Adobe and Oracle’s financial reports are coming. Let me remind you that there are 6 major factors that U.S. stocks should pay attention to this week.

1. The market plummeted on Friday, with six of the seven giants falling sharply. TSLA fell 8.45%, NVDA fell 4.09%, GOOG fell 4.02%, AMZN fell 3.65%, META fell 3.21%, and MSFT fell 1.64%. However, AAPL basically did not fall much, only down 0.7%. Therefore, the risk of this press conference can be imagined, and it will definitely not be too small. Judging from the market trend, AAPL is the only one among the seven giants that has not fallen, so there will inevitably be a market to make up for the decline.

2. Now the market has begun to price in the Fed’s interest rate cut of 50 basis points in September. The next week is the silence period before the Fed’s interest rate meeting, which means that no Fed officials will come out to protect the market this week. In addition, after September 13, there will be close to 50 basis points. % of the S&P constituent stocks will also enter the repurchase silence period. Once there are no corporate repurchases to support the market, the market liquidity will definitely be worse. I believe that the fluctuations in U.S. stocks in the next week will not be small.

3. This week also has the first debate between Harris and Trump. The presidential election is a key factor in determining the trend of US stocks this year. The debate topics are expected to be similar to the debate between Trump and Biden on June 27, focusing on domestic economic policies, including inflation, corporate and personal taxes, housing, immigration and other issues. How Harris, who lacks policy experience, responds will be a highlight. The latest polls show that Harris is slightly ahead of Trump in several swing states.

4. After the release of non-agricultural data on Friday, the market's expectations for an interest rate cut by the Federal Reserve fluctuated greatly. Shortly after the data was released, the market predicted a 65% chance that the Fed would cut interest rates by 50 basis points in September. However, as time has passed and several Fed officials have spoken, expectations for rate cuts have adjusted significantly. Expectations of a 25 basis point interest rate cut in September have regained the upper hand, with the market’s latest pricing being a 70% probability. However, Wall Street professionals remind that the possibility of a 50 basis point interest rate cut cannot be completely ruled out at the moment, so next week's CPI data will become the decisive factor. Thursday's PPI (producer price index), initial jobless claims, and the University of Michigan's consumer confidence index released on Friday may also be the vane of U.S. monetary policy.

5. As for the trend of the market this week, I am overall bearish. Everyone has their own choice whether to go short or not, but after the Federal Reserve meeting on September 17, it should return to bullish thinking in stages. After all, the rebalancing at the end of the quarter is coming, and with the delivery of vix options, there will definitely be a wave of upward movement. Everyone should seize this long time window and enter the market to do more.

6. There is a high probability that Wall Street will also need to smash the market like crazy this week, which can force the Federal Reserve to cut interest rates by 50 basis points in September. A fast and violent plunge will definitely scare retail investors. When it was at a high level some time ago, institutions such as Goldman Sachs, Morgan Stanley and Bank of America all jumped out to say that the U.S. stock market would continue to skyrocket. You can observe these days. It will be around September 17 that these institutions will come out and say that the U.S. stock market will continue to rise. Downward. $Apple (AAPL.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

AbundantBlessedLife : Ok crystal ball

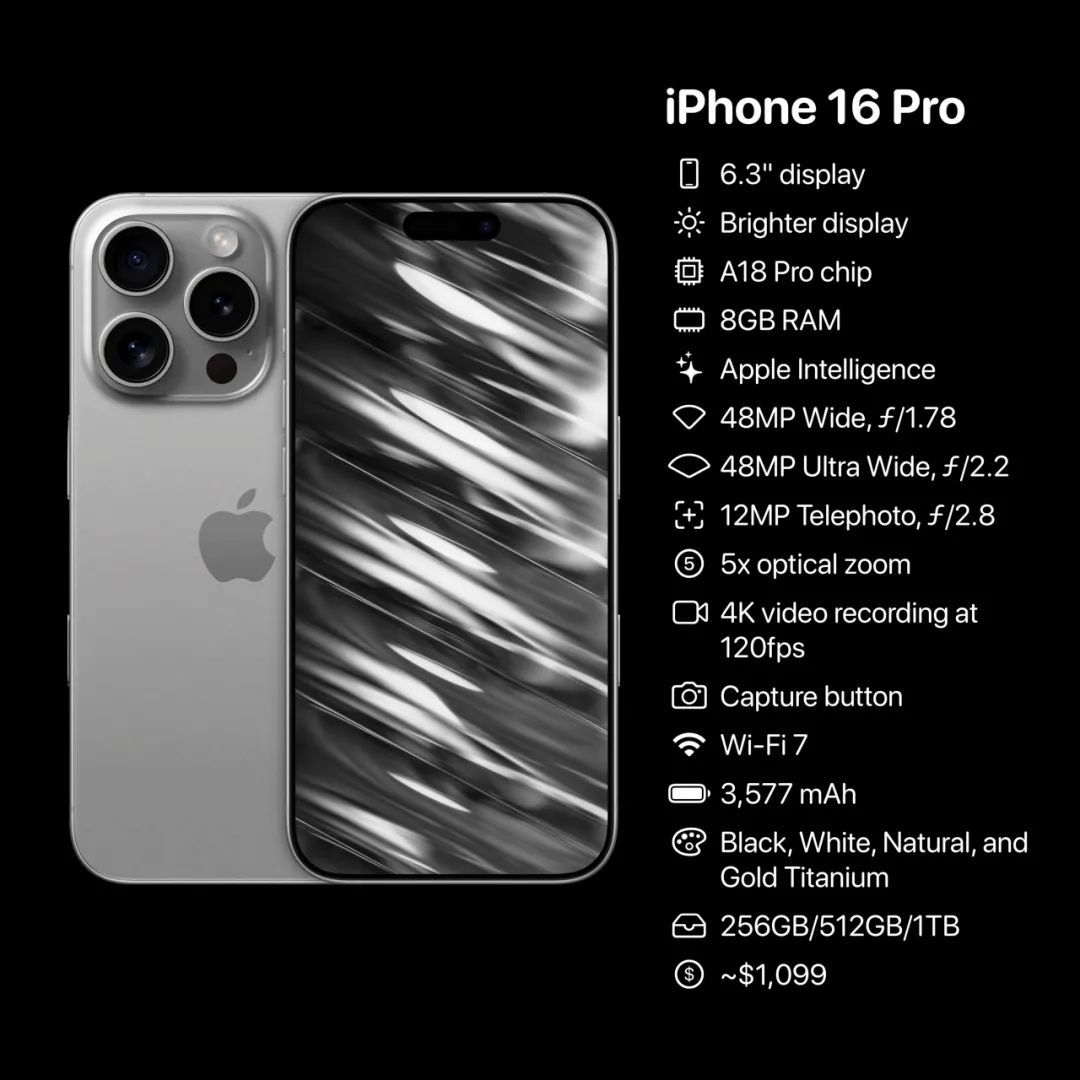

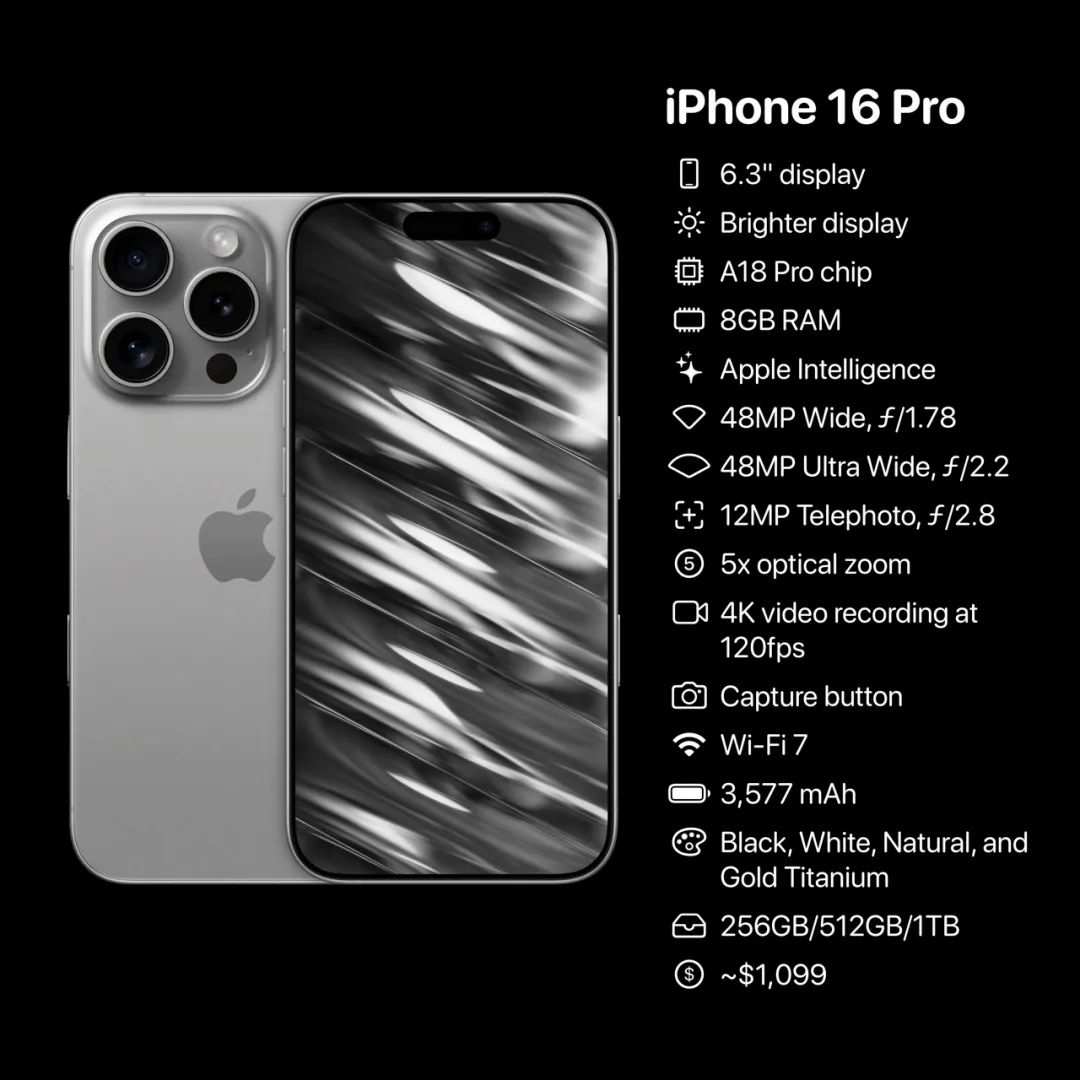

Shootingstar : oh dear the battery is quite low capacity![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Saiful Amri : I want an iPhone.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)