Morgan Stanley: Microsoft's Medium-Term Prospects in 'AI Monetization' Are Undervalued

$Morgan Stanley (MS.US)$ Analysts Keith Weiss and Josh Bae at Morgan Stanley have released a new research report stating that addressing return on investment (ROI) concerns may be $Microsoft (MSFT.US)$ 's top priority at present.

The report notes that Microsoft's share price performance has lagged behind its large-cap peers and the broader market over the past three months, reflecting an undervaluation of the company's medium-term prospects in "AI monetization."

The report notes that Microsoft's share price performance has lagged behind its large-cap peers and the broader market over the past three months, reflecting an undervaluation of the company's medium-term prospects in "AI monetization."

AI Investments Pressuring Margins, Projected AI Returns of Around 14% This Year

Morgan Stanley's report indicates that Microsoft's capital expenditures are expected to rise further, impacting the gross margins of its AI business to some extent.

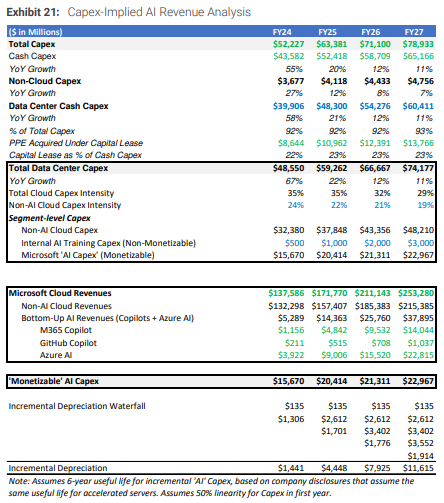

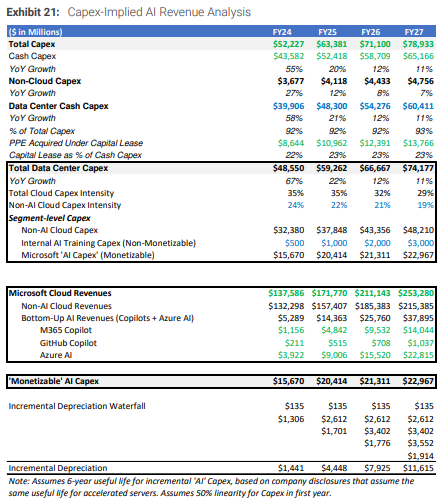

According to the report's data, Microsoft's total capital expenditures are projected to nearly double from 32 billion in fiscal year 2023 (FY23) to 63 billion in FY25.

Morgan Stanley's report indicates that Microsoft's capital expenditures are expected to rise further, impacting the gross margins of its AI business to some extent.

According to the report's data, Microsoft's total capital expenditures are projected to nearly double from 32 billion in fiscal year 2023 (FY23) to 63 billion in FY25.

Based on this, Morgan Stanley estimates Microsoft's implied AI revenue from capital expenditures for FY24 to be between 5.8 billion and 9.6 billion, within a 50%-70% gross margin range, growing to 46.5 billion to 77.4 billion by FY27.

Using the median of the projected implied AI revenue, Microsoft's AI capital return is expected to reach 13.8% this year, jumping significantly to 35% next year.

However, the report also adds that investments in OpenAI's data centers are not included in Microsoft's capital expenditures, suggesting that the company's infrastructure investments may be significantly higher than currently disclosed.

Furthermore, considering the potential exponential growth in investments required for future OpenAI model training, this could exacerbate concerns over Microsoft's AI capital expenditures.

However, the report also adds that investments in OpenAI's data centers are not included in Microsoft's capital expenditures, suggesting that the company's infrastructure investments may be significantly higher than currently disclosed.

Furthermore, considering the potential exponential growth in investments required for future OpenAI model training, this could exacerbate concerns over Microsoft's AI capital expenditures.

The report states that in the short term, AI capital expenditures will continue to weigh on gross margins. Microsoft's cloud business gross margins are projected to decline approximately 2% year-over-year in the fourth quarter, and the company's management guidance for a 100-basis-point decline in FY25 operating margins is expected to remain unchanged.

In the long run, however, operational efficiency improvements may lead to higher profit margins, and Microsoft could leverage its strong position in AI, adoption in the public cloud, and flexibility in its business model to support long-term revenue growth.

In the long run, however, operational efficiency improvements may lead to higher profit margins, and Microsoft could leverage its strong position in AI, adoption in the public cloud, and flexibility in its business model to support long-term revenue growth.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment