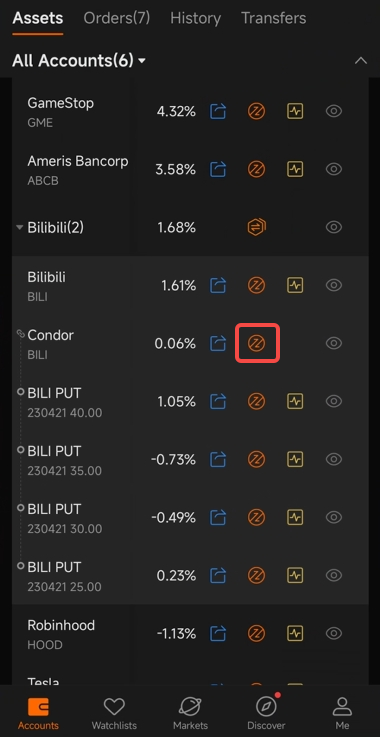

2.3 Close out multiple positions with a multi-leg options order

Right-swipe on the position list, tap the icon indicated in the illustration below, and you can close out multiple positions as you want with a multi-leg options order (applicable whether in the Option Strategy View or not).

(Any app screenshots are not necessarily up to date, and all securities mentioned are for illustrative purposes only.)

3. Multi-Leg options order fees

US multi-leg options order may consist of either a combination of US options or combination of US options + stocks/ETFs. Each leg in a multi-leg options order is charged separately and subject to the contract fee rate. Other fees may also apply. Total fees are calculated by adding up the fees for each individual leg.

Please see our fee schedule for detailed information on US equity and options fees and charges.

4. Types

Covered Stock

Covered stock includes 2 strategies built with the underlying stock: Covered Call (long stock and short call), Covered Put (short stock and short put).

Covered Call

A covered call strategy is to sell a call option of a stock while holding a long position in the stock on a share-for-share basis. When you are neutral or slightly bullish on a stock by the expiration date, you may use this strategy.

Covered Put

A covered put strategy is to sell a put option of a stock while holding a short position in the stock on a share-for-share basis. When you are neutral or slightly bearish on a stock by the expiration date, you may use this strategy.

Vertical Spread

A vertical spread strategy is to simultaneously buy and sell two options of the same underlying stock, same type (calls or puts), and same expiration date, but with different strike prices.

Debit and Credit Spread

A vertical spread strategy is mainly used to serve the following two purposes:

1. For debit spreads, it is used to reduce the payable net premium.

2. For credit spreads, it is used to lower the risks of short selling option positions.

| Type | Definition | Strike Price Comparison | Debit/Credit | TheoreticalMax Profit | TheoreticalMax Loss | Breakeven |

| Long Call Spread (Bullish) | Long Call (C1)+Short call (C2) | C2>C1 | Debit | C2 - C1 -Net Debit Paid | Net Debit Paid | C1 + Net Debit Paid |

| Short Call Spread (Bearish) | Long Call (C1)+Short Call (C2) | C1>C2 | Credit | Net Credit Received | C1 - C2 - Net Credit Received | C2 + Net Credit Received |

| Short Put Spread (Bullish) | Long Put (P1)+Short Put (P2) | P2>P1 | Credit | Net Credit Received | P2 - P1 - Net Credit Received | P2 - Net Credit Received |

| Long Put Spread (Bearish) | Long Put (P1)+Short Put (P2) | P1>P2 | Debit | P1 - P2 -Net Debit Paid | Net Debit Paid | P1 - Net Debit Paid |

Straddle

A straddle strategy is to simultaneously hold a call option and a put option of the same underlying stock, same strike price, and same expiration date.

A long straddle strategy aims to profit from volatility. You can consider using a long straddle strategy when you predict large swings (sharp rises or falls) in the underlying stock. Conversely, you can consider using a short straddle strategy when you expect the underlying stock to remain unchanged or moderately volatile.

Strangle

A strangle strategy is to simultaneously hold a call option and a put option of the same underlying stock and same expiration date, but with different strike prices.

A long strangle strategy aims to profit from volatility. You might consider using a long strangle strategy when you predict large swings (sharp rises or falls) in the underlying stock. Conversely, you might consider using a short strangle strategy when you expect the underlying stock to remain unchanged or moderately volatile.

Butterfly

A butterfly strategy is to simultaneously hold three call/put options of the same underlying stock, same expiration date, and usually with the same strike distance, with a ratio of 1:2:1.

When you are neutral on a stock, you may consider a long butterfly strategy since it benefits when the underlying trades near the short strikes. Conversely, if you expect huge swings in a stock, you can consider a short butterfly strategy since it benefits from a substantial move in the underlying price..

Condor

A condor strategy is to simultaneously hold four call/put options of the same underlying stock, same expiration date, and same strike distance, with a ratio of 1:1:1:1.

A condor strategy aims to make a profit by predicting price volatility. When you are neutral on a stock, you may consider a long condor strategy. Conversely, if you expect huge swings in a stock, you may consider a short condor strategy.

Iron Butterfly

An iron butterfly strategy is to simultaneously hold two call options and two put options of the same underlying stock, same expiration date, and usually with the same strike distance, with a ratio of 1:1:1:1.

A condor strategy aims to make a profit by predicting price volatility. When you are neutral on a stock, you may consider using a short iron butterfly strategy. Conversely, if you expect huge swings in a stock, you may consider using a long iron butterfly strategy.

Iron Condor

An iron condor strategy is to simultaneously hold two call options and two put options of the same underlying stock, same expiration date, and usually with the same strike distance, with a ratio of 1:1:1:1.

An iron condor strategy aims to make a profit by predicting price volatility. When you are neutral on a stock, you may consider using a short iron condor strategy. Conversely, if you expect huge swings in a stock, you may consider using a long iron condor strategy.

Calendar Spread

A calendar spread strategy involves buying and selling two options of the same stock, type (call or put), and strike price, but different expiration dates. This strategy aims to make a profit from time decay.

If you think the stock will trade sideways after experiencing large swings, then you may consider using a long calendar spread. On the other hand, if you anticipate large swings in the underlying stock price near-term but it will remain steady in the long term, then a short calendar spread may be considered.

Diagonal Spread

A diagonal spread strategy involves buying and selling two options of the same stock, type (calls or puts) at the same time, but with different expiration dates and strike prices.

This strategy is typically used to take directional assumptions on products in a defined risk way, while still reducing cost basis by selling a near-term option against the asset in the trade-the further-dated long option.

Protective Collar

A protective collar strategy, also known as a hedge wrapper, is used to help prevent substantial losses, which in turn puts a limit on potential gains.

This strategy comes in handy when investors want to protect any unrealized gains on the underlying long stock from the downward movement in the market. You may consider using a collar strategy if you are holding a long position in stock with substantial unrealized gains. Also, if you are bullish on a stock in the long run but are uncertain about the short-term outlook, you may consider this strategy. The tradeoff is that the covered call sold limits the potential upside of the long stock.

Custom

A custom strategy allows you to form an option strategy by selecting 2-4 options with different expiration dates.

This content is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc.

In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) and a member of Financial Industry Regulatory Authority (FINRA)/Securities Investor Protection Corporation (SIPC).

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.