IPO opening auction analysis

1. Entry

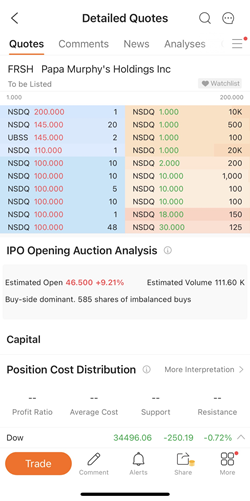

Detailed Quotes of US Stocks -- IPO Openning Auction Analysis (Only displayed duringauction period)

2. Brief Introduction

IPO At-Auction Order Analysis is to estimate the opening price and trading volume during auction on the IPO day, thus understanding investors' interest, and predicting the opening performance of new stocks.

2.1 Order book during auction

Newly-listed U.S. stocks will not be traded directly on the IPO day. Instead, they will enter an auction. During this time, investors can place orders, but those orders will not be matched by the exchange. Rather, a "crossed market" may occur, a situation when the highest bid price is higher than the lowest ask price. At this time, the exchange will calculate the corresponding reference price, at which the eligible orders will be traded later.

2.2 Indicative opening price

It is also known as "reference price", at which the first match is traded at the opening. It is exceuted under the following conditions:

1) Maximum matched shares can be executed;

2) Prices of buy orders higher than it and those of sell orders lower than it can all be traded;

3) Either buyers or sellers at the same price as the indicative opening price or both of sides can complete transactions;

2.3 Estimated trading volume

It refers to the number of traded shares which are matched immediately at the indicative opening price. Only orders that offer better prices than the indicative open will be included, i.e., buy orders with prices higher than the estimated open, and sell orders with prices lower than the estimated open.

2.4 Judging investors' interest

An excess of buy or sell orders for a specific stock results in order imbalance. This mismatch of supply and demand of at-auction orders can be interpretated through what is remaining. Relevant situations are as follows:

Imbalanced Auction | Interpretation |

Buy ordersremaining | Buy-side dominance |

Sellordersremaining | Sell-side dominance |

Buyers and sellers have equal orders | Buy-sellBalance |

2.5 Function permissions

For newly-listed stocks on NASDAQ, you need to access NASDAQ TotalView to view order book and IPO order auction analysis; for IPO stocks on the NYSE, you need to access NYSE OpenBook to view.

Risk Disclosure This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.

Overview

- No more -