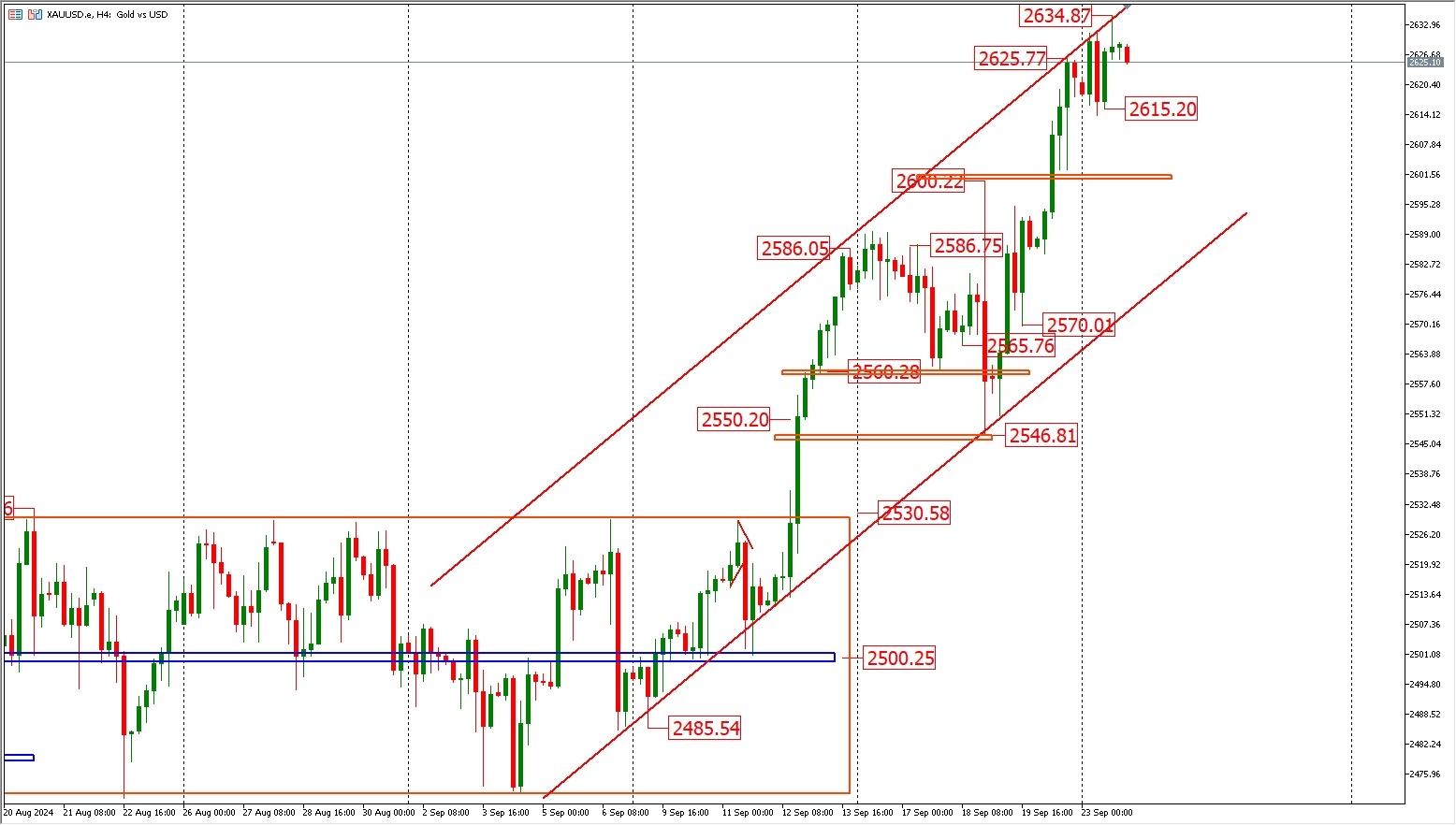

The PMI data for the manufacturing and services sectors in the USA was released last night. The data shows that the services sector performed better than expected, but the manufacturing sector remains below the 50 boom-bust line, falling short of expectations. The services sector is steadily expanding, but the manufacturing sector hit a new low in 15 months. According to CME data, the market's expectation for the Fed to continue cutting interest rates by 50 basis points in November exceeds 50%. Aside from the impact of the US dollar, in terms of geopolitics, yesterday Israel launched attacks on multiple areas in Lebanon, resulting in nearly 300 casualties. Safe-haven sentiment led to the gold price continuing to hit new highs near 2635 after hitting 2631 in early trading, before closing at 2628.