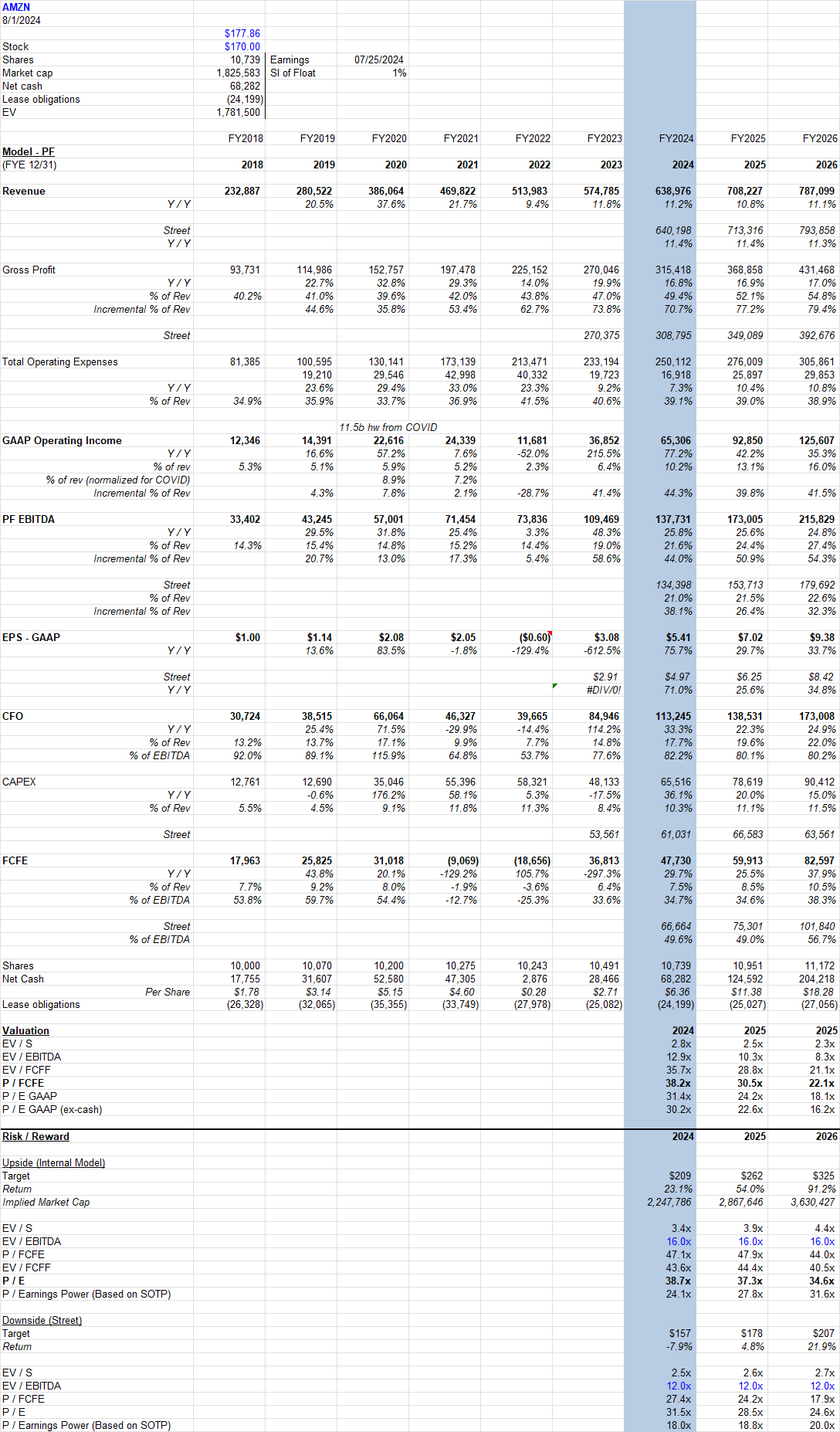

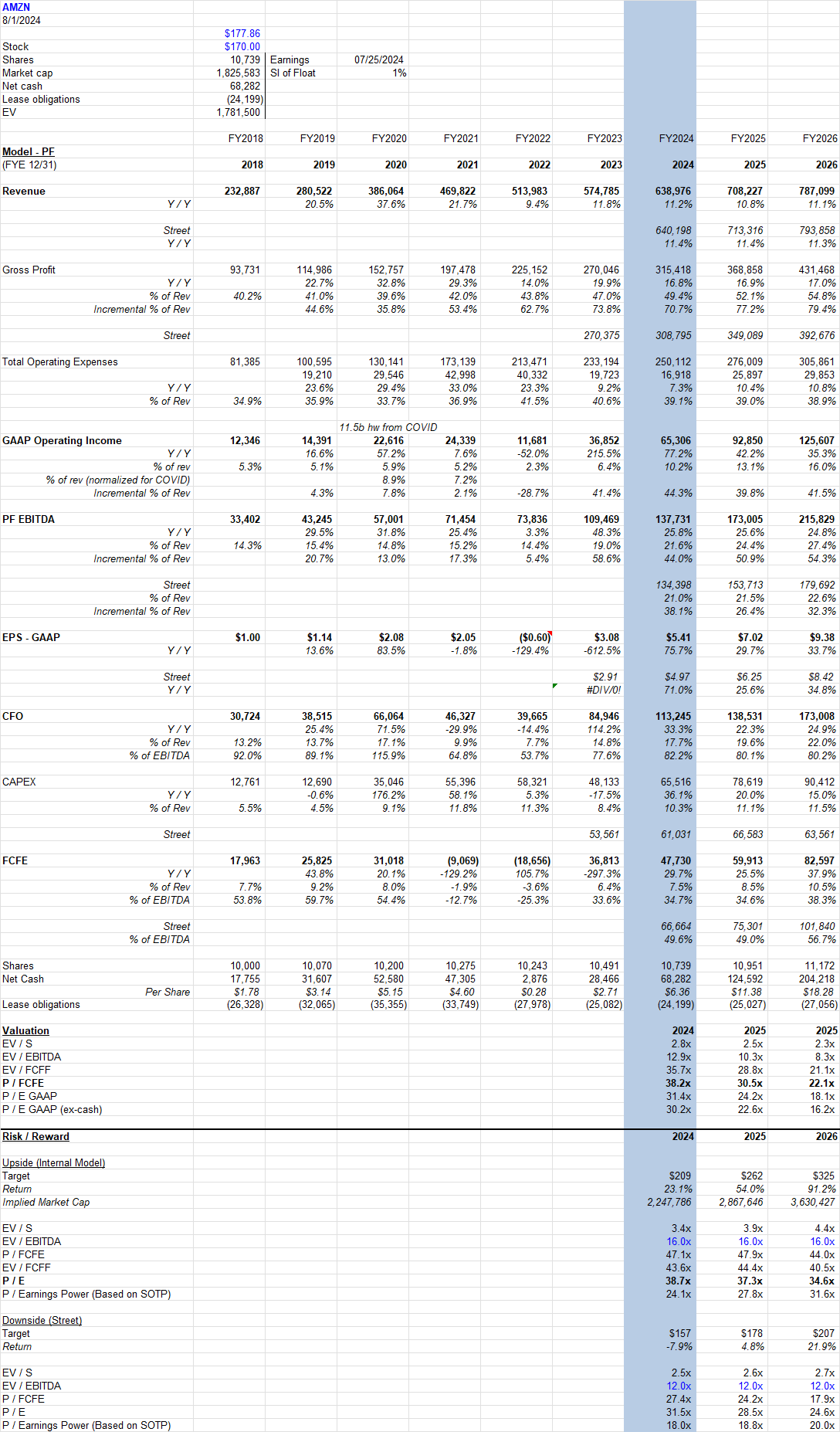

$AMZN missed and guided below on consumer softness and increased investment.

There is a lot of good stuff happening (AWS accelerating, international profitability inflecting, NA retail showing improved margins from cost optimization) and risk / reward pretty attractive.

Numbers hard to predict qtr to qtr but seems like room for company to beat estimates annually on profits. I think gross profit grows in the mid teens going forward w/ opex growth of 7-10%; at this low op margin this spits out 35-40% growth in profits.

Upside of 54% to 37x my 2025 GAAP EPS and 91% to 35x my 2026 GAAP EPS.

Hard to model any downside here but every stock can go down 20%.

North America

Rev of 90b grew 9% yy down from 11% normalized in Q1 and < street at 91b.

Rev of 90b grew 9% yy down from 11% normalized in Q1 and < street at 91b.

OI of 5.1b or 5.6% margin was < street at 5.4b and down from 5.8% in Q1 but up nicely from 3.9% last Q2.

Segment is on track to add ~35b in incremental rev this year similar to prior 2 years, and also suggests that growth likely stays in high single digit area from here.

Paid unit growth decelerated from 7% yy last qtr to 6% yy this qtr, and they also are seeing consumers trade down to cheaper products.

Subscription rev of 10.9b grew 11% yy which is consistent.

Advertising decelerated to 8% qq / 20% yy (24% last qtr and 22% last year) which is disappointing given the ramp in video monetization and stronger results from peers – then again vast majority of advertising is Sponsored listings so maybe not surprising to see this decelerate alongside the entire retail business which also implies advertising growth could stay here (w/ video monetization helping to only sustain growth rates).

Margins for stores improved qq but the incremental investment in Kuiper masks this. Business is doing fine and they highlighted continued room to improve profitability of retail.

Video ad revenue should flow through at very high margin since they already have all the content costs in place w/ question being how much it moves the needle – Disney and Paramount combined do ~6b in linear advertising – even if AMZN got 100% of their lunch at 75% incremental margin that would be 4.5b incremental profit on a company that will do 65b in GAAP profit this year.

International

Rev of 31.7b grew 10% yy cc down from 11% in Q1 and < street at 32.1b.

Rev of 31.7b grew 10% yy cc down from 11% in Q1 and < street at 32.1b.

OI of 0.3b or 1% margin was > street at 0%.

No real color here. Worth noting international could see a very sharp profitability inflection. Company has said mature international markets are ramping as expected, and incremental profit margins were 70% in 2022, 39% in 2023, and I think could be 43% this year.

AWS

Rev of 26.3b accelerated to 19% yy cc up from 16% normalized last qtr and > street at 26.0b.

Rev of 26.3b accelerated to 19% yy cc up from 16% normalized last qtr and > street at 26.0b.

OI of 9.3b or 35.5% of revs up 300 bps yy excluding accounting benefit from D&A extension > street at 8.5b. Profit did decline 1% qq so may be stepping on the investment pedal here again.

Commentary similar to last qtr – cost optimizations done and AI is exciting. AWS had 46.2% share of the big 3 hyperscaler market in the qtr down from 46.6% last qtr and 48.2% last year. Notably, the entire hyperscaler market continues to accelerate (19.4% in 3Q23, 20.9% in 4Q23, 22.8% in 1Q24 and 24.0% in 2Q24). Will be interesting to see how this plays out but I suspect we are at or near peak growth rates.

Overall

Guidance for Q3 was below at 154.0-158.5b in revs (9% yy) < street at 158b and OI of 11.5-15.0b < street at 15.3b.

Guidance for Q3 was below at 154.0-158.5b in revs (9% yy) < street at 158b and OI of 11.5-15.0b < street at 15.3b.

Margin compression was explained as 1) step-up in Kuiper satellite builds [Let’s hope this idea works – Starlink doing very well], 2) margin headwind from Prime Day [What? Prime Day was in Q3 last year too], 3) ramping season hiring for holidays [doesn’t that happen every year? never been that meaningful a drop in NA margins in Q3..], 4) football content costs [fine]. CAPEX will be higher in 2H than 1H (up 38% in first half).

Other Notes

NA

-Stores seeing headwind from shoppers trading down

-Seller fees lower

-Stores profitability improved qq but overall segment margin decreased due to investment including Kuiper

-Pharma offering Medicare patients unlimited generic delivery for $5 / mo.

-Rufus AI helps shoppers [I’ve tried it. It’s terrible.]

-Regionalizing inbound network as well

NA

-Stores seeing headwind from shoppers trading down

-Seller fees lower

-Stores profitability improved qq but overall segment margin decreased due to investment including Kuiper

-Pharma offering Medicare patients unlimited generic delivery for $5 / mo.

-Rufus AI helps shoppers [I’ve tried it. It’s terrible.]

-Regionalizing inbound network as well

AWS

-Optimizations mostly over

-Margin includes 200 bps tw from extension in server lifetimes in Q1

-Optimizations mostly over

-Margin includes 200 bps tw from extension in server lifetimes in Q1

AI

-Lot of d

-Lot of d

Satellites

-Accelerating manufacturing of birds

-Accelerating manufacturing of birds

Qtr

-FX 300m more of a headwind than anticipated

-FX 300m more of a headwind than anticipated

Guidance

-Q3: margin headwind from prime day (marketing for event / margin of event), ramping seasonal hiring ahead of Q4, content costs for football

-CAPEX will be higher in 2H

-Q3: margin headwind from prime day (marketing for event / margin of event), ramping seasonal hiring ahead of Q4, content costs for football

-CAPEX will be higher in 2H

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment