After AI Hype Reverses, Will Nvidia's Earnings Results Trigger the Next Market Move?

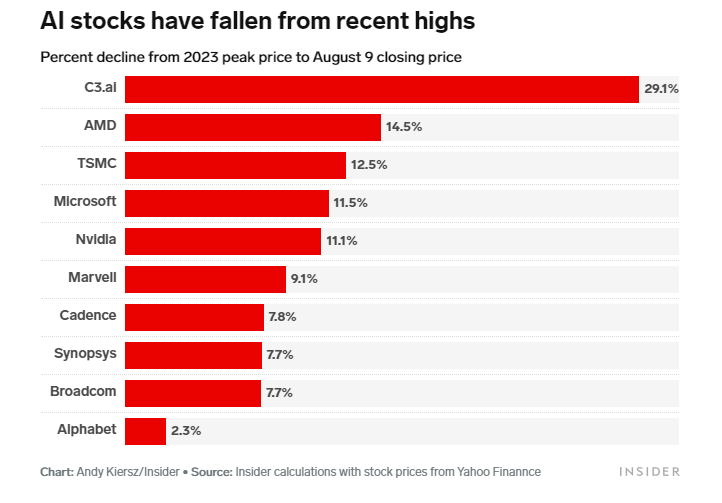

Recently, AI concept stocks have collectively pulled back, causing concern among investors. In the first half of the year, many stocks rode the wave of the AI trend, buoyed by optimistic views on industry trends, high investor sentiment, and an influx of capital. However, investors are now increasingly focused on companies' ability to deliver sustainable long-term performance and are seeking out those with genuine competitive advantages. Analysts predict that after a period of short-term adjustment, the sector will see increased stratification.

Amara's Law, coined by American researcher Roy Charles Amara, describes how people tend to overestimate the short-term impact of technology while underestimating its long-term effects.

"If Generative AI is to avoid becoming an Amara Law hype cycle, these tools will need to demonstrate stickiness over the medium-term, a feat that is becoming more challenging over time," Morgan Stanley analysts wrote in early June.

While competition patterns in the computing power industry chain pose challenges, some analysts believe that the overall market scale for AI has promising prospects. In the long run, the global AI market, represented by ChatGPT, is expected to significantly expand the demand for computing power. As such, the focus moving forward will be on implementing large-scale AI applications.

The AI sector has now entered a phase of performance verification, during which stock prices are expected to diverge based on companies' actual performance. High-quality stocks are expected to take the lead in this regard.

The drop in $Super Micro Computer (SMCI.US)$ 's stock price following its earnings report may indicate investors' concerns about its long-term growth prospects and position in the industry chain. The company's latest financial report shows a continuous decline in gross profit margins. $NVIDIA (NVDA.US)$ , the leading AI company, is slated to release its quarterly earnings report on August 23rd, which may have a significant impact on sector sentiment.

Source: Super Micro Computer, Business Insider, Zerohedge

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

TobbyStock : I think that Nvidia will regain trust in artificial intelligence when it comes to computers.

Yishu : The long-term development trend of Nvda is good

102933211 : Unless Nvidia's performance is impressive, the topic of personnel intelligence needs to be reinterpreted

smoothshoe : $NVIDIA (NVDA.US)$

This is a stock that makes its own rules. It trades at a ridiculous multiple. Earnings don't impact the price as much as forward guidance. I'm long on Nvidia and add to my position on extended dips.

Yishu : Nvda's current situation is that product supply is in short supply, production capacity cannot keep up, and there is good performance growth this month.

buy the dips : to make my answer short I hope so because I've loaded up on all the dips