Analysis of FPG Australian dollar trend on 9.16

AUDUSD H4

Due to the expectation of a rate cut by the Federal Reserve and the rise in iron ore prices, the Australian dollar rose on Thursday. However, on Friday, the decline in iron ore prices continued to suppress the rise of the Australian dollar, causing a daily decline. Currently, the economic downturn in China has caused the real estate market to cool down, which has put pressure on Australia as a major exporter of iron ore. In Australia, the market continues to focus on two data points: the Federal Reserve interest rate decision on Thursday and Australia's unemployment rate. Currently, market expectations for a 50 basis point rate cut by the Federal Reserve have exceeded 50%, and the Reserve Bank of Australia, due to its later rate cut compared to the United States, has boosted the Australian dollar to some extent due to the interest rate differential advantage. If Australia's unemployment rate announced this week is disappointing, the Reserve Bank of Australia may weaken its previous hawkish rhetoric and adjust interest rates like other major central banks later this year.

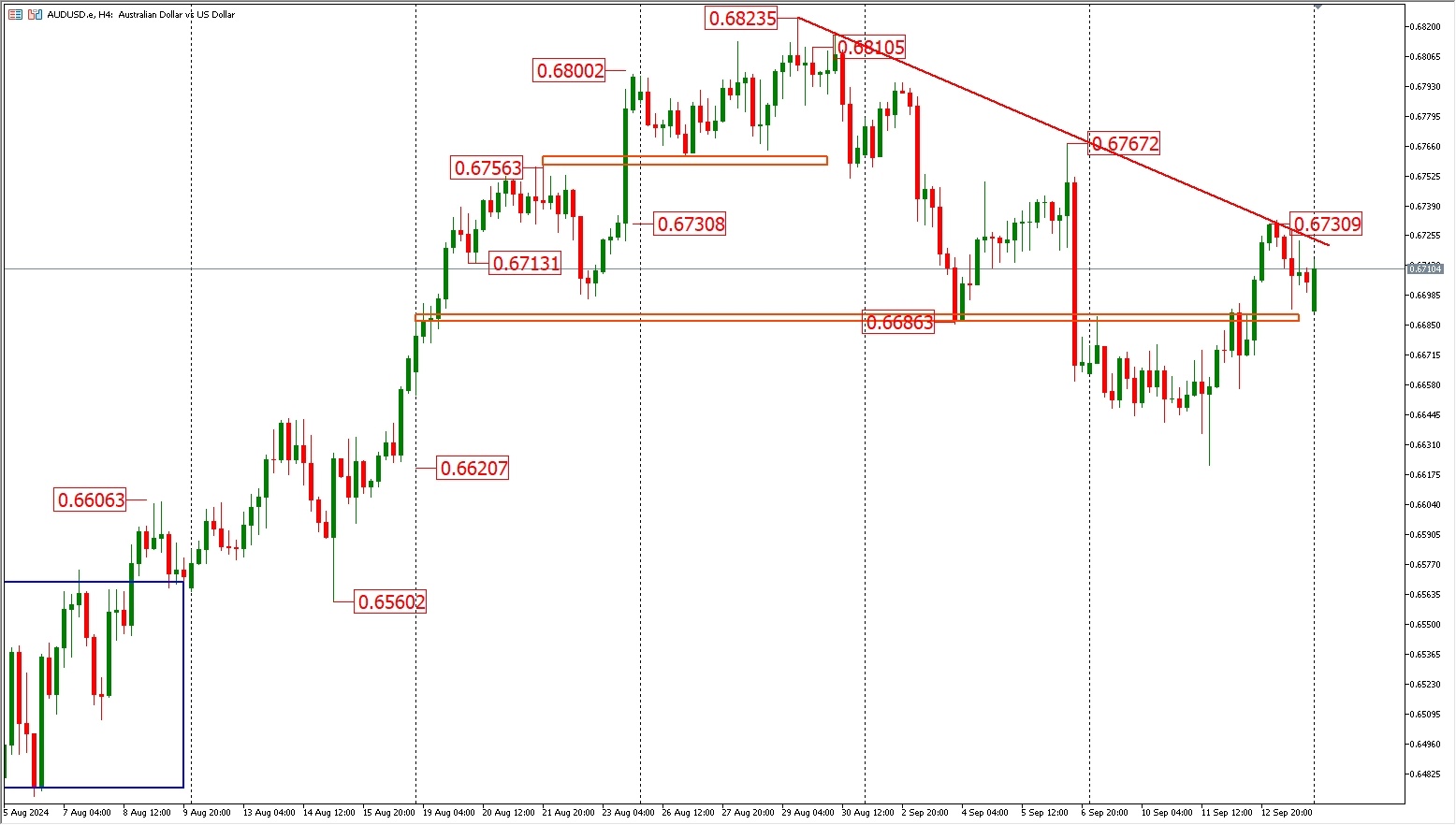

Technically, the Australian dollar rebounded on Thursday but was rejected near the previously mentioned downtrend line and fell back. The intraday low and the opening low are both above 0.668, and in the short term, we can focus on the converging triangle formed by the downtrend line and the 0.668 level.

Upper resistance levels are 0.671, 0.672, and 0.673.

Lower support levels are 0.670, 0.669, and 0.668.

# This advice is only general advice and does not take into account your specific financial situation and needs. Investment involves risk, so please evaluate it carefully. #

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment